Hi there, could you please update the link to the ATO's current tax table for daily & casual workers (NAT 1024)?

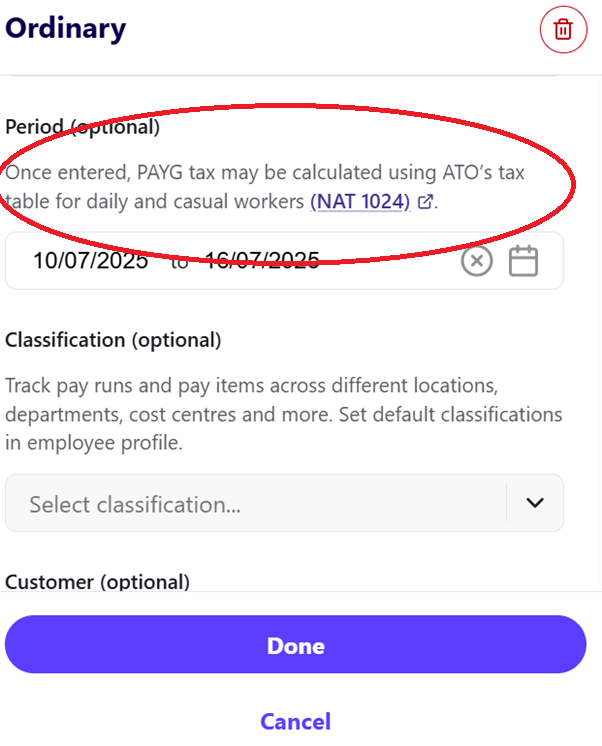

When you ‘create a pay run’ and ‘edit the employee pay run details’, you are given the option of adding the ‘period’ or dates worked. Under ‘period’ it states ‘Once entered, PAYG tax may be calculated using ATO’s tax table for daily and casual workers (NAT 1024)’.

The tax table that is linked has expired and hasn’t been relevant since July 1, 2024. Can this please be updated asap? Many thanks, Julie