Refunding overpayments

We have a client who has hired equipment for the last 6 months @ $300 per invoice, they have decided to buy out equipment. We are refunding them $1800.00 as they have overpaid hire. I have written out a cheque to them but it now says they are $1,800 credit??? I don't know how to fix this so their balance is zero?

HELP! (please advise in simple terms how to fix this).

I also have a client that has made a double payment and need to refund.

Answers

-

Hi @Burnbaby

Create an Adjustment Note (using exactly the same Item(s), tax code(s) etc as their usual hire invoices) but you can state in the Description as per your explanation above.

When you save it, the system will prompt you to save as a credit, apply to an invoice or refund the customer. Select “Refund ….” & the system will generate a linked refund Chq so again, just note the reason in the Memos & check/select the appropriate Date, bank account etc

Lastly, go to Receive Payments & enter the customer name. You will see the refund Chq in the invoices list, along with the credit (Adj Note). Use the same date as those entries & apply the credit against the refund Chq to offset it 😁

For the customer who has overpaid, if you go to their Receive Payment entry, you should see the “Refund …” option there. (NOTE: You don’t need to create an adjustment note in this scenario as the overpayment has already created the ’credit’ status 😊)

1 -

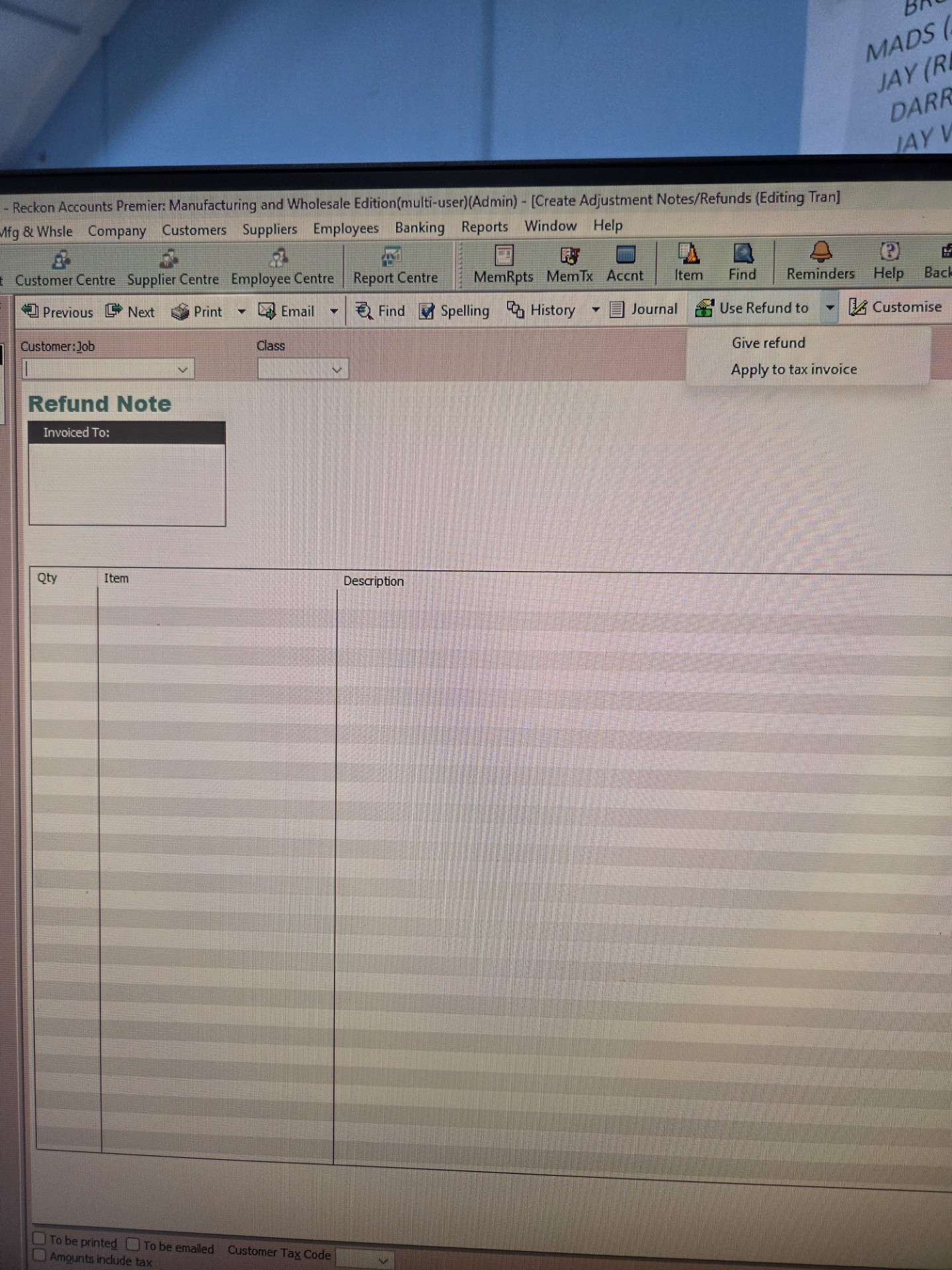

Hi @Burnbaby I usually do 'Refund & Adjustment' to raise the credit for the customer 1st. Once the refund note is raised, you 'Use Refund to', from the drop down tab, 'Give Refund' or 'Apply to Tax Invoice'. If you select 'Give Refund' then a cheque will automatically be generated to that selected customer. So no credit will remain in the customer file.

0 -

Hi, we don't have a "Refund Note" in our Reckon Accounts Premier we only have an "Adjustment Note"???

0 -

@Burnbaby That’s the Adjustment Note. They’ve just edited the name in the template 😁

0 -

Thankyou all for your help, between you all I have managed to figure it out. NOTE: Some of those instructions Reeta sent in that article were not applicable to our Reckon system but I worked it out myself.

0 -

Yes I am using Reckon Accounts Premier V34

0