Reckon One UPDATE (28 June 2017)

Options

Rav

Administrator, Reckon Staff Posts: 15,391  Community Manager

Community Manager

Community Manager

Community Manager

Hi everyone,

Hope you're all having a productive EOFY, just a heads up to let you know Reckon One has received an update this morning which includes the compliance update.

TAX UPDATES 2017-2018

Tax, HELP and SFSS rates have been updated for the 2017-2018 financial year.

PAYMENT SUMMARIES 2017-2018

Payment summaries can now be added for the 2017-2018 financial year.

INB PAYMENT SUMMARIES 2016 - 2017

INB payment summaries for the 2016-2017 financial year have been updated to include the Gross Payments Type and the Fringe Benefit Tax question.

Gross Payments type

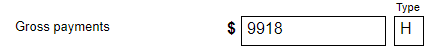

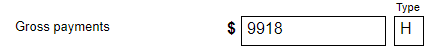

Employees with a tax rate of ‘Working holiday makers’ will have a Gross Payments Type of H on the payment summary:

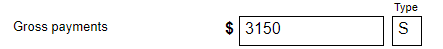

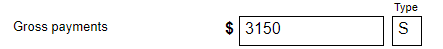

Employees with all other tax rates will have a Gross Payments Type of S on the payment summary:

If an employee has changed to or from the ‘Workingholiday makers’ rate within this financial year, then they will have 2 paymentsummaries (one for each Type).

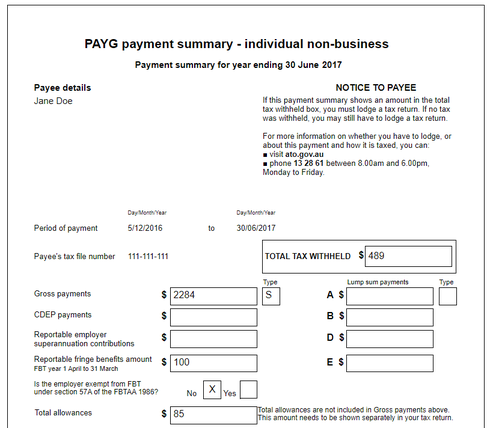

Fringe Benefit Tax

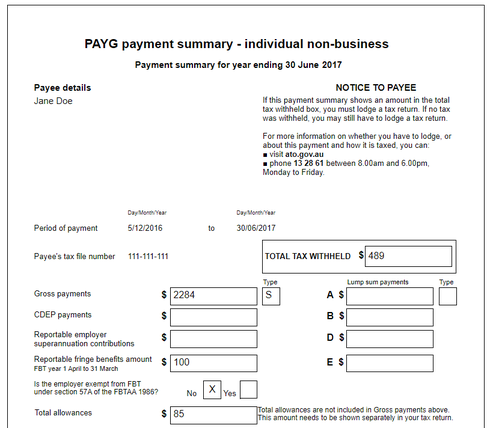

The payment summary includes a question ‘Is the employer exempt from FBT under section 57A of the FBTAA 1986?’ with No and Yes selection options. If the employee has no Fringe Benefit Tax amounts entered in YTD set up, then the No and Yes boxes will be blank.

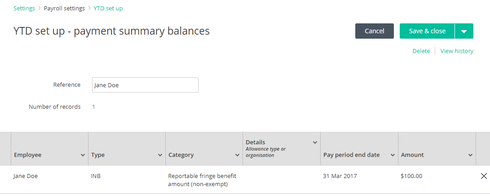

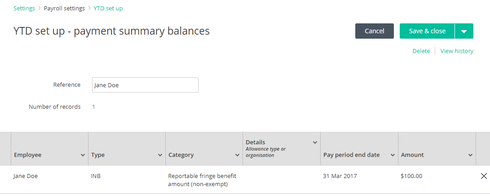

If the employee has an amount for ‘Reportable fringe benefit amount (non-exempt)’ entered in YTD set up, then the 'No' option will have an X.

Note: This category in YTD set up was previously named ‘Reportable fringe benefit amount’.

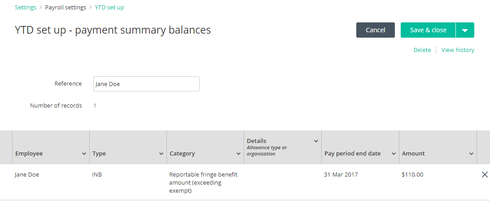

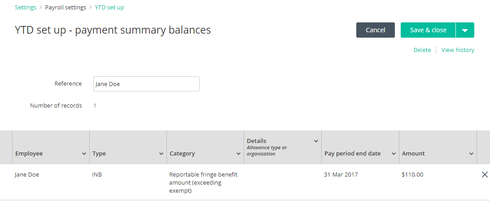

If the employee has an amount for ‘Reportable fringe benefit amount (exceeding exempt)’ entered in YTD set up, then the Yes box will have a X.

If the employee has an amount for ‘Reportable fringe benefit amount (non-exempt)’ and ‘Reportable fringe benefit amount (exceeding exempt)’ entered in YTD set up, then 2 payment summaries will be generated.

The ‘Reportable fringe benefit amount (non-exempt)’ will be on the same payment summary as the amounts for Gross payments, Total tax withheld, and all the other amounts.

The ‘Reportable fringe benefit amount (exceeding exempt)’ will be on a second payment summary with no other amounts.

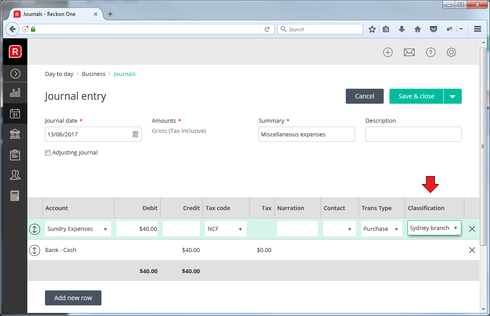

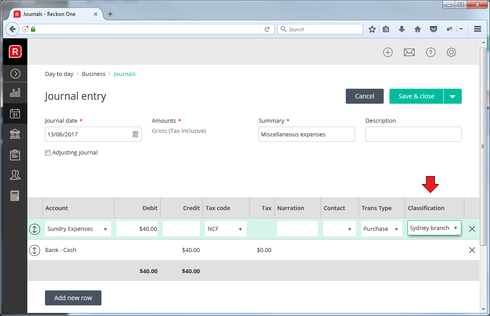

CLASSIFICATIONS FOR JOURNALS

Classifications are now available in journals!

The Classification feature for Reckon One is a progressive introduction and this is the third release for classifications.

Classification reporting will be available in a subsequent release. For more information on classifications please visit our earlier Community posts here -

Reckon One UPDATE (19 December 2016)

Reckon One UPDATE (25 May 2017)

Hope you're all having a productive EOFY, just a heads up to let you know Reckon One has received an update this morning which includes the compliance update.

TAX UPDATES 2017-2018

Tax, HELP and SFSS rates have been updated for the 2017-2018 financial year.

PAYMENT SUMMARIES 2017-2018

Payment summaries can now be added for the 2017-2018 financial year.

INB PAYMENT SUMMARIES 2016 - 2017

INB payment summaries for the 2016-2017 financial year have been updated to include the Gross Payments Type and the Fringe Benefit Tax question.

Gross Payments type

Employees with a tax rate of ‘Working holiday makers’ will have a Gross Payments Type of H on the payment summary:

Employees with all other tax rates will have a Gross Payments Type of S on the payment summary:

If an employee has changed to or from the ‘Workingholiday makers’ rate within this financial year, then they will have 2 paymentsummaries (one for each Type).

Fringe Benefit Tax

The payment summary includes a question ‘Is the employer exempt from FBT under section 57A of the FBTAA 1986?’ with No and Yes selection options. If the employee has no Fringe Benefit Tax amounts entered in YTD set up, then the No and Yes boxes will be blank.

If the employee has an amount for ‘Reportable fringe benefit amount (non-exempt)’ entered in YTD set up, then the 'No' option will have an X.

Note: This category in YTD set up was previously named ‘Reportable fringe benefit amount’.

If the employee has an amount for ‘Reportable fringe benefit amount (exceeding exempt)’ entered in YTD set up, then the Yes box will have a X.

If the employee has an amount for ‘Reportable fringe benefit amount (non-exempt)’ and ‘Reportable fringe benefit amount (exceeding exempt)’ entered in YTD set up, then 2 payment summaries will be generated.

The ‘Reportable fringe benefit amount (non-exempt)’ will be on the same payment summary as the amounts for Gross payments, Total tax withheld, and all the other amounts.

The ‘Reportable fringe benefit amount (exceeding exempt)’ will be on a second payment summary with no other amounts.

CLASSIFICATIONS FOR JOURNALS

Classifications are now available in journals!

The Classification feature for Reckon One is a progressive introduction and this is the third release for classifications.

Classification reporting will be available in a subsequent release. For more information on classifications please visit our earlier Community posts here -

Reckon One UPDATE (19 December 2016)

Reckon One UPDATE (25 May 2017)

ℹ️ Stay up to date with important news & announcements for your Reckon software! Click HERE for more info.

0

Categories

- All Categories

- 6.9K Accounts Hosted

- 11 📢 Reckon Accounts Hosted - Announcements

- 6K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.2K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3.1K Reckon One

- 7 📢 Reckon One - Announcements

- 11 Reckon Invoices App

- 14 Reckon Insights

- 114 Reckon API

- 830 Payroll Premier

- 326 Point of Sale

- 2K Personal Plus and Home & Business

- 74 About Reckon Community