Post June 1983 Untaxed Element (O) vs Post June 1983 Untaxed Element (Low Rate Threshold)

Hi, What is the difference between the two above relating to STP PHASE 2?

I have a type O that is concessionally taxed. Basically an inlieu of notice payment that was made on termination (therefore ETP) taxed at 32%.

Reason for termination was voluntary cessation.

I am just trying to ensure that my STP phase 2 file is correct.

Comments

-

Hello @LIDA ,

Termination pay items are handled in a manner separate to STP Phase 2.

You can review these elements here:

Kind regards,

Alexander McKeown

Reckon Senior Technical Support

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20181 -

Hi @LIDA

To answer your question, this used to relate to employees over pension age. If an employee over pension age had a post-June ETP component, this was taxed at a lower rate up to a lifetime limit called the "low rate threshold". However, these specific transitional arrangements ceased over 10 years ago so it's not relevant anymore 😊

If it's an ordinary (non-pension age) employee who is just leaving voluntarily & hasn't been employed with you longer than 20 years, it will just be the … Untaxed Element (O)

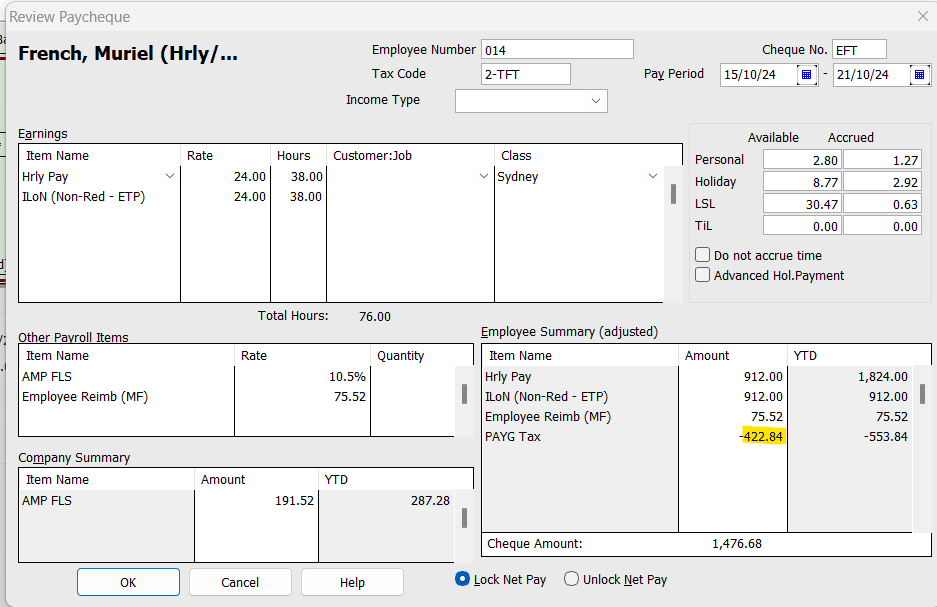

NOTE: Super applies but no leave accrues on In Lieu of Notice payments, The 32% needs to be calculated manually on the Paycheque & entered in the PAYG Tax Amount box in the Employee Summary section here:

.

1