Sole Trader without PAYG payments - how do I record a tax refund?

Options

Dave Dennis

Member Posts: 29 ✭

I am a sole trader (part time) with a small business that does not attract PAYG payments at this time. I don't record any payroll or Tax Withholding etc.

So how do I record a tax refund from the ATO? I did a journal entry but for some reason the refund comes up as a liability in my balance sheet. That can't be right!

Please help a simple graphic artist understand this...

So how do I record a tax refund from the ATO? I did a journal entry but for some reason the refund comes up as a liability in my balance sheet. That can't be right!

Please help a simple graphic artist understand this...

0

Comments

-

22/03/17

Hi Dave,

Following on from my last post in your previous thread

https://community.reckon.com/reckon/topics/using-tax-bas-for-payment-but-no-bank-transaction-is-disp...

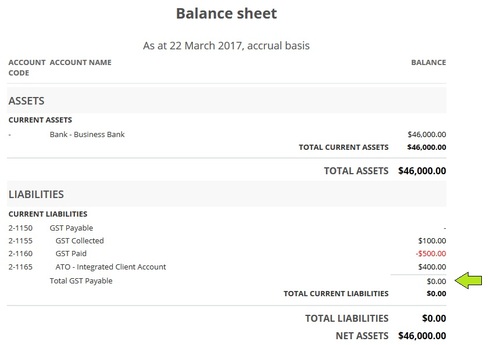

The 4 tax accounts in R1 are all liability accounts.

GST Payable (this the the parent account & you don't really need to use it)GST Collected (tracks tax on sales)

GST Paid (tracks tax on purchases)

ATO - Integrated Client Account (can be used to record ATO payments/refunds to offset the amounts in both GST Collected & GST Paid accounts)

I'll use a simple example to explain...

Income for the period is $1,000.00 + $100.00 tax collected on sales/income.

Expense for the period is $5000.00 + $500.00 tax paid on purchases/expenses.

The $100.00 tax collected is tracked under the 'GST Collected' liability account as positive amount (increasing the balance).

The $500.00 tax paid is tracked under the 'GST Paid' liability account as a negative amount (reducing the balance).

The current balance of the 4 tax liability accounts is (negative) -$400.00. So in this scenario the ATO owes me a $400.00 refund.

The ATO pays me the $400.00. So in my journal I need to increase the balance of the liability by $400.00 & increase the balance of my bank account by $400.00

My bank account has increased by $400.00

My tax liability has increase by $400.00 (bringing the total from -$400.00 back to $0.00)

0 -

Thanks, Qwerty. I appreciate your time offering a detailed response.

That all makes sense for GST tracking, but I'm talking about a personal income tax refund, not a GST refund.

As a sole trader I don't track payroll, so I'm not clear on how it works for PAYG.

Perhaps this is confusing because I have started a new set of accounts with Reckon One (in this fin. year) and the refund in question is for the previous year? I'm just thinking that I did pay quarterly tax payments in the previous year, and I supposed this refund would offset against those payments, but they're not shown in this set of accounts.

Is it possible (pretty please?) you could do a similar explanation to the above but for payg?

0 -

Are you using 1 book to cover both personal finances & business finances or do you have 2 books, one for personal finances & one for business finances?0

-

I have a separate business account, so personal finance generally doesn't cross over (in theory) but the ATO deposited my refund into the business account so I have to reconcile it somehow even though it's not 'income'. Does that make sense?

0 -

Also, in future I will likely need to make quarterly PAYG contributions as I have done in the past. This area has always confused me more than the GST part. At least the collection of GST is clear but we don't 'collect' personal income tax so it just accumulates and doesn't reduce or 'balance'.

0 -

This is probably something that would best be answered by an accountant. From my understanding this would fall into the owner contribution scenario (i.e. adding personal funds to a business account). There are a a couple threads on this topic.

https://community.reckon.com/reckon/topics/how_do_i_enter_owners_contribution

https://community.reckon.com/reckon/topics/transferred-money-from-personal-bank-account-to-pay-bill

0 -

That's a helpful concept. I have emailed my accountant to get some further clarity and discuss it with respect to future PAYG contributions as well.

Mate, I am super-appreciative of your time.

1 -

Hi Dave

This is a personal item, so you should put this in the Equity section, the account name is Owner's Capital contribution, (deposits) or Owners Capital Drawings (withdrawals)

When you start your PAYG instalments, make another account in this section calling it PAYG Instalments, so that when you give your accountant your paperwork they can identify them.

Cheers

Lynda

0

Categories

- All Categories

- 6.9K Accounts Hosted

- 11 📢 Reckon Accounts Hosted - Announcements

- 6K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.2K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3.1K Reckon One

- 7 📢 Reckon One - Announcements

- 11 Reckon Invoices App

- 14 Reckon Insights

- 114 Reckon API

- 830 Payroll Premier

- 326 Point of Sale

- 2K Personal Plus and Home & Business

- 74 About Reckon Community