Reckon One UPDATE - Single Touch Payroll & 2018/19 tax table RELEASE (28 June 2018)

Options

Rav

Administrator, Reckon Staff Posts: 15,416  Community Manager

Community Manager

Community Manager

Community Manager

Hi everyone,

Exciting news! We're really pleased to let you know Single Touch Payroll functionality and 2018/2019 tax table update is now live in Reckon One!

RECKON ONE SINGLE TOUCH PAYROLL

Reckon One now has Single Touch Payroll (STP) functionality via the new Reckon GovConnect STP application.

The Reckon GovConnect STP application is currently in the process of being rolled out.

Please note: This post assumes that the company book has been setup for use with payroll in Reckon One and that a pay run has been completed.

Single Touch Payroll is enabled by default for all Reckon One Payroll module users.

For information about the specific fields required in Reckon One to be set up before a STP submission can occur please refer to our Knowledge Browser article here -

Preparing Reckon One for Single Touch Payroll (STP)

PROCESSING A SUBMISSION TO RECKON GOVCONNECT STP FOR REVIEW

Once you have completed a pay run in Reckon One, it will be available to submit to the ATO once you have sent it to the Reckon GovConnect STP application.

To do this perform the following tasks;

Open 'Single Touch Payroll' in Reckon One. Click the 'Single Touch Payroll' option listed in the sidebar under the Payroll heading.

If this link is not available, you may not have permissions to this area. Please discuss this with your Reckon One administrator.

The Single Touch Payroll summary page will then open and you will see a list of all the pay runs which can be submitted to Reckon GovConnect STP for onward processing to the ATO.

These pay runs are known as 'Pay Events' in Single Touch Payroll.

The summary page gives you the name of the pay run, the date of the pay run, the number of employees included in the event, whether it is set to be a full file replacement and the total gross of the pay period. This allows you to quickly and easily identify each unique event that may need to be submitted to the ATO for processing.

Once you click on a entry in the summary list, the details of the employees included in the pay event will display.

The information includes the pay period, the gross (year to date) amounts paid to the employees as well as the tax withheld from the employees. This is where you must determine which type of transmission you need to send. A new submission, full file replacement or update.

SUBMITTING A NEW PAY EVENT

To submit a new pay event to Reckon GovConnect STP for review, ensure that the data displayed is correct and then click 'Send to GovConnect STP' as shown below.

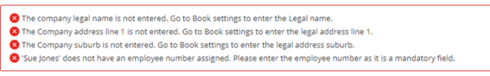

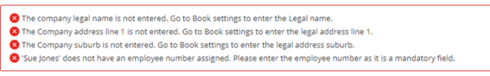

Once you have clicked 'Send To GovConnect STP', validation errors may occur as per below. Ensure you resolve all these before trying again.

Once you have successfully sent the data, it will appear in the Reckon One area of Reckon GovConnect STP for review before being sent for processing by the ATO.

SUBMITTING A UPDATE EVENT

If Reckon or the ATO has advised that you should perform a update event to correct a issue, or alternately you decide to perform a update event to correct a issue, please see the below process on completing this.

In the employee list, you will see a column with Update and a checkbox next to each employees name, such as below:

If you select the Update checkbox and then submit a update event, that employee will be included in the submission. Only those employees which have been selected will be included in the Update request as per the rules of Single Touch Payroll.

If you need to replace every employee's information you should perform a full file replacement submission which is detailed further down this post.

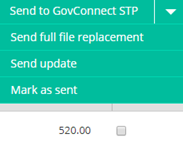

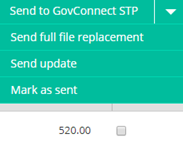

To submit a update event, click the dropdown arrow next to 'Send to GovConnect STP' which will give you a drop down set of options.

Click Send Update and the transmission will be sent to Reckon GovConnect STP as an Update Event.

SUBMITTING A FULL FILE REPLACEMENT

If you need to replace a entire submission that has been processed by the ATO already, you need to use a Full File Replacement.

In order to do this you need to firstly perform the changes required such as an updated pay run, and then return to the Reckon One Single Touch Payroll page.

All employees are included in a Full File Replacement and as such do not need to be individually selected for updating.

To send a Full File Replacement, click the dropdown arrow next to Send to GovConnect STP and click Send Full File Replacement.

The submission will then be sent to Reckon GovConnect STP as a Full File Replacement transaction.

2018/2019 PAYG TAX TABLES

Reckon One now has the 2018/19 tax tables coming into effect from July 1 2018.

All pays dated from July 1 2018 will use these new tax tables. Pays processed before 1 July 2018 will continue to use the previous tax tables.

Exciting news! We're really pleased to let you know Single Touch Payroll functionality and 2018/2019 tax table update is now live in Reckon One!

RECKON ONE SINGLE TOUCH PAYROLL

Reckon One now has Single Touch Payroll (STP) functionality via the new Reckon GovConnect STP application.

The Reckon GovConnect STP application is currently in the process of being rolled out.

Please note: This post assumes that the company book has been setup for use with payroll in Reckon One and that a pay run has been completed.

Single Touch Payroll is enabled by default for all Reckon One Payroll module users.

For information about the specific fields required in Reckon One to be set up before a STP submission can occur please refer to our Knowledge Browser article here -

Preparing Reckon One for Single Touch Payroll (STP)

PROCESSING A SUBMISSION TO RECKON GOVCONNECT STP FOR REVIEW

Once you have completed a pay run in Reckon One, it will be available to submit to the ATO once you have sent it to the Reckon GovConnect STP application.

To do this perform the following tasks;

Open 'Single Touch Payroll' in Reckon One. Click the 'Single Touch Payroll' option listed in the sidebar under the Payroll heading.

If this link is not available, you may not have permissions to this area. Please discuss this with your Reckon One administrator.

The Single Touch Payroll summary page will then open and you will see a list of all the pay runs which can be submitted to Reckon GovConnect STP for onward processing to the ATO.

These pay runs are known as 'Pay Events' in Single Touch Payroll.

The summary page gives you the name of the pay run, the date of the pay run, the number of employees included in the event, whether it is set to be a full file replacement and the total gross of the pay period. This allows you to quickly and easily identify each unique event that may need to be submitted to the ATO for processing.

Once you click on a entry in the summary list, the details of the employees included in the pay event will display.

The information includes the pay period, the gross (year to date) amounts paid to the employees as well as the tax withheld from the employees. This is where you must determine which type of transmission you need to send. A new submission, full file replacement or update.

SUBMITTING A NEW PAY EVENT

To submit a new pay event to Reckon GovConnect STP for review, ensure that the data displayed is correct and then click 'Send to GovConnect STP' as shown below.

Once you have clicked 'Send To GovConnect STP', validation errors may occur as per below. Ensure you resolve all these before trying again.

Once you have successfully sent the data, it will appear in the Reckon One area of Reckon GovConnect STP for review before being sent for processing by the ATO.

SUBMITTING A UPDATE EVENT

If Reckon or the ATO has advised that you should perform a update event to correct a issue, or alternately you decide to perform a update event to correct a issue, please see the below process on completing this.

In the employee list, you will see a column with Update and a checkbox next to each employees name, such as below:

If you select the Update checkbox and then submit a update event, that employee will be included in the submission. Only those employees which have been selected will be included in the Update request as per the rules of Single Touch Payroll.

If you need to replace every employee's information you should perform a full file replacement submission which is detailed further down this post.

To submit a update event, click the dropdown arrow next to 'Send to GovConnect STP' which will give you a drop down set of options.

Click Send Update and the transmission will be sent to Reckon GovConnect STP as an Update Event.

SUBMITTING A FULL FILE REPLACEMENT

If you need to replace a entire submission that has been processed by the ATO already, you need to use a Full File Replacement.

In order to do this you need to firstly perform the changes required such as an updated pay run, and then return to the Reckon One Single Touch Payroll page.

All employees are included in a Full File Replacement and as such do not need to be individually selected for updating.

To send a Full File Replacement, click the dropdown arrow next to Send to GovConnect STP and click Send Full File Replacement.

The submission will then be sent to Reckon GovConnect STP as a Full File Replacement transaction.

2018/2019 PAYG TAX TABLES

Reckon One now has the 2018/19 tax tables coming into effect from July 1 2018.

All pays dated from July 1 2018 will use these new tax tables. Pays processed before 1 July 2018 will continue to use the previous tax tables.

ℹ️ Stay up to date with important news & announcements for your Reckon software! Click HERE for more info.

0

Comments

Categories

- All Categories

- 6.4K Accounts Hosted

- 10 📢 Reckon Accounts Hosted - Announcements

- 5.9K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.3K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3K Reckon One

- 7 📢 Reckon One - Announcements

- 10 Reckon Invoices App

- 14 Reckon Insights

- 107 Reckon API

- 822 Payroll Premier

- 307 Point of Sale

- 1.9K Personal Plus and Home & Business

- 63 About Reckon Community