Leave without Pay not allowed to produce $0 payslip or transaction

Kelly_8164450

Member Posts: 6 ✭

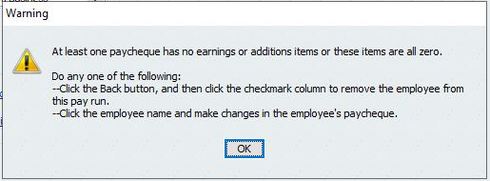

We have an employee on 7 weeks leave. He has used his leave balance and is now on LWOP. I have set up a LWOP payroll item however it is not allowing me to create a pay transaction for him? When selecting create payment, I am receiving an error message:

I need to create a payslip showing LWOP for this period and leave accured etc.

I need to create a payslip showing LWOP for this period and leave accured etc.

1

Comments

-

hmm.. you could make a LWOP Salary item - and when using it in the pay - make it 1c...then put the tax as .01c and this will make it a NIL item - not sure that leave would/should accrue when on leave without pay?1

-

Hi Kelly

Why??? Why do you need to create a pay for zero for 2 weeks, simply record this 7 weeks in the 'leave of absense' on the employee info tab2 -

how is that completed "leave of absense"?0

-

Go to employee profile & edit>employment info drop down menu>leave of absense tab, click on leave of absence button (this will close all open windows). It takes you to the employee organiser, simply 'add'.

Complete the effective date (start) anticipated return, reason, leave type, paid or unpaid button, and enter a note if you wish0 -

To enable me to report each pay period to the ATO. I need to keep a record of what a full time perm employee has earned each week.

0 -

The STP reports on YTD, so each pay you send to ATO updates the YTD, the only time you may have to do a nil pay, is if they are still off when you do your final reporting at the end of the year.

Or you could report on an individual pay and make it final during the year when they go off on leave if they are going to be off over the end of the financial year.

If they are not off over the EOFY then if they are not getting paid ATO doesn't want to know, they have the last pay you lodged with the YTD before they went off, if nothing has changed there is nothing to report.

There will be a way around this through STP without having to do zero pays for 7 weeks1

Categories

- All Categories

- 6.9K Accounts Hosted

- 11 📢 Reckon Accounts Hosted - Announcements

- 6K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.2K Reckon Payroll 🚀

- 19 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3.1K Reckon One

- 7 📢 Reckon One - Announcements

- 11 Reckon Invoices App

- 14 Reckon Insights

- 114 Reckon API

- 830 Payroll Premier

- 326 Point of Sale

- 2K Personal Plus and Home & Business

- 74 About Reckon Community

Accredited Partner

Accredited Partner