How to process gst on imported goods - visual guide?

Hi

I am trying to work out how to enter a bill for GST (from freight company) into our system.

I found found this link:

But I can not visualize it in action. Is there any screen shots of what I should be doing of what it would look like?

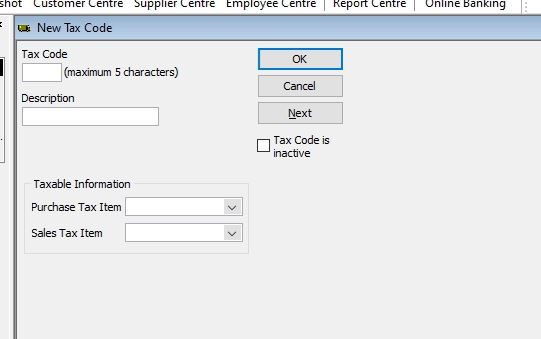

The above url also doesn't seem to make sense, as for transaction one, "create tax items" - it mentions tax

agency, tax rate etc but this does not appear in reckons accounts enterprise? and there is no radio box either that it mentions.. (see image attached)

Thanks for any assistance.

Cheers

Comments

-

I assume you mean to enter a bill for freight including GST that is more than the usual 10%

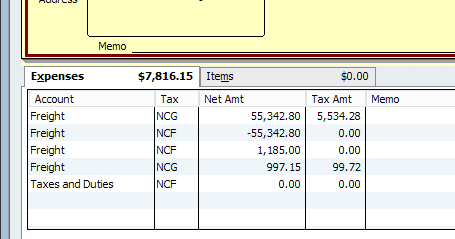

if so this is what I do

in bill window breakdown

Freight. (GST x 10) Tax code NCG

Freight. Balance of bill. Tax code NCF

the second line should be a negative figure

0 -

Here is a visual example Of what Kris has said. This example includes other lines for duty etc but you should get the idea.

0 -

Thanks for that Ian I didn’t have access to the file to get a screenshot at the time

0 -

It's the GST to be paid on imported goods, the supplier (overseas) isn't collecting the gst, its the freight company on behalf of the ato.

Thanks

Luke

0 -

Yep understand, above procedure correct

0 -

I do not have any freight to enter though, only the GST

0 -

See this example for $250.00 GST. Net freight amount is zero.

0