HELP Debt

Hi

One of our employees has a HELP debt. We can see the amount is included in the PAYG total but doesn't show it separately anywhere. Is there a report in Reckon to show us how much is taken out for the HELP debt separately to everything else?

Thanks

Debbie

Comments

-

Hi @DebA

The extra PAYG isn't a separate tax/deduction, it's just an increase in the total PAYG amount payable (just like when someone isn't claiming the tax-free-threshold)

The ATO has annual "HELP Repayment Thresholds" that deem a specific repayment % rate & once an employee reaches those limits, these repayments are compulsory. These "HELP Repayments" are just facilitated via the tax system & finalised in an employee's tax return each year.

To determine this, each pay the payroll system will annualise that particular pay's gross, then pro rata it over the applicable pay frequency (weekly, fortnightly etc) - It then refers to the repayment threshold to determine the relevant percentage & adds this calculation into the total PAYG amount displayed.

The standard calculation for PAYG is a complex formula, in line with the actual ATO tax tables & there are also alternate tax tables for those other scenarios (no TFT, HELP debt etc)

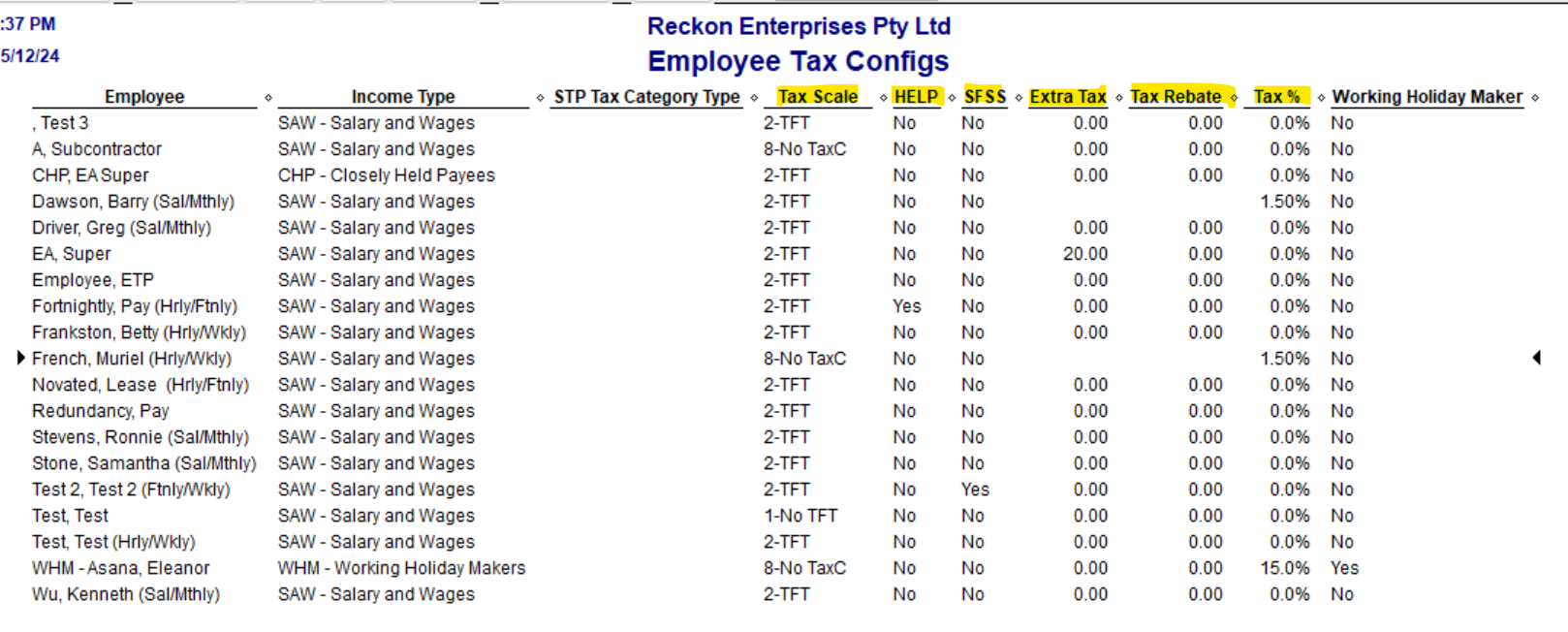

Payroll systems link to the applicable tax table to calculate the baseline PAYG - along with any other/ voluntary tax options, based on the employee's related selections/settings in their record eg :

Hope that helps 😁

0 -

Hi Shaz,

thanks for explanation. But we we're hoping to find a report that showed HELP debt separately somehow, but looks like there isn't one. bit frustrating.

Thanks

Debbie

0 -

It’s not a separated amount …. It’s just like when someone doesn’t claim the TFT or asks to have an extra $10 tax taken out per pay - You can’t report on just that PAYG difference (between the standard TFT-claiming amount v other scenarios 😬

This is because at the end of the year, ALL income is combined & taxed together, rather than per source 😁

1