remove an entry from 'unbilled jobs by cost that cannot be billed?

Hi ,

my accountant has reversed an payment received into our bank account and allocated to accounts payable from a customer to show the reverse of the payment by the bank.

The reverse payment through the bank account was allocated from accounts payable and it needed a customer.

The reverse payment was done back in previously closed period and because it has been allocated to accounts payable now this is showing up in the un-billed costs by job .

I cannot change the past entry but I cannot work out how to remove this costing from the job report.

I did think I could bill it and then credit it, but it doesn't let me select the billable.

Any help appreciated.

Best Answers

-

Hi Shaz,

nice to hear from you as always

this was back in 2024.

- Did the customer inadvertently make a payment to you, so you returned it to them ? yes they made us a payment but the bank reversed it 3 days later.

- Was this a product/service refund, relating to an invoice No

not sure what happened but it came into the acct and I receipted the payment, but I could not allocate it to an invoice as the customer had none open.

Then 3 days later the bank reversed the payment out of our account. In reckon this was handled by writing a cheque to the customer and taking the payment back from accounts payable where it had been received to. This seemed right, until we had to do some costing by job and this appears in the report now.

I cannot actually accidentally bill it as it won't let me so no danger there but it appears in the cost report for the jobs I send; but I found out I can work around this by filtering the customer name out.

I only noticed recently otherwise I think it could have been handled better by simply depositing the money into the bank to a clearing account and reversing it from here rather than accounts Payable.

0 -

You're absolutely right … As it was an incorrect payment that was just returned, it should have been entered as a stand-alone Deposit to a non-Accounts Receivable account. A/R always requires a customer name allocation as it assumes it is related to an A/R transaction (eg an Invoice/Adjustment Note !)

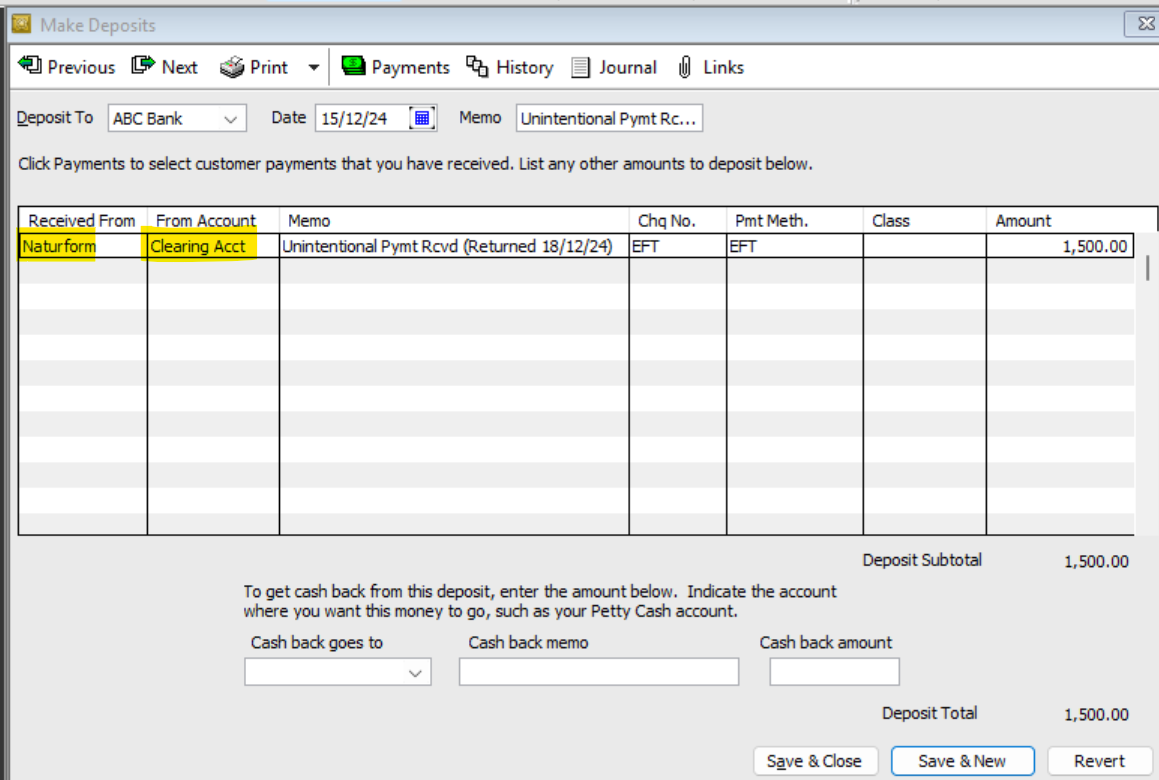

I would have posted it as Received From the relevant customer, but just to a Clearing (Bank) account:

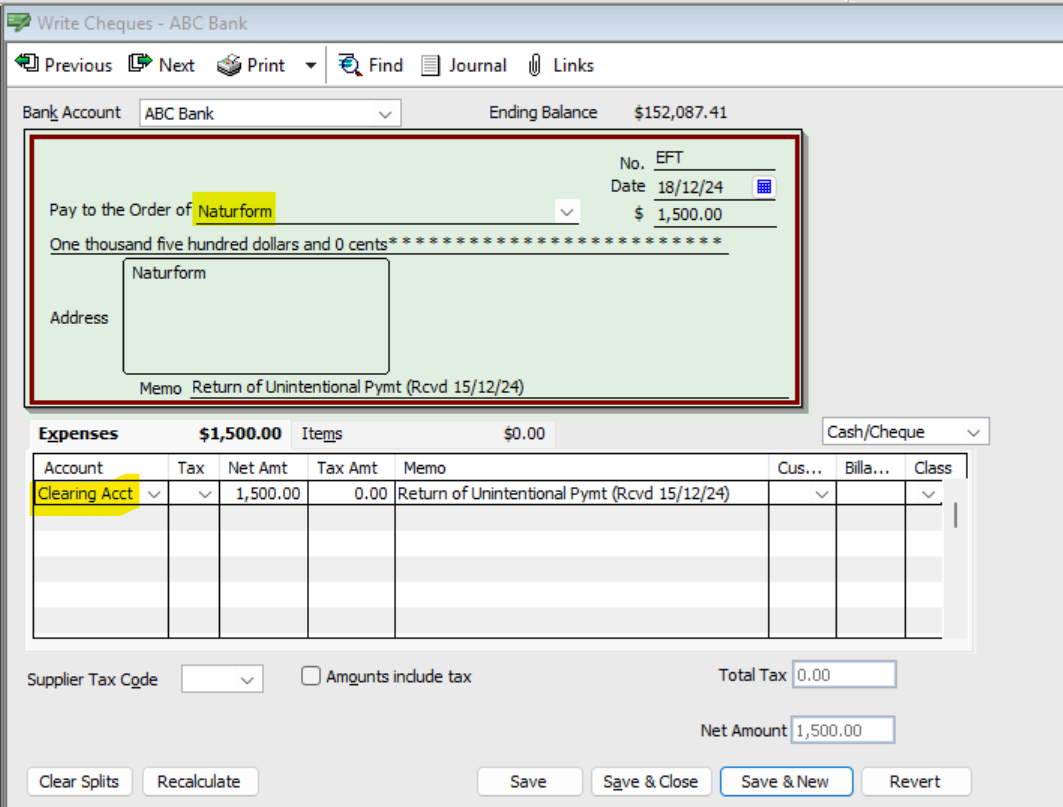

… with the Chq posted back there also, to offset it.

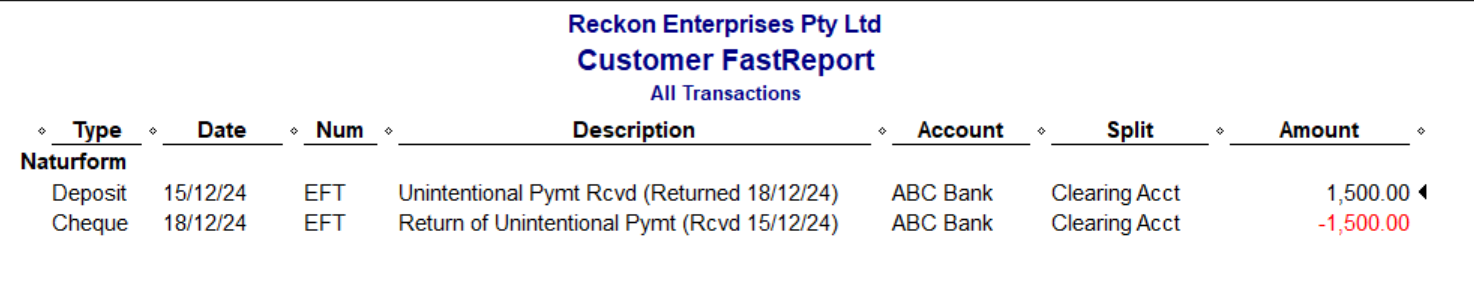

The 2 then cancel each other out with no issues 😊 :

2

Answers

-

Hi @Tilley

What’s the specific scenario ?

Eg

- Did the customer inadvertently make a payment to you, so you returned it to them ?

- Was this a product/service refund, relating to an invoice ?

1