Long Distance Transport- Travel Allowance

Hi, I am hoping someone can assist me pls as this also happened last year.

I have a Transport Travel Allowance set up in Payroll as per Reckon Technical Support suggestion:

Type -Addition

Expense account -Wages Truck

Tax Tracking Type- Allowance- Award Transport Payments

Taxes - Nil ( no tick against PAYG or State Payroll Tax)

Calculate item based on Quantity

Default Rate - 56.28 Limit is blank Ticked -This is an annual limit

Super is Nil against All.

Could someone please explain why the Travel Allowance has changed from appearing on the Payslip from : Adjustments to Net Pay to now appearing under Earnings and Hours. The changed happened on Payslip 25/03/2025 on all 65 drivers. Does it have something to do with the Ticked -This is an annual limit? If this is the case why this payperiod? There has been no alteration to the Payroll Item as I am the only person with permission and it happened last year. I have attached some payslip for your reference.

With the STP reporting the value appears under the Allowances.

I am receiving phone calls from Drivers asking why it has changed and they now think it is being taxed as it appears with Taxable items. I look forward to your reply.

Answers

-

Hi @Kathyd,

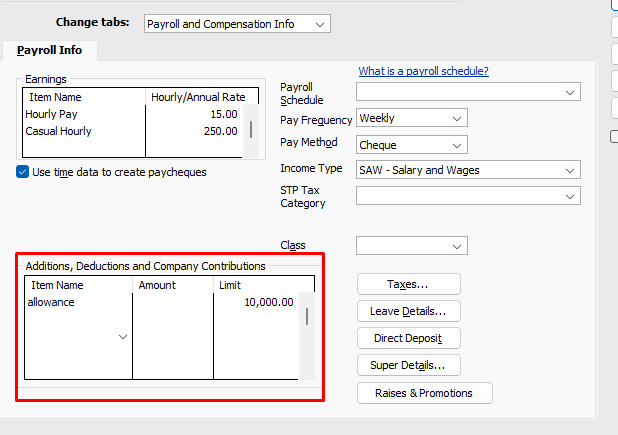

Have you checked whether there is a limit set for this employee in their payroll and compensation information? Additionally, have you tried to Untick the Annual limit box in the Allowance settings to see if that makes any difference.

Best regards,

Karren

Kind regards,

0 -

Hi @Kathyd

I stumbled across this Help article which may assist:

0 -

Many Thanks All. There is no limit in the Payroll section as Klaura suggested but I will unticking the annual limit in the Payroll item. I will do Shaz's work around until I can look how to set up a custom paylsip.

1