STP year end.

megan_10040714

Member Posts: 107 Reckoner

Is there instructions for year end reporting of STP through Reckon Gov Connect. Don't need to finalise with the ATO until July 10th (?). Our first payroll is on the 1st July. Really want to know do we have to finalise year 2019 before we can run the next years payroll? Would like to reconcile my accounts before sending the last STP through Reckon Gov Connect. Thanks

2

Comments

-

I would also like to know this. I presume you just use the "final pay event" box when preparing to upload? Like Megan our first pay run for the new financial year will be 1st July0

-

Hi Megan & Wendy,

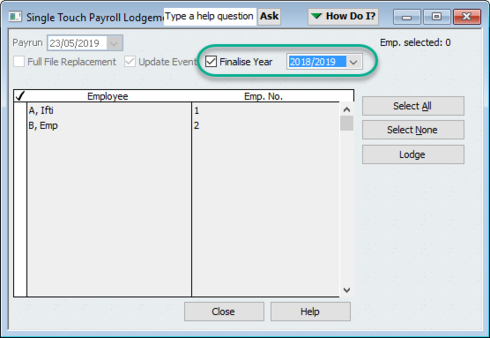

We'll have a new function coming this month with the new tax tables that will include a 'Finalise Year' checkbox. This will bring up all the employees that you've paid throughout the year and will be sent to finalise the year. The screenshot below shows what it will look like (could be subject to change) in Reckon Accounts Hosted and Reckon Accounts Business R2 and we'll have a detailed guide available a little closer to release.

0 -

Thanks, will we be able to process a pay for the 2020 year before the final year 2019 is lodged?0

-

I have just processed our final pays for the financial year but don't see the new button on the STP in Hosted. Or the new tax tables.0

-

Hi Wendy,

Hosted 2019 is right around the corner which will include the new tax tables and year end STP functionality. It will be available within the next couple of days at the latest.0 -

Hi Rav - So those that have already done the Final Payment - will need to go back and "finalise the 2018/2019 year" when the update comes through - so that it closes off the all those employees that have left throughout the year? So confused!!!0

-

Megan,

If you've had employees that have left over the course of the financial year then I would safely assume they were not included when you processed your Final Pay Event.

In that case, to answer your question, yes, what you can do is perform the Finalise Year in Hosted 2019 (most likely available tomorrow). This will bring up ALL the employees paid including those terminated and can be sent.2 -

How does FBT get entered for EOFY? Does a separate pay event need to be processed, and how is it supposed to be processed in Reckon Hosted? I'm doing our last pay for the financial year today.0

-

I am using Payroll Premier and have only started sending reports throught the STP. The report does not include an employee that retired earlier in the year. Do I go to the STP report summary and change the date to show the last pay event for this employee and mark it as a final event and submit their data only through STP, even if it is 4 months ago, before I do the last pay for the year, or when you tick "End of Financial Year" are the terminated employees added to the list? Thanks Pam

1 -

When will the guide you mentioned above for Reckon Accounts Business R2 be available?0

-

0

-

Thanks Rav!0

This discussion has been closed.