TPAR file not uploading to the Tax Department

Hi Everyone

Am I the only person having this problem? It's never been a problem in the past.

My TPAR 2024-2025 file isn't uploading to the Tax Department.

I did a search here for the same question and followed the links, no success.

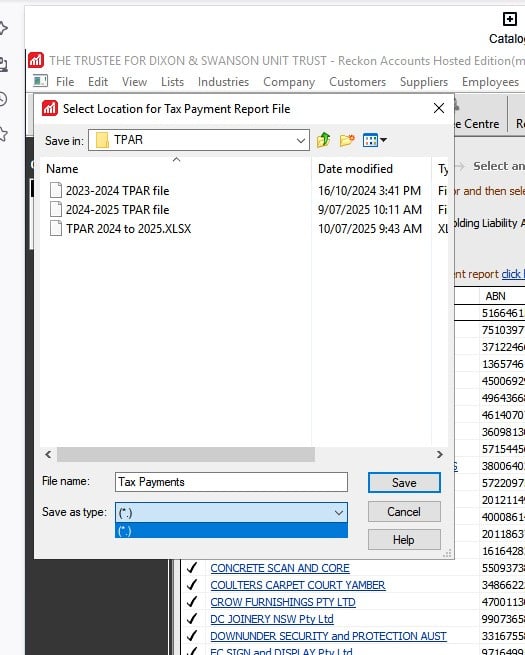

I've checked the Business names for anything with non-alphabetic characters. The file only has one way to save, which is the photo attached. (*.) I'm not sure what that means. It doesn't help that I'm not tech savvy either.

How do I change this? Is it somewhere in Reckon I change it? Is it something on my PC? I'm stumped at the moment.

Any help is much appreciated.

Rebecca

Answers

-

Ive never had a problem

Kr

0 -

When you save your file does it save as (*.) ?

0 -

the one on the 9th looks ok but the one on 10th has .xls at the end

2 -

You're right and I have no idea how that happened. I'm not sure what I did differently.

0 -

so don’t try to upload that one and perhaps try to export the file again, don’t do anything in the file name

0 -

It was those files I tried to send yesterday and it didn't work.

Somehow I've saved a Excel today.

0 -

When you attempt to upload the TPAR file, what is happening specifically? Are you encountering an error message? If so, what is it and where is it appearing? Within your Reckon software or on the ATO site?

The file type showing a * when saving is normal as the TPAR is a non-standard file type. However the latest showing saving as an Excel file (XLSX) is unusual.

0 -

So my accountant is having trouble sending it through. This is the message my accountant gets:

The validation report states the following errors (invalid format)

TEST FAILED FILE FORMAT VALIDATION REPORT

Your File D_S 2024-2025 TPAR file was received by the Australian Taxation Office. File submitted is for test only and is NOT lodged. The file contained errors that prevented processing it further.

The errors found are listed below. Please correct the errors, then re-test the file before lodging.

================================================================================

Validation status: Test failed

Document name: D_S 2024-2025 TPAR file

ATO Reference number: 2515588017429

Date/Time file received: 09/07/2025 10:44:51

File size (bytes): 308220

File sent by: stephen healy

Reason: The file is an invalid format. To lodge a file electronically you must first create a file that is generated from your software in a format and version supported by our systems. Scanned images or forms, screen prints, spreadsheets and word processing files (for example .pdf, .doc, .xls, .jpg, .tiff) cannot be lodged via the file transfer function on our portals. More information can be found at: www.ato.gov.au/filetransfer or contact your software developer.

0 -

I'm not sending the excel TPAR file. I don't know how I did that.

0 -

I don’t think you can as it’s not meant to be in excel format to my knowledge. Been sending them for years just as the default file that is exported

0 -

Hang on, I've sent another file through to my accountant. I may have been sending the file from the wrong place.

0 -

Correct

The file extension is not xls

It should be C01

Im not surprised it was rejected

Kr

0 -

@Rebecca_7630369 Delete the .xls extension from the file name & it should be fine 😊

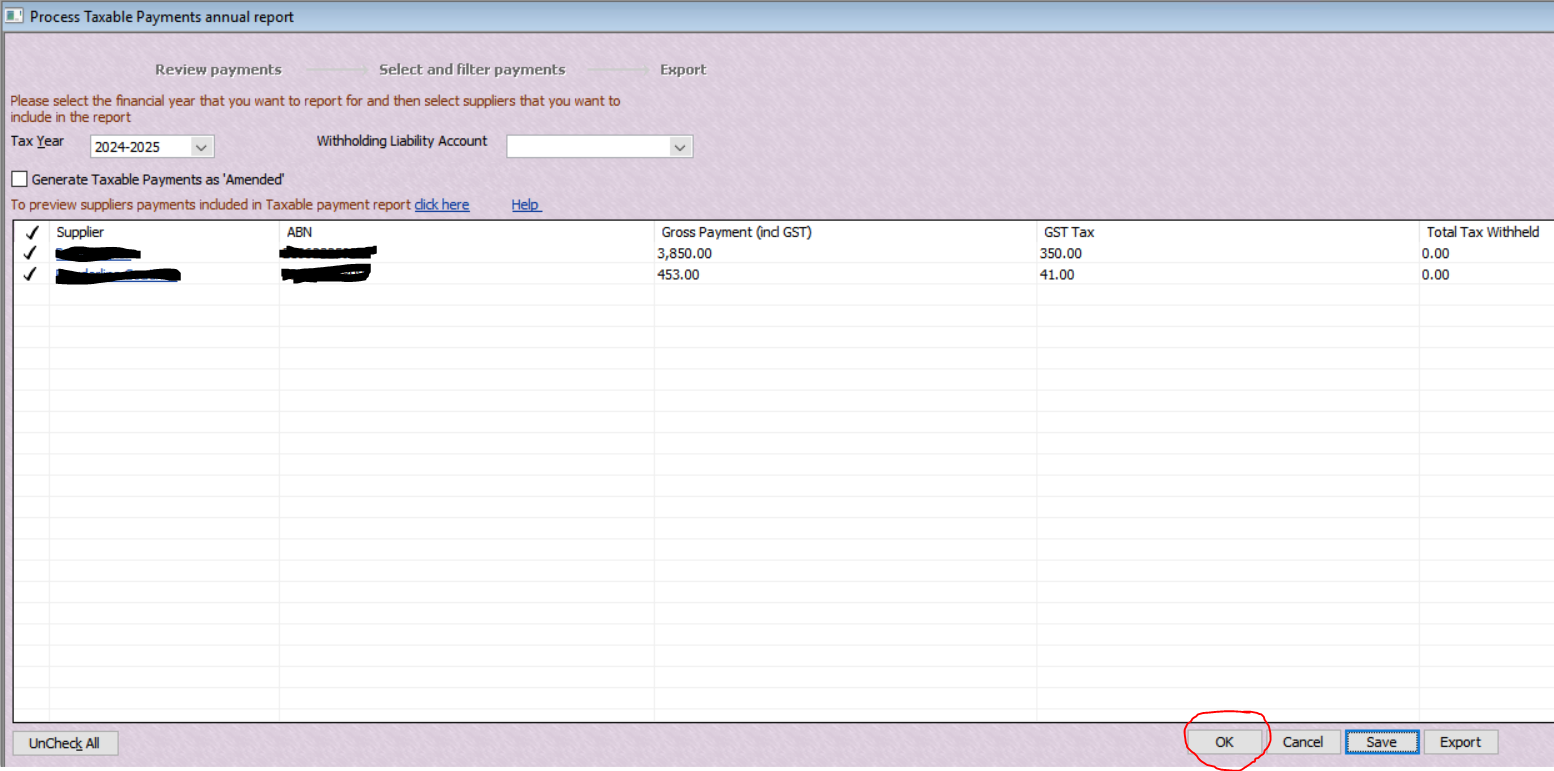

Alternatively, he can enter the TPAR Supplier details manually in his Agent Online Services portal so you can always send him the printed version as a PDF, by just selecting OK to generate it:

0 -

(Hmmm, well you could … but I've just clicked OK on the above in the RAH file I'm in at the moment & it automatically generates the CURRENT (2025-26) FY to print instead !

@Rav Has this option been removed or is there a glitch with it ??? 🤔)

0 -

Ok, so I was the problem not Reckon. With the new locations of files, I was attaching the wrong file. I had to click through a few more folders to find the correct location and it all worked. Sorry. Thanks for all the help.

3 -

1

-

The default location is hidden far too deep in the directory structure.

It SHOULD default to the desktop.

Luckily you can set the export up to work this way.

Kr

1