ETP - Time in Leiu of Notice

Options

Emma Allford

Member Posts: 10 ✭

I am trying to add and ETP for Time in Lieu of Notice as a new payroll item. When I get to the Tax Tracking option there are no options for Post 1983 (O). How do I add this in or what option do I select so it will be reported correctly?

0

Comments

-

Set up a new payroll item deduction, call it what you need, ETP TILN Tax, link it to the ATO and PAYG liability account, from the tax tracking drop down list link it to the Payment summary item you need to, set how to calculate & at what rate according to ATO guidelines for the ETP you are setting up, tick PAYG tax, state tax if needed.0

-

It is still a similar issue. There is no correct item in the tax tracking to be able to have the taxed ETP on the payment summary. Creating the payroll item is not the problem. It is the fact there is not correct tax tracking option.

0 -

because a lot of ETP tax has to be manually calculated with many components, the purpose of this is to put the right payment against the right ETP code for the payment summary & by setting up the separate tax deduction lets you put in your manual calculation for each part, so it is clear on the payslip, & tracks to the payment summary.0

-

Hi Emma

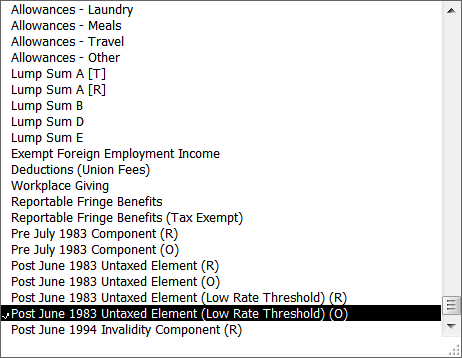

This is the lower part of the dropdown list you should see under the Tax Tracking option:

Are some of these missing in your display?

Shaz Hughes Dip(Fin) ACQ NSW, MICB

Reckon Accredited Professional Partner Bookkeeper / Registered BAS Agent (No: 92314 015)

Accounted 4 Bookkeeping Services

Ballajura, WA

0422 886 003

Shaz Hughes Dip(Fin) ACQ NSW, MICB

*** Reckon Accredited Partner (AP) Bookkeeper - specialising EXCLUSIVELY in Reckon Accounts / Hosted ! ***

* Regd BAS Agent (No: 92314 015)* ICB-Certified Bookkeeper* Snr Seasonal Tax Consultant since 2003 *

Accounted 4 Bookkeeping Services

Ballajura, WA

(NB: Please give my post a Like or mark as Accepted Answer if I have been able to resolve your query as this helps others when seeking solutions!)

0 -

All of these are there but any options for (O) post 1983 are for untaxed payments. I need it to be taxed.

0 -

Emma

These are your choices, if you are taxing for post Jun 1983 because it is over the cap threshold use the one Shaz has highlighted.

If not what are you trying to tax in ETP post 1983.0

Categories

- All Categories

- 6.4K Accounts Hosted

- 10 📢 Reckon Accounts Hosted - Announcements

- 5.9K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.3K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3K Reckon One

- 7 📢 Reckon One - Announcements

- 11 Reckon Invoices App

- 14 Reckon Insights

- 107 Reckon API

- 822 Payroll Premier

- 308 Point of Sale

- 1.9K Personal Plus and Home & Business

- 63 About Reckon Community

Reckon Accounts Hosted Expert

Reckon Accounts Hosted Expert