Can you make the Tax Amount editable in the Sales Receipts window

Options

[Deleted User]

Posts: 0 ✭

When processing recipient created invoices often the Tax Amount varies due to rounding and you have to muck around making adjustments.

0

Comments

-

31/08/2016

Hi Helen,

Reckon One has a setting that allows you to edit tax amounts.

This setting applies to receipts, payments, estimates, invoices, customer adjustment notes, bills, supplier adjustment notes, general journals and expense claims.

Australian books

1. Open the book

2. Select the cog icon which is located in the top right

3. Select 'Settings'

4. Tax settings > General

5. Enable the option 'Allow users to edit tax amounts'

New Zealand books

1. Open the book

2. Select the cog icon which is located in the top right

3. Select 'Settings'

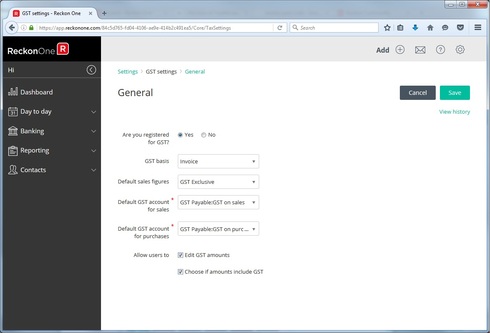

4. GST settings > General

5. Enable the option 'Allow users to edit GST amounts'

There are two more settings that are worth mentioning...

#1

The option 'Default sales figures' controls whether new transaction forms default to displaying gross (tax inclusive) amounts or net (tax exclusive) amounts.

This setting applies to estimates, invoices, customer adjustment notes, bills, supplier adjustment notes, general journals and expense claims. Receipt and payment forms are locked to displaying gross (tax inclusive) amounts regardless of this setting.

#2

The option 'Allow users to choose if amounts include tax' allows you to toggle transactions forms between displaying gross (tax inclusive) amounts or net (tax exclusive) amounts.

This settings applies to estimates, invoices, customer adjustment notes, bills, supplier adjustment notes, general journals and expense claims. Receipt and payment forms are locked to displaying gross (tax inclusive) amounts regardless of this setting.0

Categories

- All Categories

- 6.9K Accounts Hosted

- 11 📢 Reckon Accounts Hosted - Announcements

- 6K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.2K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3.1K Reckon One

- 7 📢 Reckon One - Announcements

- 11 Reckon Invoices App

- 14 Reckon Insights

- 114 Reckon API

- 830 Payroll Premier

- 326 Point of Sale

- 2K Personal Plus and Home & Business

- 74 About Reckon Community