How to Finalize STP for year 24/25 when no employee was paid.

I am trying to do my STP finalization for the year 2024/2025, however, when I do this, I receive a warning window that displays, "No employees have been paid in the given year". This is true as my company has no more employees, and it is just me, and I did not pay myself this year as things are just too tough to keep the business profitable, so it was all work and pay off debts and expenses.

Anyway, I believe I still have to do my STP finalization for the financial year ending, however, it won't create or let me export the JSON file as it shows no employees in the window to select and tells me I have not selected any employee.

So how do I complete the STP finalization showing $0.00 was paid to no employee.

Best Answer

-

Steve I wouldn't trust that AI summary, they're wrong more often than they're right.

If you haven't paid anything at all throughout the year and sent STP then the ATO don't have any records so there's nothing to finalise.

Hope your business picks up again this year mate

1

Answers

-

if no wages were paid I can’t see why you would have to do a finalisation, and that message confirms that. In the old days you wouldn’t have had to fill out zero group certificates either. But I’ll stand corrected if I am missing something

0 -

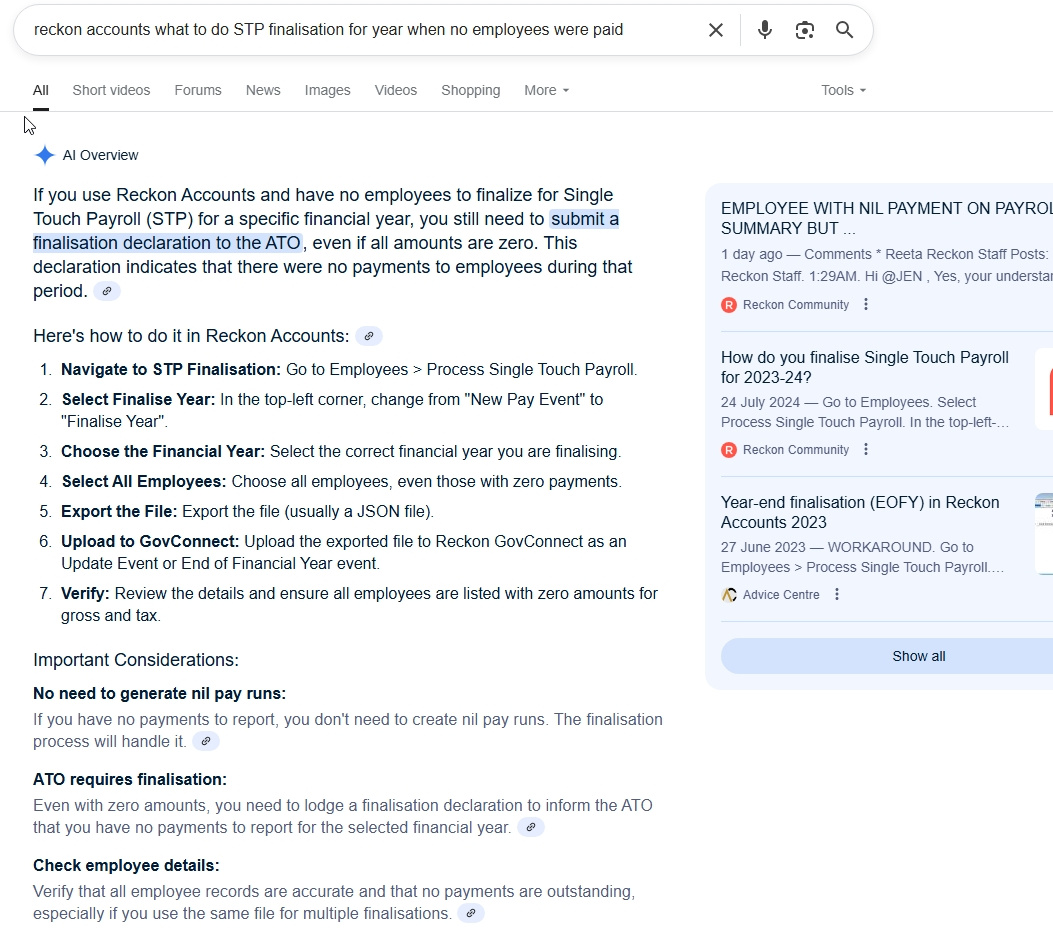

I would agree @Kris_Williams . The only thing is when I do Google research I find the following information. (I took a screen shot as well).

If you use Reckon Accounts and have no employees to finalize for Single Touch Payroll (STP) for a specific financial year, you still need to submit a finalisation declaration to the ATO, even if all amounts are zero. This declaration indicates that there were no payments to employees during that period. Here's how to do it in Reckon Accounts:

- Navigate to STP Finalisation: Go to Employees > Process Single Touch Payroll.

- Select Finalise Year: In the top-left corner, change from "New Pay Event" to "Finalise Year".

- Choose the Financial Year: Select the correct financial year you are finalising.

- Select All Employees: Choose all employees, even those with zero payments.

- Export the File: Export the file (usually a JSON file).

- Upload to GovConnect: Upload the exported file to Reckon GovConnect as an Update Event or End of Financial Year event.

- Verify: Review the details and ensure all employees are listed with zero amounts for gross and tax.

Important Considerations:

- No need to generate nil pay runs:If you have no payments to report, you don't need to create nil pay runs. The finalisation process will handle it.

- ATO requires finalisation:Even with zero amounts, you need to lodge a finalisation declaration to inform the ATO that you have no payments to report for the selected financial year.

0 -

Thank you @Eric Murphy . While what you say makes total sense , I hope it’s correct. Thank you for the kind words as well. Much appreciated.

0 -

@Eric Murphy is absolutely correct - STP is solely based on actual payments. Not employees, accruals, time or anything else, only amounts actually paid.

Unfortunately, that's a classic example of AI getting it wrong 🙄😬🤦♀️😩

0