Reckon One Enhancements (13 February 2017)

Rav

Administrator, Reckon Staff Posts: 15,380  Community Manager

Community Manager

Community Manager

Community Manager

Hi everyone,

Our Reckon One team have been busy and have delivered a new update to Reckon One bringing in enhancements to emailing, chart of accounts and more.

You'll find details of the new update below

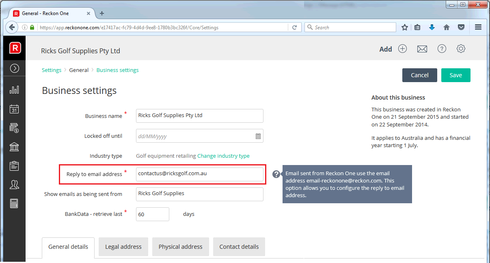

UPDATES TO EMAILING IN RECKON ONE

In the November 2016 Reckon One update we introduced some significant changes to emailing -

https://community.reckon.com/reckon/topics/reckon-one-enhancements-24-november-2016

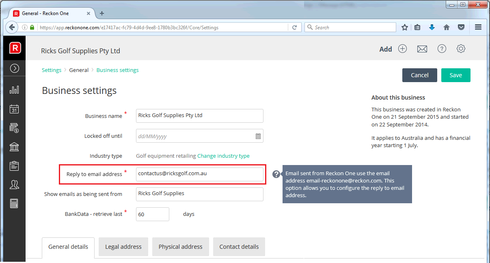

Today's update includes an additional email change that adds a line of text to emails sent from Reckon One.

The new line of text contains the ‘Reply to’ email address defined for the book.

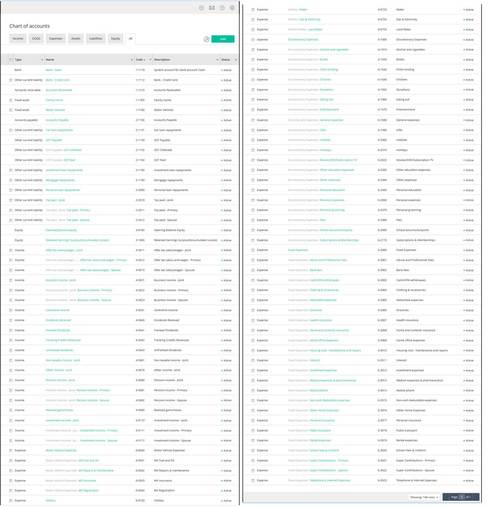

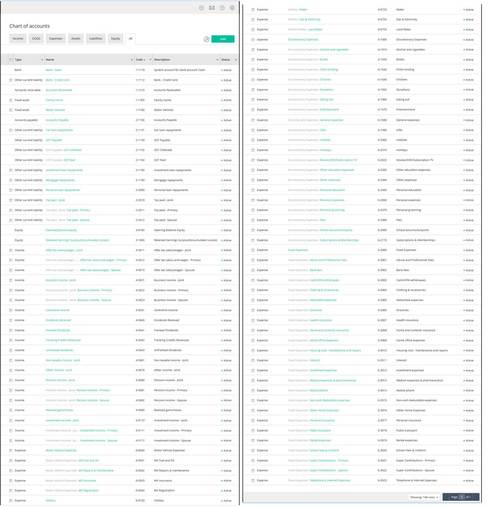

CHART OF ACCOUNTS UPDATE: DUPLICATE ACCOUNT NAMES

You can now use multiple instances of an account name in the chart of accounts.

Parent account names must be unique against other parent account names.

Sub-account names must be unique against other sub-account names within the same sub branch.

In the example below, multiple instances of Drinks expense, Venue fee and Food expense accounts exist. Each instance is located under a different parent account.

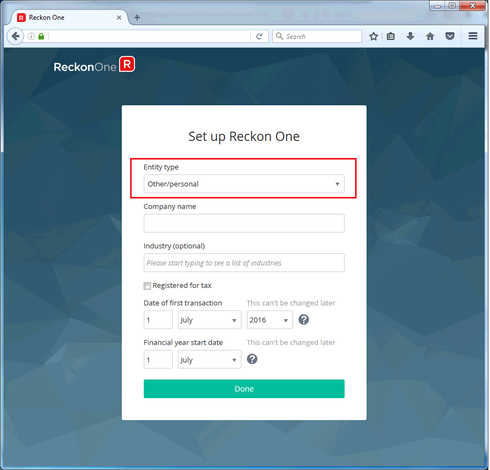

CHART OF ACCOUNTS UPDATE: PERSONAL CHART OF ACCOUNTS

In the November 2016 Reckon One update we introduced some changes to the book setup wizard and the chart of accounts.

https://community.reckon.com/reckon/topics/reckon-one-enhancements-24-november-2016

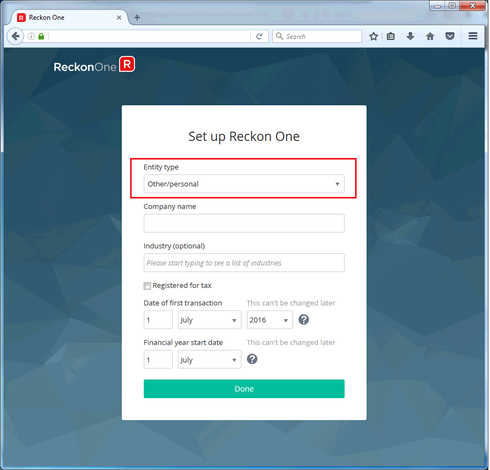

Today's update includes an additional change that relates to new Australian books.

When creating a new Australian book, specifying the entity type Other/personal now creates a Personal chart of accounts listing for the book. The personal entity/chart of accounts is tailored toward those who wish to use Reckon One for personal finances instead of business finances.

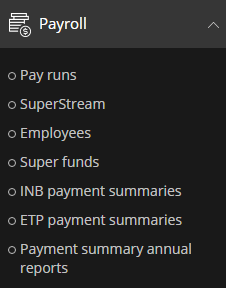

PAYROLL MENU CHANGES

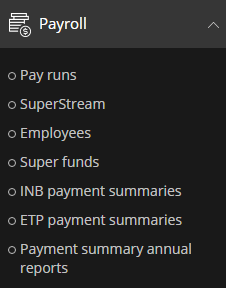

Several changes have been made to the Payroll side navigation menu:

PAYROLL WIDGET FOR DASHBOARD

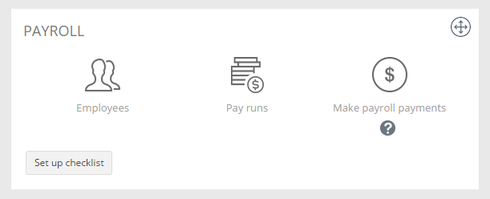

A payroll widget has been added to assist with setting up payroll, and to provide quick links to common functionality.

When a new book is created with the Payroll module, this is the initial view of the Payroll widget which displays on the dashboard.

Existing books can display this widget by selecting Customise dashboard and enabling the Payroll widget.

Selecting the link ‘Watch the Payroll Getting Started Videos’ will take you to a number of our How-To videos to help you get everything setup in Reckon One: You'll find these here - http://go.reckon.com/newreckonone-videos/

Selecting the link ‘Get started with Payroll’ will open a set up checklist.

Select each step to view a brief description of what is required and a button to navigate to the appropriate page.

As each step has some minimum information saved, it will automatically be marked as completed. Once a step has been marked as completed, the button can still be accessed to navigate to that page again.

When all the steps have been completed or skipped (steps 4 and 7 are not essential so may be skipped), select Hide checklist to display a quick links view of the widget.

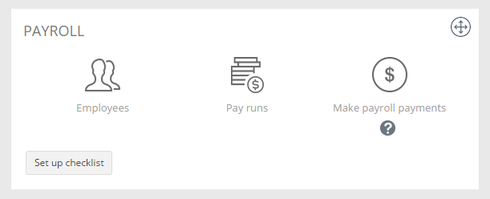

This view of the widget has links to Employees, Pay runs, and Make payments.

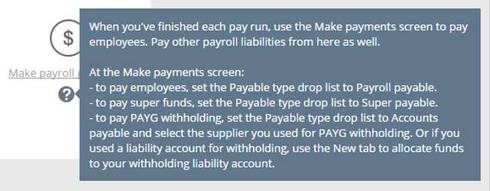

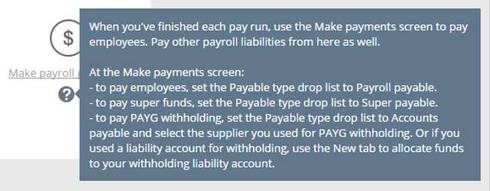

A help icon under ‘Make payroll payments’ has information about creating payments for payroll and superannuation.

Select Set up checklist if you want to return to the checklist view of the widget at any time.

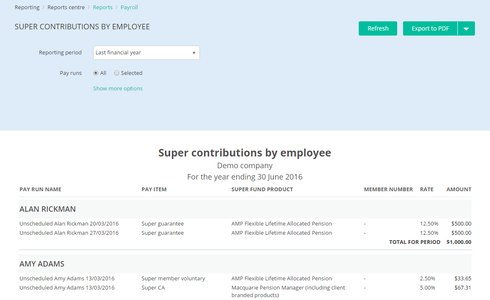

SUPER CONTRIBUTIONS BY EMPLOYEE REPORT

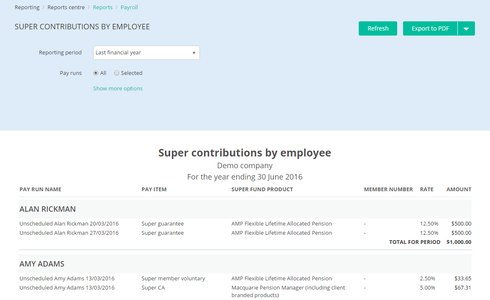

A new report for Super contributions by employee has been added.

It can be accessed by selecting Reporting > Reports Centre, then selecting the Payroll category.

This report shows a breakdown of super amounts by employee, and is similar to the existing Super Transactions Report which shows a breakdown of super amounts by super fund.

The report can be run for selected pay runs, super fund products and employees.

BASE RATE FOR EMPLOYEE OTE EARNINGS

A new column Base rate has been added to the Earnings grid on the Employee Pay set up page.

The checkbox is automatically ticked when the first OTE pay item is added to the Earnings grid. Only one OTE pay item can be ticked, so if a second pay item is ticked then the first will become unticked.

The checkbox isn’t visible for non-OTE pay items (where earnings type is Overtime, Variable or Termination).

The Rate for the Base rate pay item will be stored in the pay run when the employee is added to it, and is the default rate used when adding leave items to the Earnings & Leave grid in the pay run.

The pay slip will be amended in a future update to use this Base rate value for the Hourly rate / Annual salary value in the Pay Details section.

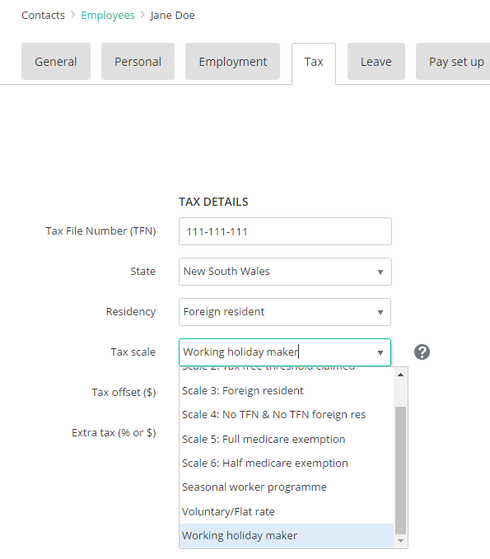

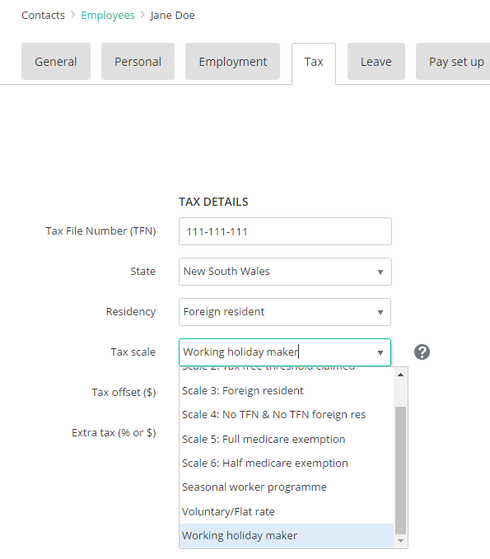

TAX CATEGORIES MOVED FROM RESIDENCY TO TAX SCALE

Changes have been made to the Residency and Tax scale options on the Employee Tax page.

Previously, Working holiday maker and Seasonal worker programme were available as Residency options. They have now been moved to the Tax scale dropdown options, and can be selected when Residency is set to Foreign Resident.

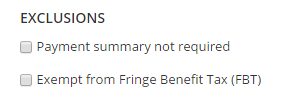

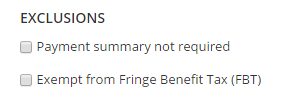

EXEMPT FROM FRINGE BENEFIT TAX

A new checkbox Exempt from Fringe Benefit Tax (FBT) has been added to the EXCLUSIONS section of the Employee Tax page.

This checkbox defaults to unticked. The checkbox value will be stored in the pay run when the employee is added to it.

The payment summary annual report will be updated to use the Exempt from Fringe Benefit Tax (FBT) value from the pay run in a future update.

PERSONAL AND OTHER TYPES OF LEAVE INCLUDED IN GROSS TAX CALCULATION

In a termination pay run, if Personal and Other types of leave are paid on termination they will now be included in the gross earnings tax calculation.

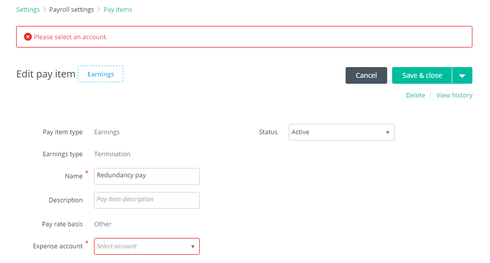

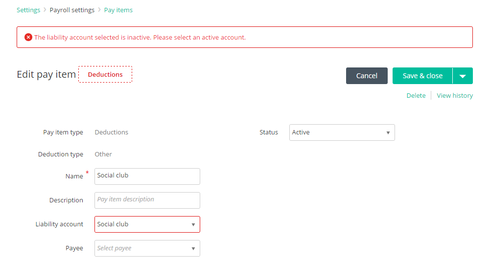

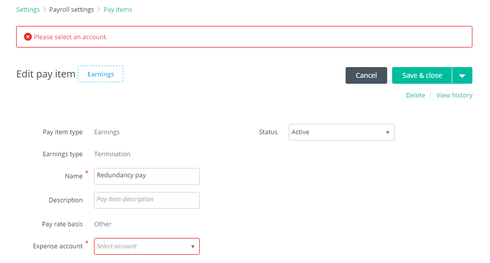

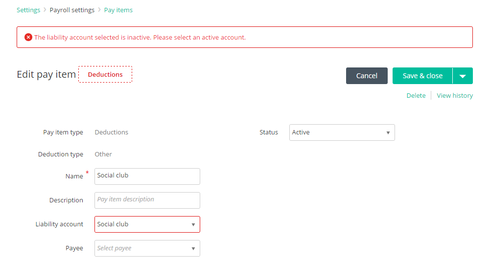

VALIDATION FOR MISSING OR INACTIVE ACCOUNTS

When viewing the list screens Settings > Payroll settings > Pay items and Settings > Payroll settings > Leave, “Missing account” will display in red in the Account column if the required account field is missing or inactive.

When saving a pay item or leave item with a missing account, an error message “Please select an account.” will display:

When saving a pay item or leave item with an inactive account, an error message will display:

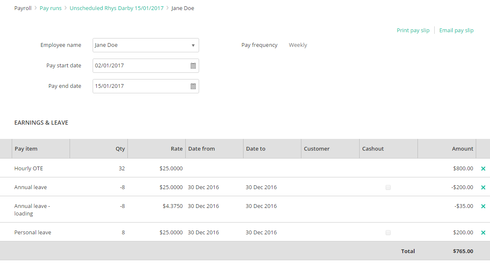

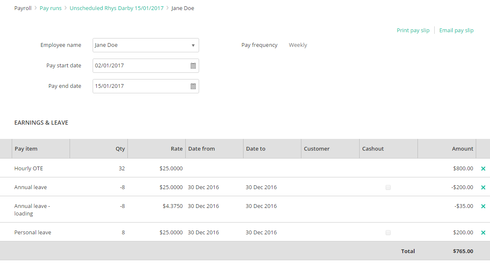

ALLOW NEGATIVE QUANTITIES IN THE PAY RUN

Negative values can now be entered in the Qty column of a pay run for all pay item types.

This is to allow adjustments to be made to an employee’s pay items from previous pay runs without having to undo that pay run, for example, if Annual leave was paid instead of Personal leave.

For superannuation pay items, negative values can be entered in the Rate column.

Note: if the employee’s total gross earnings for the pay run are negative, no tax will be calculated.

Our Reckon One team have been busy and have delivered a new update to Reckon One bringing in enhancements to emailing, chart of accounts and more.

You'll find details of the new update below

UPDATES TO EMAILING IN RECKON ONE

In the November 2016 Reckon One update we introduced some significant changes to emailing -

https://community.reckon.com/reckon/topics/reckon-one-enhancements-24-november-2016

Today's update includes an additional email change that adds a line of text to emails sent from Reckon One.

The new line of text contains the ‘Reply to’ email address defined for the book.

CHART OF ACCOUNTS UPDATE: DUPLICATE ACCOUNT NAMES

You can now use multiple instances of an account name in the chart of accounts.

Parent account names must be unique against other parent account names.

Sub-account names must be unique against other sub-account names within the same sub branch.

In the example below, multiple instances of Drinks expense, Venue fee and Food expense accounts exist. Each instance is located under a different parent account.

CHART OF ACCOUNTS UPDATE: PERSONAL CHART OF ACCOUNTS

In the November 2016 Reckon One update we introduced some changes to the book setup wizard and the chart of accounts.

https://community.reckon.com/reckon/topics/reckon-one-enhancements-24-november-2016

Today's update includes an additional change that relates to new Australian books.

When creating a new Australian book, specifying the entity type Other/personal now creates a Personal chart of accounts listing for the book. The personal entity/chart of accounts is tailored toward those who wish to use Reckon One for personal finances instead of business finances.

PAYROLL MENU CHANGES

Several changes have been made to the Payroll side navigation menu:

- Super funds has been added. It can still be accessed from the Contacts menu as well.

- INB has been renamed INB payment summaries.

- ETP has been renamed ETP payment summaries.

- Annual report has been renamed Payment summary annual reports.

PAYROLL WIDGET FOR DASHBOARD

A payroll widget has been added to assist with setting up payroll, and to provide quick links to common functionality.

When a new book is created with the Payroll module, this is the initial view of the Payroll widget which displays on the dashboard.

Existing books can display this widget by selecting Customise dashboard and enabling the Payroll widget.

Selecting the link ‘Watch the Payroll Getting Started Videos’ will take you to a number of our How-To videos to help you get everything setup in Reckon One: You'll find these here - http://go.reckon.com/newreckonone-videos/

Selecting the link ‘Get started with Payroll’ will open a set up checklist.

Select each step to view a brief description of what is required and a button to navigate to the appropriate page.

As each step has some minimum information saved, it will automatically be marked as completed. Once a step has been marked as completed, the button can still be accessed to navigate to that page again.

When all the steps have been completed or skipped (steps 4 and 7 are not essential so may be skipped), select Hide checklist to display a quick links view of the widget.

This view of the widget has links to Employees, Pay runs, and Make payments.

A help icon under ‘Make payroll payments’ has information about creating payments for payroll and superannuation.

Select Set up checklist if you want to return to the checklist view of the widget at any time.

SUPER CONTRIBUTIONS BY EMPLOYEE REPORT

A new report for Super contributions by employee has been added.

It can be accessed by selecting Reporting > Reports Centre, then selecting the Payroll category.

This report shows a breakdown of super amounts by employee, and is similar to the existing Super Transactions Report which shows a breakdown of super amounts by super fund.

The report can be run for selected pay runs, super fund products and employees.

BASE RATE FOR EMPLOYEE OTE EARNINGS

A new column Base rate has been added to the Earnings grid on the Employee Pay set up page.

The checkbox is automatically ticked when the first OTE pay item is added to the Earnings grid. Only one OTE pay item can be ticked, so if a second pay item is ticked then the first will become unticked.

The checkbox isn’t visible for non-OTE pay items (where earnings type is Overtime, Variable or Termination).

The Rate for the Base rate pay item will be stored in the pay run when the employee is added to it, and is the default rate used when adding leave items to the Earnings & Leave grid in the pay run.

The pay slip will be amended in a future update to use this Base rate value for the Hourly rate / Annual salary value in the Pay Details section.

TAX CATEGORIES MOVED FROM RESIDENCY TO TAX SCALE

Changes have been made to the Residency and Tax scale options on the Employee Tax page.

Previously, Working holiday maker and Seasonal worker programme were available as Residency options. They have now been moved to the Tax scale dropdown options, and can be selected when Residency is set to Foreign Resident.

EXEMPT FROM FRINGE BENEFIT TAX

A new checkbox Exempt from Fringe Benefit Tax (FBT) has been added to the EXCLUSIONS section of the Employee Tax page.

This checkbox defaults to unticked. The checkbox value will be stored in the pay run when the employee is added to it.

The payment summary annual report will be updated to use the Exempt from Fringe Benefit Tax (FBT) value from the pay run in a future update.

PERSONAL AND OTHER TYPES OF LEAVE INCLUDED IN GROSS TAX CALCULATION

In a termination pay run, if Personal and Other types of leave are paid on termination they will now be included in the gross earnings tax calculation.

VALIDATION FOR MISSING OR INACTIVE ACCOUNTS

When viewing the list screens Settings > Payroll settings > Pay items and Settings > Payroll settings > Leave, “Missing account” will display in red in the Account column if the required account field is missing or inactive.

When saving a pay item or leave item with a missing account, an error message “Please select an account.” will display:

When saving a pay item or leave item with an inactive account, an error message will display:

ALLOW NEGATIVE QUANTITIES IN THE PAY RUN

Negative values can now be entered in the Qty column of a pay run for all pay item types.

This is to allow adjustments to be made to an employee’s pay items from previous pay runs without having to undo that pay run, for example, if Annual leave was paid instead of Personal leave.

For superannuation pay items, negative values can be entered in the Rate column.

Note: if the employee’s total gross earnings for the pay run are negative, no tax will be calculated.

ℹ️ Stay up to date with important news & announcements for your Reckon software! Click HERE for more info.

1

Categories

- All Categories

- 6.9K Accounts Hosted

- 11 📢 Reckon Accounts Hosted - Announcements

- 6K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.2K Reckon Payroll 🚀

- 19 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3.1K Reckon One

- 7 📢 Reckon One - Announcements

- 11 Reckon Invoices App

- 14 Reckon Insights

- 114 Reckon API

- 830 Payroll Premier

- 326 Point of Sale

- 2K Personal Plus and Home & Business

- 74 About Reckon Community