Novated Leases - is it worth saying yes?

An employee wants to do a novated lease. @Acctd4 has send me a wonderful 'how to' document. But I would like opinions on whether it is worth it or not.

It's not a busy office here, but it's just me doing the payroll. If I go on leave, another person has to take it over and I want to know if she will be able to handle it without mucking it up? I will obviously have step by step instructions, but that doesn't mean they will be followed properly.

There just seems to be a lot of steps each pay run and I don't want to say yes to this employee if it's way too much administration work involved.

I hope this question is ok to ask here, but I don't really have any other contacts to ask.

Thank you.

Answers

-

Hi @Zappy,

Sorry, I should clarify, I mean from an accounting point of view. I am not the employee wanting it, but I am the accountant having to deal with all of the paperwork and entries every fortnight doing the pays.

The boss has asked me to find out how easy or hard it is from an accounting point of view, so I was hoping to find out from people with experience in it.

0 -

If you understand the concept the accounting is easy. Also there is a support note for this

Kr

0 -

Hi @Zappy, I had looked at that and it isn't very helpful. It actually may be worth deleting that one if it isn't STP2 compliant. And I do understand the concept, but some systems just make your life miserable if they aren't set up to do those type of things.

The one that @Acctd4 sent me is much clearer and gives a step by step process. Thanks Shaz, they are good instructions, but I know from past experience that reading the instructions and then putting them into action and having to do it every pay cycle is very tedious. So I guess that's what I was trying to work out. I guess we can only say yes and if it's annoying, I can swear under breathe for the next five years and we don't let anyone else do it!!! 😂

2 -

Welcome to the Community @Mariella ! 👋

I'm out on site at the moment but shoot me through an email direct & I'll send it through to you once I'm home 😊

1 -

Hi Shaz,

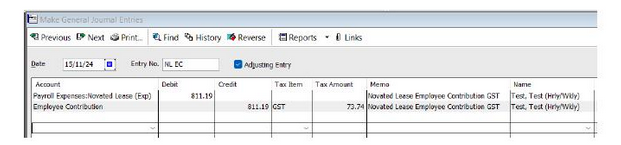

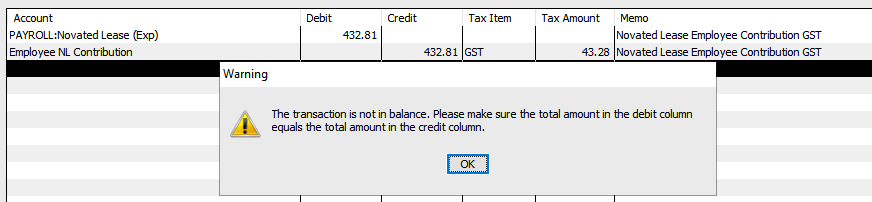

I can't figure out how to do this entry:

It says that the journal isn't balanced and it's out by the GST amount.

How do I get it to balance please?

Thank you!

0 -

Hi @Retreev

My example is gross. You have your journal set for net entry (so your DR line is $ 432.81 BUT the CR line is $ 476.09 ($ 432.81 + $ 43.28 GST!)

You just need to tick the Amounts include tax checkbox at the bottom & enter the $ 432.81 as a gross amount (The included GST will then calculate as $ 39.35) 😊

0