Gross Payments not correct on PAYG Payment Summaries for 2024

Hello, i am using Reckon desktop and checking payment summaries for 2024 financial year.

The gross balances are not correct. How do i check what payroll items are included in the gross payment figure?

What else can I check and how do I fix it to agree with my payroll reports?

thanks, Ann

Answers

-

Have a look at my info on this thread here:

1 -

Thank you, I will have a look.

0 -

Hi Shaz

Thank you, your explanation has been very helpful with my reconciliations' also.

Ann

0 -

Hi Shaz

I'm just checking all my totals from your instructions.

I've just realised I have one employee with a payroll item of "Holiday Pay" instead of "Holiday Hourly". The leave is added into with the "Hourly pay" instead of in with the "Leave" totals on the STP draft.

Not sure how this has happened but wondering if i can edit each pay affected to the correct item code? Would I then need to do an amended STP report or will it rectify in the Final Year lodgment to STP?

Please advise the best option / correct procedure here.

Thanks

Ann

0 -

Dear @Ann_10524711 ,

You can modify payruns by doing the following:

- Go to Employees.

- Select Employees Centre.

- Select your employee on the left-hand-side. Once you do so, you should see their pays appear on the right.

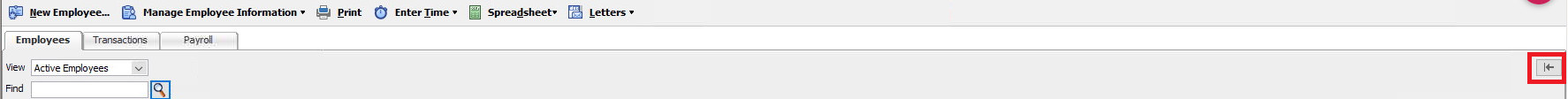

- If you do not see your employees pays, you may need to maximise the Employee Payroll info screen by pressing this button here.

- Left-Click the payrun you wish to modify.

- Right-Click the payrun, and select Edit transaction.

- Select Paycheque Detail…

- At the bottom of the Review Paycheque window, toggle Unlock Net Pay.

- Find the pay item you wish to remove (eg. Holiday Pay), and Left-Click to highlight it.

- Press Backspace or Delete to remove it.

- Go to a new line in the paycheque.

- Add the item you wish to add (eg. Holiday Hourly), and enter its figures in.

- After it has been added, and the amounts line up, press OK.

- Finally, click Save & Close to return to the Employee Centre.

You will need to repeat this process for each payrun and employee affected.

After this, you can submit an Update Event for the latest payrun to submit updated details to the ATO.

Kind regards,

Alexander McKeown

Reckon Senior Technical Support

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20182 -

Depending on how your "Holiday Pay" Payroll Item is configured, you may actually be able to just merge it into your "Holiday Hourly" one. To try this, double click on Holiday Pay in your Payroll Item List & change the name of it to the EXACT same as the one you want (eg "Holiday Hourly") It will either accept & merge it, or tell you it can't be merged.

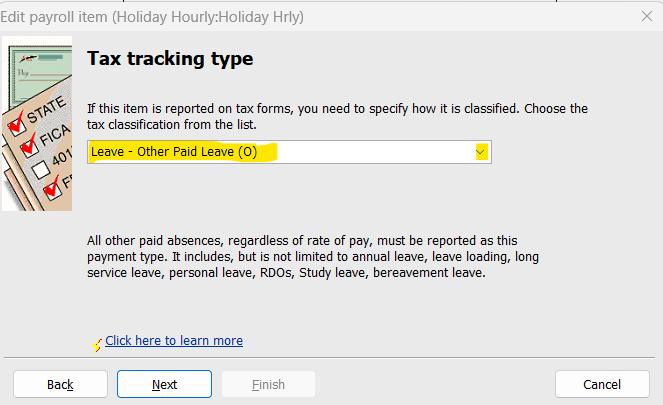

If it can't be merged - & your "Holiday Pay" Payroll Item is still impacting the leave balances correctly (eg reducing the leave balance when taken) - you just need to update the Tax Tracking Type mapping selection for it to Leave - Other Paid Leave (U), here (Double-click on it in your Payroll Item List & click Next through the windows to this one. Continue clicking Next after updating this selection & click Finish on the last window to save):

Tio avoid future confusion, decide which one you want to use & make the other one Inactive (by right-clicking on it in your Payroll Item List & selecting Make Payroll Item Inactive from the popup menu) 😊

3 -

Thank you for your detailed instructions. I have it sorted now and balances all agree.

Appreciate your help, thanks.

2 -