Long Service Leave

Hi

I need some assistance in setting up addition & deduction items in payroll. A couple of our employees have taken Long Service Leave from Leaveplus to which we contribute but since there is no paycheque for them for the LSL period taken, I need to know how to set this up in payroll for the super guarantee and annual leave calculation.

Thanks

Carrie

Answers

-

Hi @SIDA

Regarding the Long Service Leave set-up in Reckon Accounts Hosted. Please check this out -

Processing Long Service Leave in Reckon Accounts - Reckon Help and Support Centre

I hope this helps. Please let us know if any concerns/issues. Thank you!

Regards

Tanvi

0 -

Hi @SIDA

Are you (the employer) paying the employees' leave or is it being paid to them direct by Leaveplus ?

0 -

Hi Shaz

Leave paid by Leaveplus. I need to create a $0 pay cheque with Super being calculated and annual leave accrued.

Thank you

Carrie

1 -

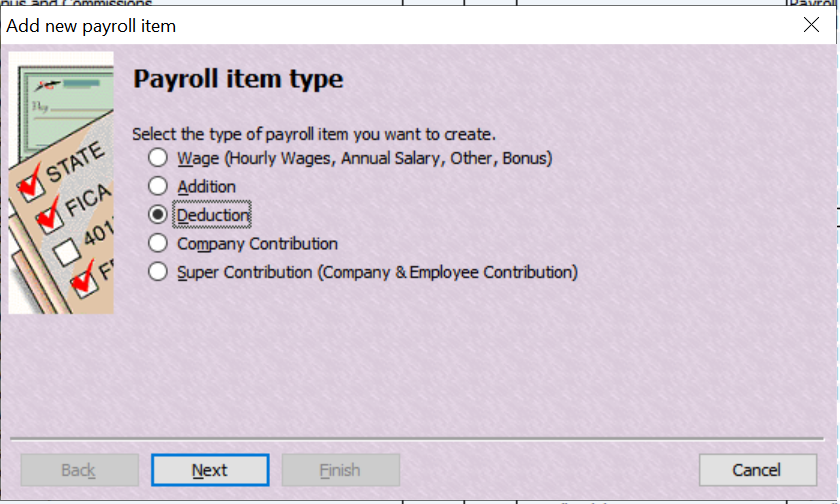

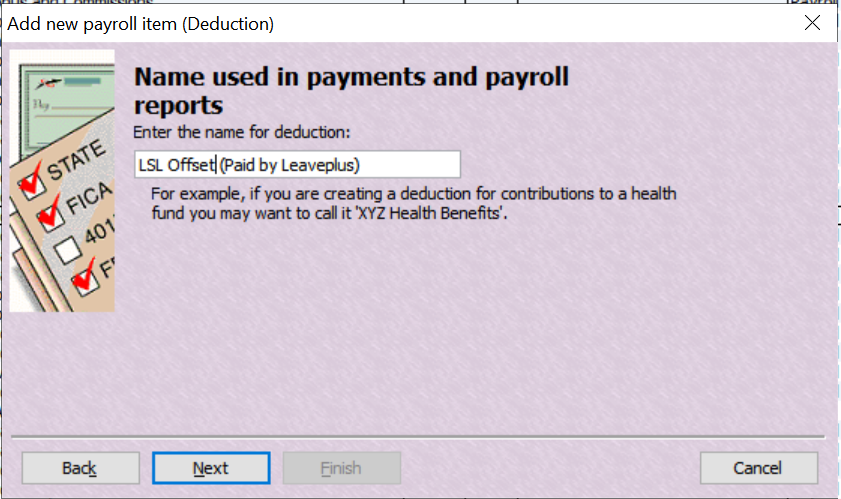

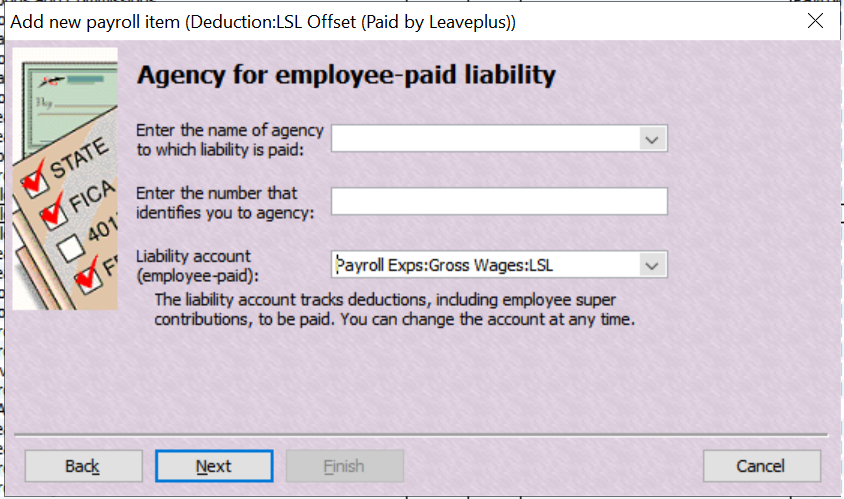

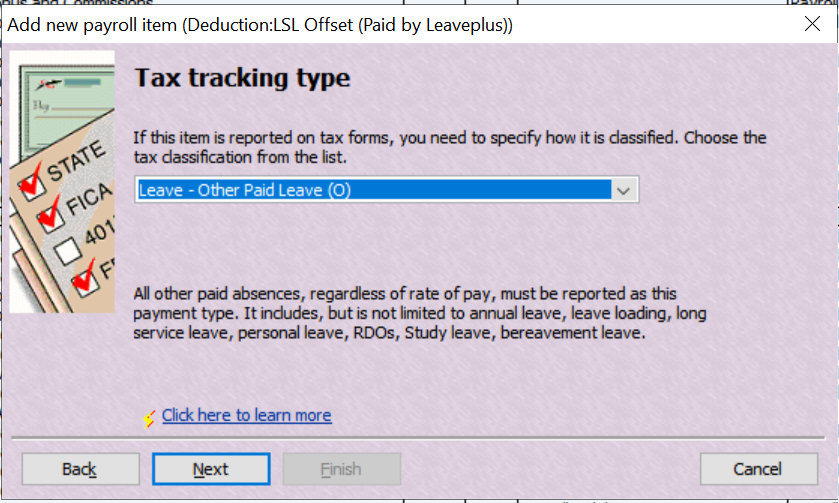

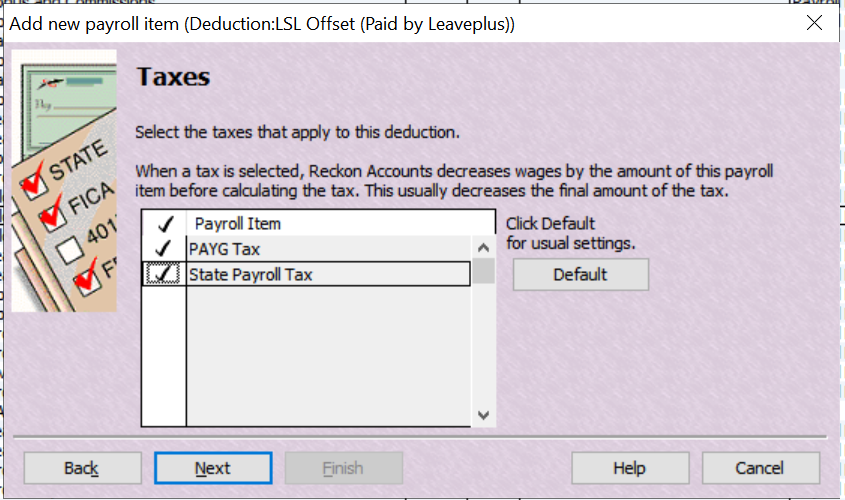

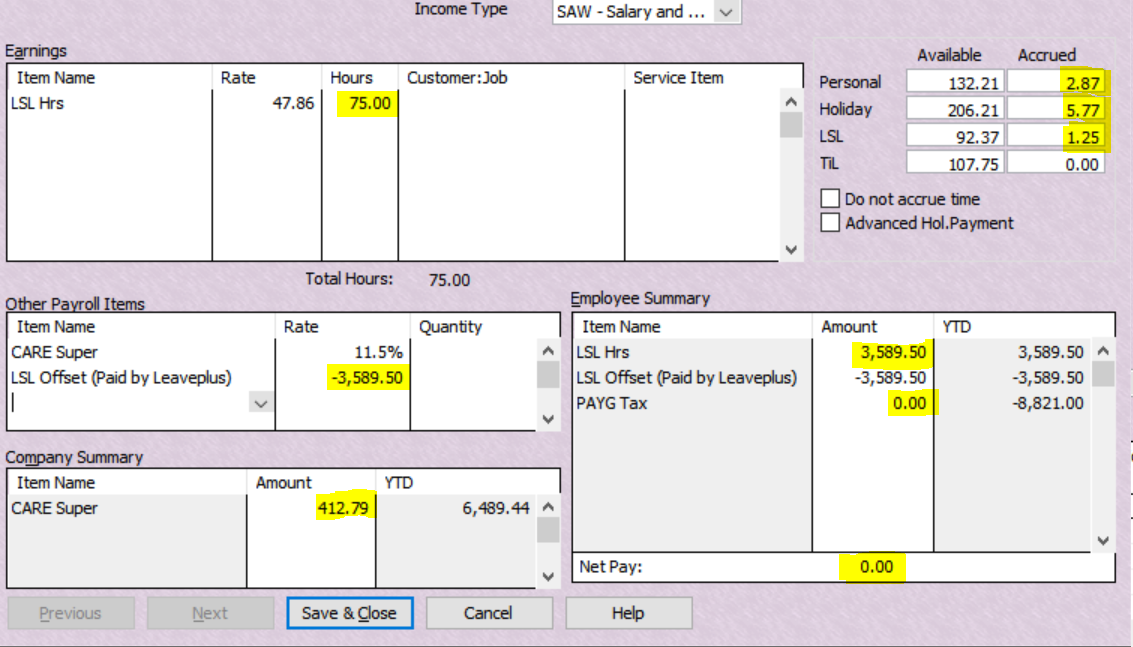

As the system doesn't allow solely $ 0 gross amounts (but will accept a $ 0 net Paycheque), you'll need to use both an Hourly Leave-linked Payroll Item - for the Super calc & leave reduction - & a Deduction Payroll Item (posting to the exact same account, STP tax category & other configs) to offset the $ values.

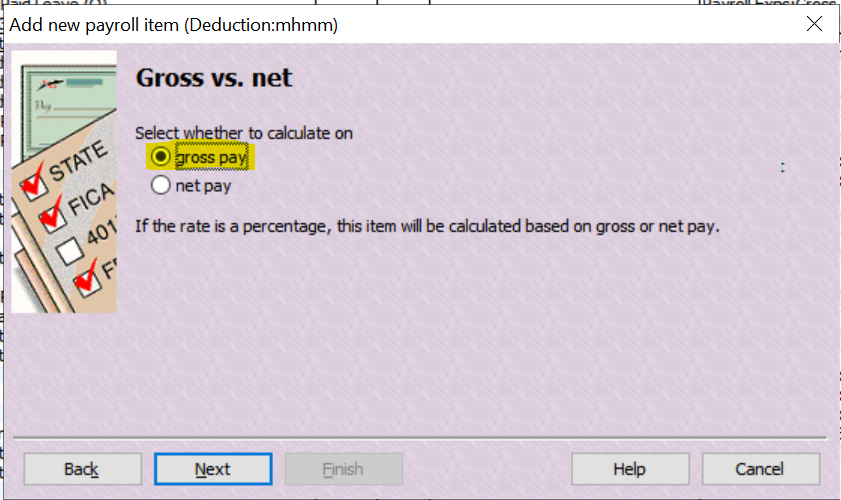

IMPORTANT: Ensure you select gross pay (not net …) here ! :

0 -

Hi Shaz

Can you post some examples or steps please

Regards

Carrie

0 -

(Note: In this particular file, the Wages are broken down into subaccounts, but the linked account should be whatever Payroll expense account you have your LSL Payroll Item posting to, in your particular Chart of Accounts 😊) :

Enter the gross $ amount of the leave payment in the deduction Rate:

Hope that helps ! 😊

3 -

Thank you Shaz, that worked however the annual leave is not accruing. Can you send me the steps to this as well. I understand that LSL accrues annual leave as well.

Much appreciated

Carrie

0 -

Hi Carrie

That's correct.

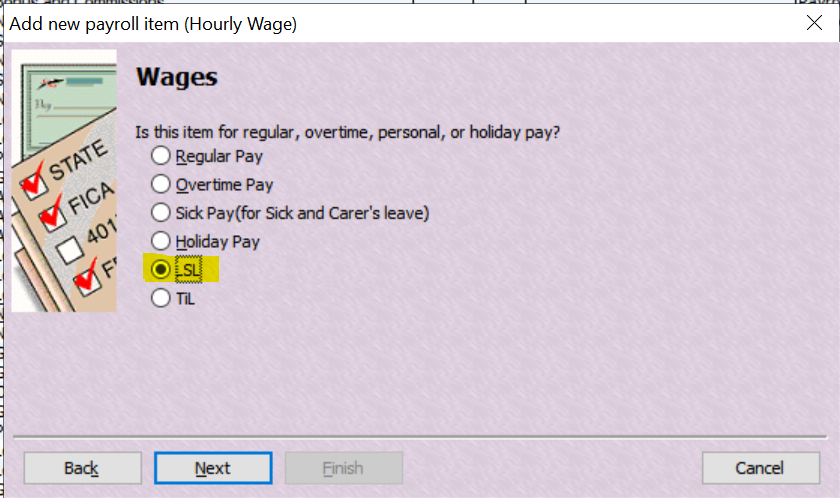

If it's not accruing, your normal LSL Payroll Item has either not been linked to LSL when originally created:

(This link is crucial as this is the only way the system knows when - & which - leave is to be affected! Unfortunately, this selection is ONLY available at initial setup though, as this particular window is not accessible again afterwards 😬)

or …..

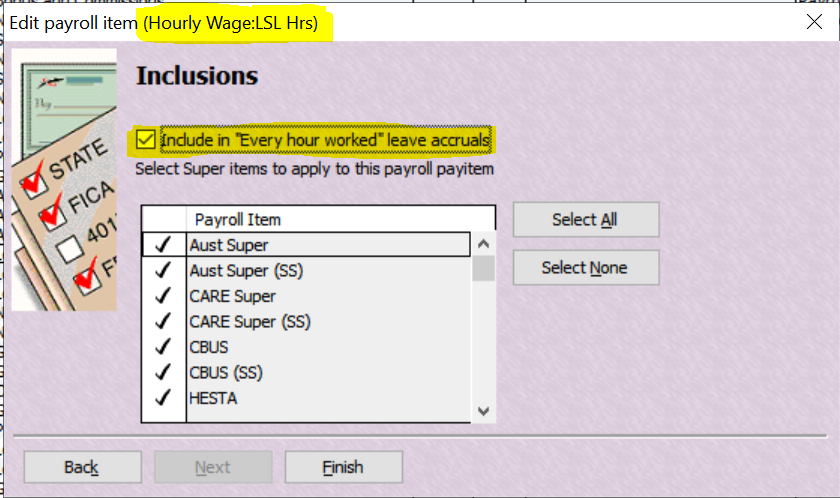

… it's not been ticked here, to accrue :

0 -

Thank you Shaz, this worked. I just need to sort out how to stop RDO hours being accrued on the LSL.

Regards

Carrie

0 -

Good to hear! 👏🏻👌🏻

" … just need to sort out how to stop RDO hours being accrued on the LSL …"

That will depend on how it's been setup (I have it set up as another Leave type, accruing via specific entry of a negative line which deducts the additional RDO hrs worked, so it isn't automatically impacting any Payroll Items in my files 😬 )

0 -

Hi Shaz

Can you please send me an example of your setup.

Regards

Carrrie0 -