Reckon One update! ✨ Another new report - The Leave Taken report!

Reckon One has just received a new update which introduces a highly requested new report, more updates to read-only mode and other enhancements! Check out the inclusion of the latest update below.

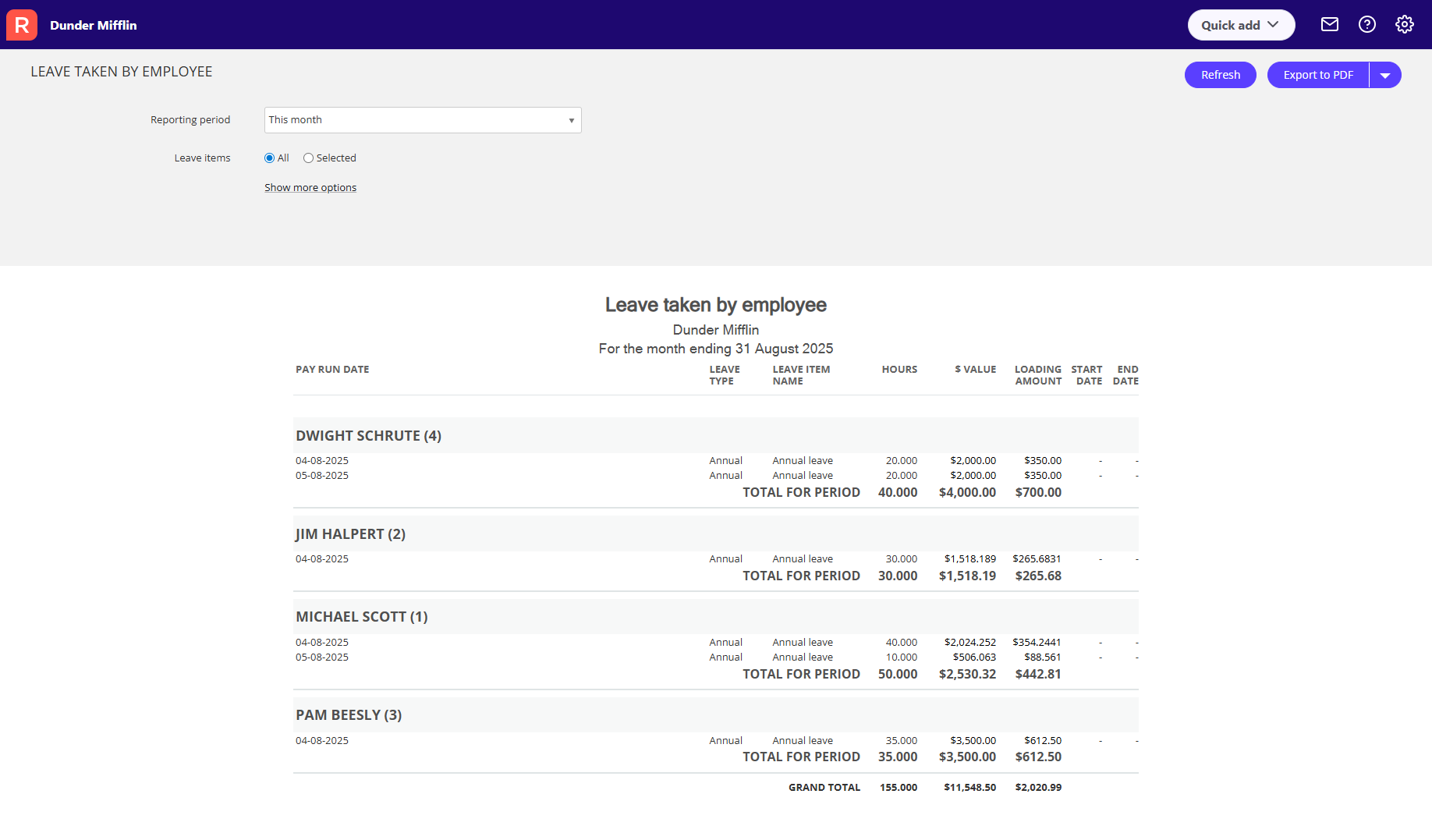

🆕 A brand new report - the Leave Taken report

Another highly requested new report is now available; the Leave Taken report!

The Leave Taken report will give you clear visibility of leave recorded within a selected date range to assist you in tracking leave and associated costs more effectively.

Thank you to our Community members and customers who requested this, provided feedback, and shared their use-cases.

✨ Key Features

Date Range Selection: The leave taken report uses the pay run date to filter results which ensures accuracy.

Draft pay runs included: Leave from draft pay runs is included to provide a comprehensive overview.

Organised Grouping and Sorting:

- Data is grouped by employee

- Leave types are sorted alphabetically under each employee

Summarised Totals:

- Each employee section includes subtotals for hours taken, $ value and leave loading

- A grand total is displayed to summarise data across all employees

✨ Read-only access on deactivated books

Some further updates have been made to ensure you can view historical payroll data in a deactivated book. Additional payroll screens that are now accessible in a deactivated book are: the bank account and pay details screens within an employee profile and pay templates.

✨ Minor Enhancements

Added bank - Wise Australia Pty Ltd has been added to the list of banks to select.

Previously, in certain termination pay scenarios where tax (PAYG) was not automatically calculated, the PAYG pay item was not visible which prevented users from manually entering a tax amount when needed. This issue has now been resolved and the PAYG item will now appear in applicable termination pay runs allowing you to add a tax value manually where required.

We’ve updated the error messaging that appears when an employee’s superannuation fund is updated to one that is no longer valid. This change aligns with our ongoing efforts to ensure only valid and compliant superannuation funds are selectable and displayed.

The NAT1024 information link within the pay run drawer for daily and casual workers has been updated to link to the latest ATO information.

We've updated the messaging under the Effective Date label within the Employee Initial YTD screen for FBT to provide clearer guidance - Enter the date up to which reportable fringe benefits were accrued, within the FBT year (1 April to 31 March).

Improvements to the display of unit price on an invoice.