How to write off a bad debt in Reckon Accounts Premier?

Options

Graham Taylor Automotives

Member Posts: 41 ✭

I have set up my General Ledger exactly as listed in the Reckon help guide, which notes that the AR account should list the gross amount of the invoice (which is less GST) and than the bad debt account shall be Net (GST including amount)

I did this but it put the total over by the amount of included GST creating an unbalanced ledger.

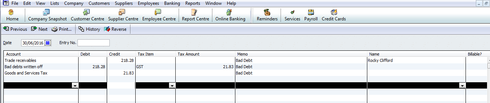

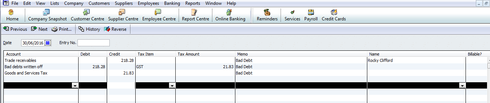

So I have pulled it apart entering the excluding amount and creating a third line for the GST amount. As you can see the ledger balances which means the journal can now be saved and this will create a credit note on the customer account to be applied to the invoice.

The customer name allocated has only been done so in the first instance as this is all the help guide listed, however I have been through and allocated the name to all lines and saved to see if this makes a difference and it doesn't.

The problem I am having is that the amount to be credited is $240.11 the amount entered in the credit field is also the amount that appears as the credit note to apply to the invoice leaving the gst portion un-credited and still on the account.

what am I doing wrong and how do I also credit off the gst amount? I need for the customer account to be nil.

I have also tried entering the net amount in the credit field to see if it will generate a credit of that amount. It doesn't the amount to allocate is then over by the gst amount and creates an unuseable credit on the account instead of zeroing it.

Thanks

J

I did this but it put the total over by the amount of included GST creating an unbalanced ledger.

So I have pulled it apart entering the excluding amount and creating a third line for the GST amount. As you can see the ledger balances which means the journal can now be saved and this will create a credit note on the customer account to be applied to the invoice.

The customer name allocated has only been done so in the first instance as this is all the help guide listed, however I have been through and allocated the name to all lines and saved to see if this makes a difference and it doesn't.

The problem I am having is that the amount to be credited is $240.11 the amount entered in the credit field is also the amount that appears as the credit note to apply to the invoice leaving the gst portion un-credited and still on the account.

what am I doing wrong and how do I also credit off the gst amount? I need for the customer account to be nil.

I have also tried entering the net amount in the credit field to see if it will generate a credit of that amount. It doesn't the amount to allocate is then over by the gst amount and creates an unuseable credit on the account instead of zeroing it.

Thanks

J

0

Comments

-

Have you tried just posting the full amount of $218.28 with the tax set to GST and not having a separate GST line. This should then take $218.28 off the specific client crediting receivables in total and debiting $218.28 to bad debts. If both are marked as GST under the tax line the GST should handle fine. I haven't done one for a while but you could try that. Cheers0

-

Thanks Shayne,

That does work and I have done it in this case, however I am not sure that this appropriately deals with the GST component. Perhaps if someone has a view on that, that would be helpful.

Thank you

J0 -

Hi

Instead of entering a journal, do this and all will be well:

1. Create a new item (type service) called Bad Debts, allocate it to the Bad Debts (expense) account with tax code GST.

2. Create a customer adjustment note for this customer and put the Bad Debts item on it for the total amount. It will tell you you are allocating to an expense account but just click ok to accept that.

3. Clear the invoice with the credit in the usual way by going into Customer Payment, click the relevant invoice and set the credit.

That always works and put the GST and the net amount of the credit in all the right places.

Hope this helps.

Stella

1

Categories

- All Categories

- 6.9K Accounts Hosted

- 11 📢 Reckon Accounts Hosted - Announcements

- 6K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.2K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3.1K Reckon One

- 7 📢 Reckon One - Announcements

- 11 Reckon Invoices App

- 14 Reckon Insights

- 114 Reckon API

- 830 Payroll Premier

- 326 Point of Sale

- 2K Personal Plus and Home & Business

- 74 About Reckon Community