RESC not Correct

Upon EOFY reconciliation, I have become aware that the RESC super YTD in STP (for 2 employees only) does not match the correct payroll super YTD figures. I have pinpointed 4 pay runs for one employee, following prior discussions I have gone into each payrun, deleted the salary sacrifice amount, saved the transaction then returned to the payrun to reinput the salary sacrifice amount and it still does not appear in the RESC Column. For the other employee, there is no RESC missing (1 weeks salary sacrifice).

The payment summaries in GovConnect are also wrong for these two employees.

Any help would be greatly appreciated. I have spoken with a Reckon Trainer, and followed her advise, apart from re-entering the figures I have also rebuilt the data file, with no results. I have also followed the steps with Super report by fund, as directed in Reckon troubleshooting.

I am using Reckon Desktop. I have attached copies of the reports.

Thanks.

Best Answer

-

Dear @Sinatra ,

Can you check the following:

- Go to the Employee Centre.

- Find an affected employee, and Edit Employee.

- Go into Payroll and Compensation info.

- Open their Super Details.

- Under Employee settings, ensure both options are Unticked.

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180

Answers

-

Dear @Sinatra ,

This would be due to corrupted line items in the payrun.

To fix this:

- In the Super Report by Employee report, double-click a SS figure with 0.00 RESC.

- This will open the payrun affected. Click Open Paycheque Detail.

- In the paycheque details, click Unlock Net Pay.

- Once unlocked, delete the Salary Sacrifice line.

- Go to a new, blank line, and add the Salary Sacrifice item back.

- Once completed, click OK.

- Click Save & Close.

- Repeat this process for each affected payrun on the report.

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

Hi Alexis,

thank you, but I have followed this procedure numerous times and nothing changed :-(

0 -

Dear @Sinatra ,

Just confirming: are you previewing your STP data in the Employees → Process Single Touch Payroll section (v34/2025)?

Or are you using Payment Summaries report (2024)?

If you're using the latter, then you need to be aware that Payment Summaries is inaccurate as it is not built to process STP Phase 2 data, and will not produce accurate comparisons to reports.

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

Hi Alexis,

Yes, I am previewing in the Employees - Process Single Touch Payroll section.

The Reckon trainer I have spoken with has talked me through all possible fixes, and nothing has worked.

Thanks,

0 -

Dear @Sinatra ,

Have you tried to rebuild your company file (File → Utilities → Rebuild Data)?

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

Hi Alexis,

Yes, I did rebuild our Company File this morning, with no results.

Thanks,

0 -

Dear @Sinatra ,

Out of curiosity:

- Did you update your employee's Super % before using the Employees → Update Super Rate function?

- The PDFs you provided looks closer to the Payment Summaries function we had in version 2024 - are you certain that you are in the latest version (Reckon Accounts 2025/v34)?

- When you are deleting the SAL SAC item from the employee's payrun, are you going to a new line in the Other Payroll Items section and adding it in again, or are you adding it on the same line?

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

Hi Alexis,

I haven't updated to the new 2025-V34 version as yet because I wanted to finalise this year first. Do you think that will help?

I have been going into a new line when deleting and re-entering.

Thanks for your time, I do appreciate it.

0 -

it is advisable to rebuild the data file 3 times

0 -

Dear @Sinatra ,

I would hold off 2025/V34 for now until this matter is squared off.

However, please do not refer to the Payment Summaries to Print/Email as these will always be inaccurate.

When you create the EOFY STP and upload it to GovConnect, does the RESC value appear correctly in GovConnect's records? (You do not need to submit this, we just want to use it as a frame of reference.)

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

Hi Alexis,

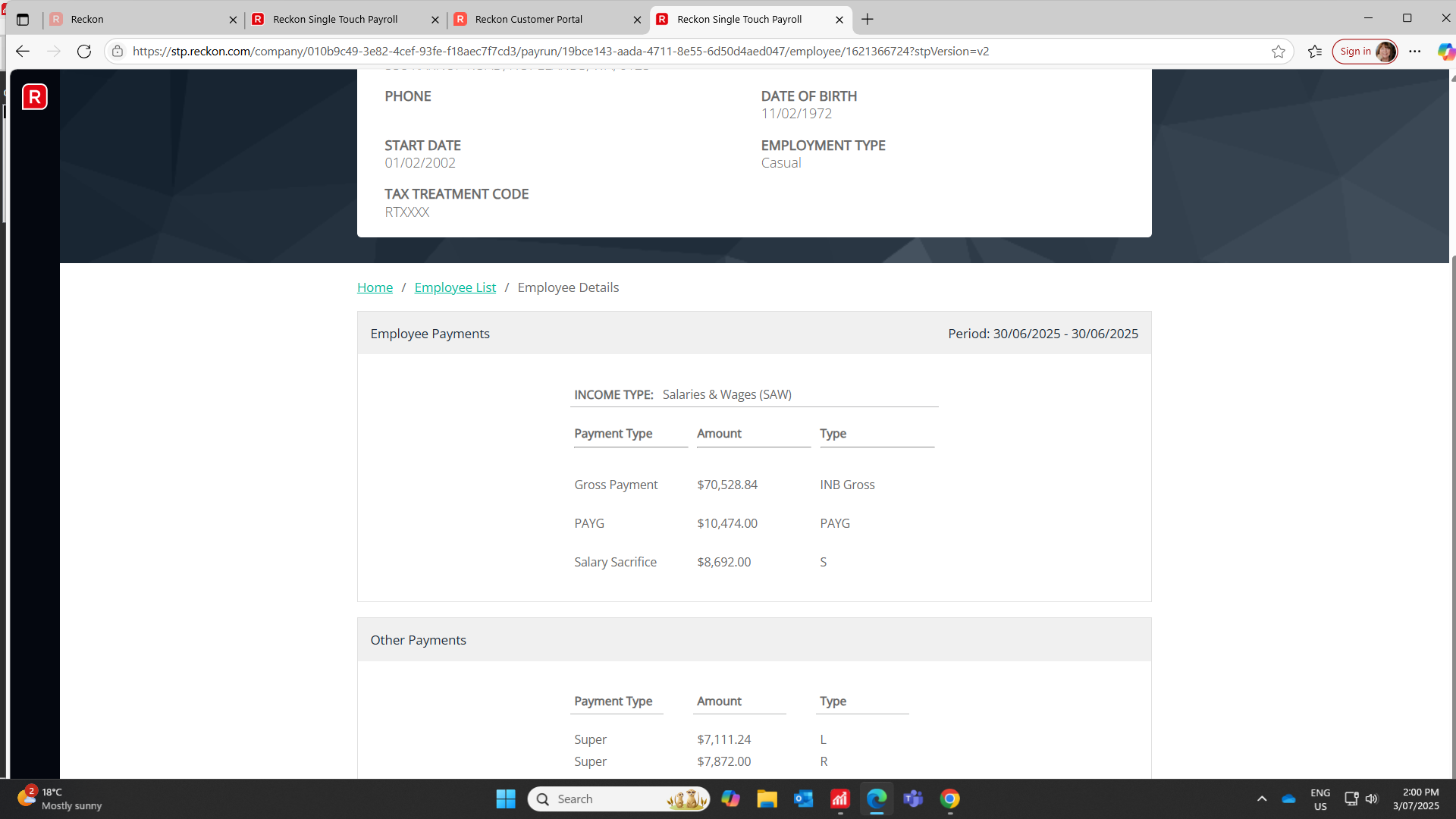

I have just uploaded the finalisation to GovConnect, and the results are still wrong. I have attached a screen shot.

Thank you

0 -

Kris, thanks.

If all else fails I will rebuild 2 more times.

0 -

Alexis,

You are a legend. The employee who had 4 blank lines had one box ticked. Now I have been able to go into the pays and re-submit the salary sacrifice amount. Thank you so much!!! Problem solved.

Now I just have to work out how to find the other employee's one week difference, all his lines have carried across to the RESC column, and none of his boxes have ticks. Any ideas for this one?

Many thanks.

1 -

Dear @Sinatra ,

I would recommend checking your STP submissions prior to the EOFY and seeing when this RESC figure goes out of balance.

From that, you should be able to use the Super Report by Employee and clear the SAL SAC item like you did previously.

We sometimes find the item can corrupt but still show figures (though this is rare).

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

Alexis,

I have just been back into GovConnect after lodging an update and I am still one salary sacrifice payment short, even though Quickbooks is now correct. :-(

0 -

Hi Alexis,

I have done as you suggested, and the RESC figure goes out of balance on 3rd Feb.

I have been back into that pay in Quickbooks and changed the salary sacrifice again, lodged an update to the GovConnect and the figure is still out by one payment. I am losing my mind over this one :-( The figure in QB is correct, it's just not carrying over to GovConnect.

Thanks,

0