Where do I find credits in Reckon One?

Options

[Deleted User]

Posts: 4 ✭

My customer paid to much - I entered the required amount in the allocate window - and the rest came up as "Issue a credit" - where do I find this credit and how do I reimburse the customer?

0

Comments

-

0

0 -

Where do I find this credit which has been issued?0

-

Hi Accounts Darwin,

I'll use a simple example to give my input on this question.

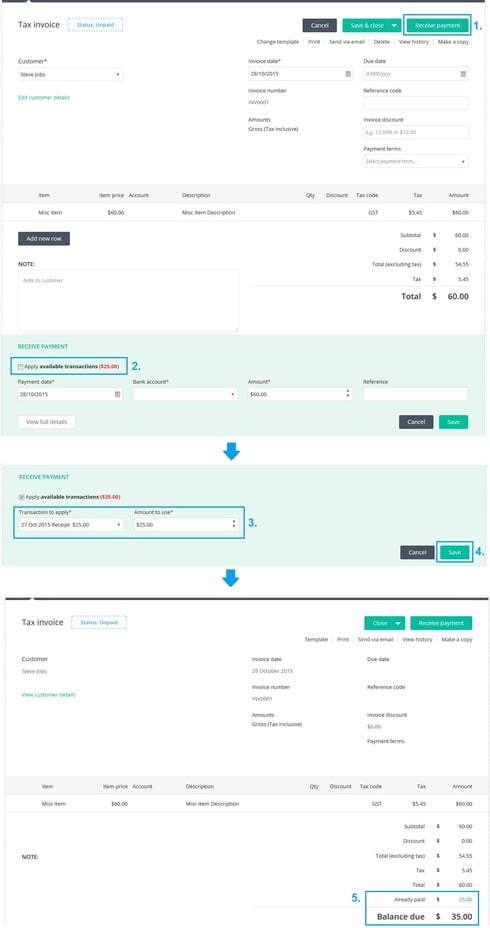

Say I have a customer Steve Jobs who has paid me $125. However Steve only owed $100, so $25 of the $125 was an over payment. Steve has requested for the $25 over payment to be refunded & not stored as a credit on his account. I have since refunded Steve the $25.

My bank statements shows two transactions...

$125 money in

$25 money out

I enter the $125 money in as a receipt against my bank account (in my example Business Bank). $100 is assigned to an income account (in my example Income X) & $25 is not assigned to any account.

Note: This receipt could also relate to an invoice, however, to keep this example simple I have chosen not to cover the invoice scenario.

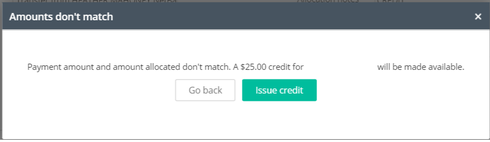

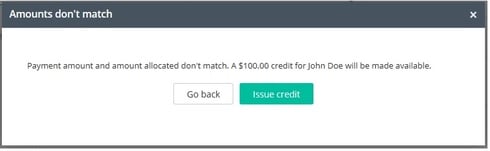

When saving the receipt, I see the credit message & select the option Issue credit

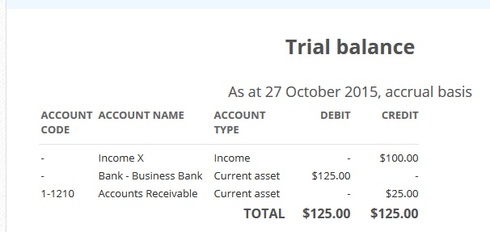

If I look at my financial reports I will see...

- that my bank account balance has increased $125

- that my income account has increased by $100

- that accounts receivable has decreased by $25

I enter the $25 money out (refund) as a journal. I debit accounts receivable $25 & credit my bank $25. On my debit line I also select the customer Steve Jobs in the contact field on that line.

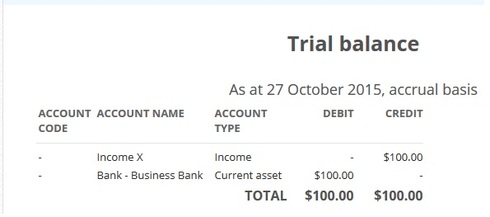

If I look at my financial reports I will see...

- that my bank account balance shows $100 (i.e the $25 customer credit has been reversed)

- that my income account shows $100

- that the negative entry of $25 on accounts receivable relating to the customer credit has been reversed

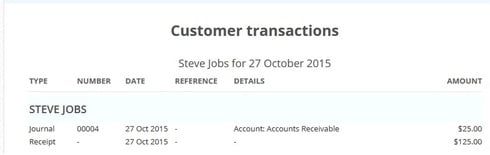

If I look at my customer reports I will see...

- the $125 payment (receipt transaction)

- the $25 refund (journal transaction)

When I reconcile my bank I will see...

- $125 money in

- $25 money out

Please note that this is just a suggestion & that there may be other community members (e.g. accountants, bookkeepers, partners, Reckon staff or other members who have gone through this process...etc) that are more knowledgeable on this topic than myself.1 -

Hi Qwerty Thanks for the reply. This is helpful if I am going to refund the customer. Suggestions on what to do if I want to retain the credit for their next invoice? How do I locate that credit to apply to a next invoice? Thanks0

-

If it's agreed that the credit will be retained for a later invoice, once you have saved the applicable invoice, you can apply the credit via the Receive payment option within that invoice.

1

1 -

One more question What if we decide to retain the credit initially but two months later the customer decides they rather want to have a refund. How do I go about doing that refund then? Do I follow the instructions on the first example? Thanks a stack0

-

Yes that is correct.0

-

I've got a similar question that unless I'm not getting it, was the same question originally asked by Accounts Darwin, but not really answered.

If a credit has been given to a customer, using your above example but with an invoice: Invoice owe was $100 but customer paid $125. So in reconciling the invoice, I apply the transaction of $125 to the invoice, which results in the invoice showing $100(PAID), and you're asked if you wish to apply the $25 as a credit to the customer, of which you say 'Yes'.

Ok, so dilemma being, weeks later, I know a $25 credit exists for a customer (perhaps I've forgotten) - How do I find that credit?

0 -

Hi David,

The easiest way to locate a customer credit is to view the Aged debtor transactions report.

Reporting > Reports centre > Customers > Aged debtor transactions

If you have a credit transaction for a customer, the report will show a negative entry for this customer & you can drill down/open the relevant transaction by clicking the transaction type (1st column)

1 -

Thanks Qwerty. That is great. And I just wrote a new invoice for the customer and hit 'Receive Payment' to notice that the available credit popped up to attribute to the invoice. Cheers.1

-

I just found a pain for this! When applying the credit to a current invoice, you can't if you've locked off your accounting period post reconciliation! So I've got to go back unlock the appropriate month to do it!0

-

Qwerty. A follow up question. If I have a payment from a customer but no invoice (they paid too much or too early) how to I make that transaction a credit to their name and thus reconciling the transaction?0

-

Hi David,

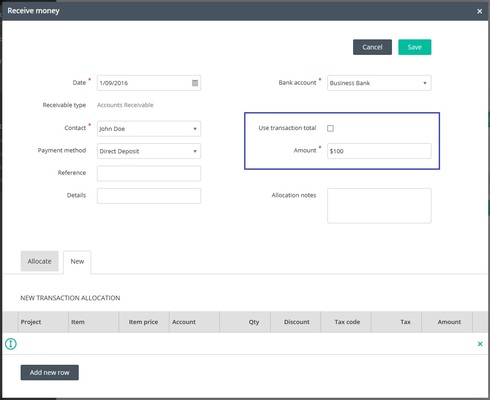

In the case where a customer pays you early & the whole payment relates to an invoice that is yet to be raised. You can enter a credit receipt transaction for this customer. In the receipt, untick the option Use transaction total, this unlocks the Amount field where you can then manually enter the amount of the early payment. Don't enter any allocations in the New or Allocate tabs in the bottom of the receipt.

When you save this receipt you should be prompted whether you want to issue a credit, click Issue credit.

This receipt will increase your bank account balance but not affect your income on the profit & loss as the two accounts updated by this credit receipt are the bank account & accounts receivable.

Later when you have raised the invoice, you can allocate the credit to the invoice when going through the invoice payment process & apply the credit.

In the case where a portiion of a customer payment needs to be treated as an early payment or overpayment. See my first comment on this thread regarding how to enter this receipt. It's almost identical to the scenario covered above except that you are allocating part of the receipt total & leaving the other part unallocated resulting in a credit for the unallocated portion of the total.1 -

Thanks Qwerty. That is the answer I've been searching for. (Is that a song lyric?) I've done that at the credit is now showing in Aged Debtors for the customer and the transaction is reconciled. Awesome.

One thing I've noticed though (and didn't affect this process) but the check box for Use Transaction Total is NEVER checked for me nor can I ever check it? Strange. But all works and this problem is now solved thankyou.0

Categories

- All Categories

- 6.4K Accounts Hosted

- 10 📢 Reckon Accounts Hosted - Announcements

- 5.9K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.3K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3K Reckon One

- 7 📢 Reckon One - Announcements

- 10 Reckon Invoices App

- 14 Reckon Insights

- 107 Reckon API

- 822 Payroll Premier

- 307 Point of Sale

- 1.9K Personal Plus and Home & Business

- 63 About Reckon Community