GST impact when allocating customer deposits to completed jobs

jokernke

Member Posts: 3 Novice Member

I am using Reckon Accounts Premier Edition 2016 for a client who is registered for GST under Cash accounting method. When they make a sale, a 'Purchase agreement' is signed by the customer & an upfront 50% deposit is taken upon signing the agreement. I am trying to use the process that Reckon tells me to use in the 'help' menu so I have created a liability account & an item called 'customer deposits'. When the customer deposit is paid, I create a sales receipt allocating the payment to the 'customer deposit' item (which is linked to the liability account). I also enter the 'agreement' as an invoice & mark it as 'pending'. When the job is completed (which could be 3 months down the track), I mark the invoice as 'final' & insert a new line on the invoice to show a negative amount of the customer deposit that was paid on signing the agreement. This should remove the deposit from the liability account & then I would assume that the GST on the 'deposit' is reported on the BAS. My query is that I'm not sure which date Reckon Accounts will use to report the GST for the 'customer deposit'?? Should I be using the above method for Accrual accounting & not Cash Accounting?? Sorry, I'm just confused which procedure to use.

0

Comments

-

Gst is not payable until the sale is final and unconditional. If the deposit is refundable this is not usually the case.0

-

It really depends if the deposit is refundable or not, as in a security deposit.

For all deposits on sale items, which are usually non-refundable and are simply part payment of an invoice for good & services, then this is really complicated and time consuming method.

We take deposits when customers sign the quote for the job to commence. A complete tax invoice is issued showing the full balance payable. Then we add in to the template a deposit amount. The customer makes payment, payment is entered and the invoice will then print showing the payment received and the balance owing.

If your books are reporting in a CASH method, then the correct GST amount allocated to the deposit will show on your reports at the time of the payment received. The balance will remain outstanding and will not appear on Tax Liability report until other payment/s are made on the invoice.

0 -

Thanks Deb, yes the system is quite time consuming & confusing. The customer is simply making a part payment for a job so I thought the deposit amount would simply be applied to the outstanding invoice & declared for GST at the time of payment. Have I understood you right? Also, there would be no need to mark the invoice as pending at any stage??0

-

Hi, yes you have it right. No there is no need to do anything out of the ordinary to the invoice. All you are doing is taking a part payment. This is very simple and will show on the invoice if you have added the Balance Due box to the invoice template.

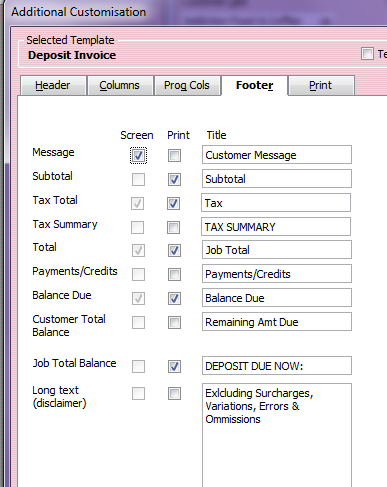

My invoices actually have the following as in the pic. This allows me to add in a deposit amount due before I take payment of the invoice. You might do this or you can add in Payments/Credits received. You will need to make this decision based on when the customers make the payment, at time of invoicing or later, after the invoice has been generated. Trialling different methods will let you choose the most suitable for your customers.

However, this is very easy for your bookkeeping once set up. 0

0 -

That's excellent Deb, thanks so much for your explanation. Much easier!!1

This discussion has been closed.