Employee Deductions

We have a driver who requires an Interlock on the truck.

Driver has to pay for this to be installed and removed, however he didnt have the money at the time. We have paid for it, therefore over the next few weeks we need to deduct amounts from his pay to repay it.

Anyone know how I would set this up correctly, and what accounts to apply it too :)

TIA

Answers

-

when you paid for it you should have put it to some kind of loan account with no GST, so when you process the pays it will go in as a deduction linked to the same account.

0 -

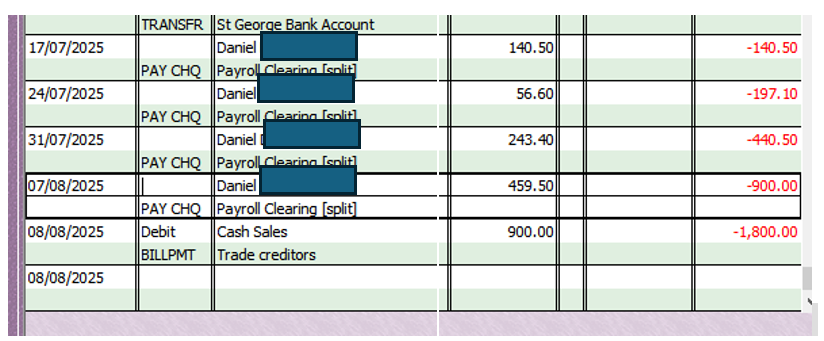

When I put the Invoice in I paid it from "Petty Cash" then in the Payroll Items I created a - RE-Imbursement by Employee - Type Deduction - Liability Account Petty Cash, but this didnt work as now petty cash is showing $1800 (double)

0 -

Where did you put the original payment? Should have gone to this same account.

0 -

What do you mean?

What I have set up (which half works but ive done something not right)

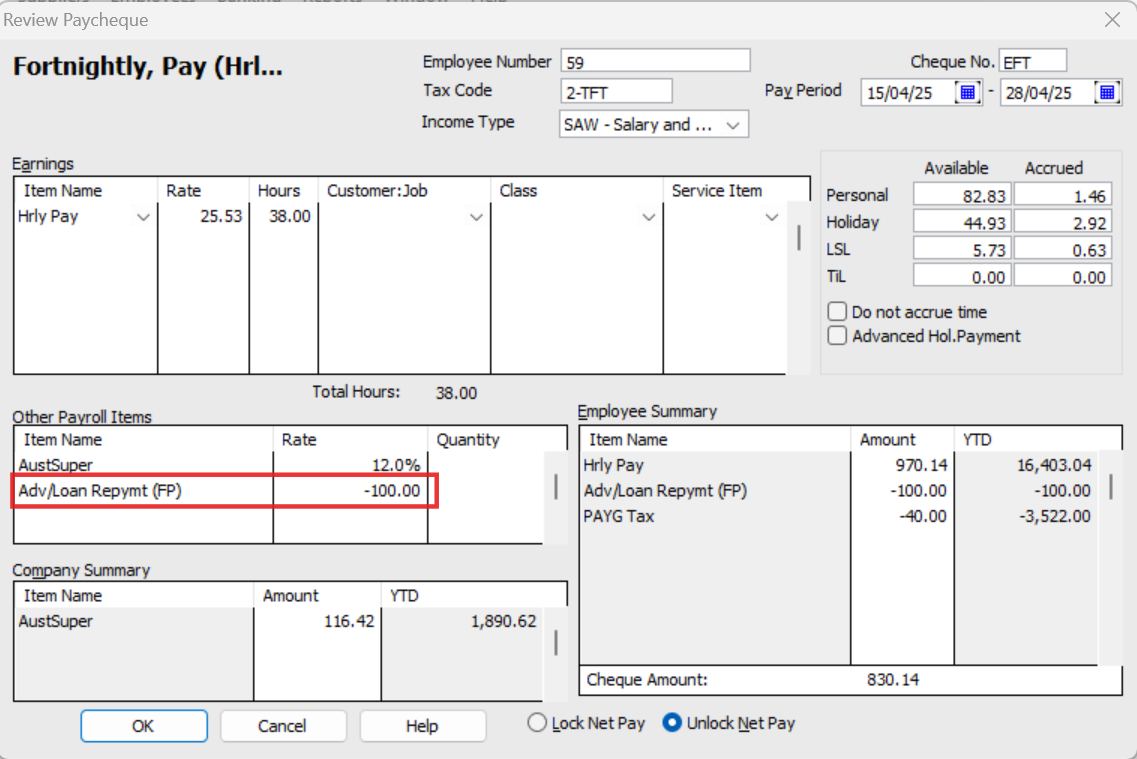

I created an account in the Payroll Item List

- Re-Imbursement By Employee

- Deduction

- Liability Account (Loans from/to employee) on NET Pay

Which seem to work on the pay slip

I assumed that then the money would sit in the Loan Account, where I would then enter the bill pay it from Petty Cash and then move the money from the Loan Account to Petty Cash but that doesn’t work as it is showing in the decrease field not the increase field ?

0 -

the cash sale is wrong

0 -

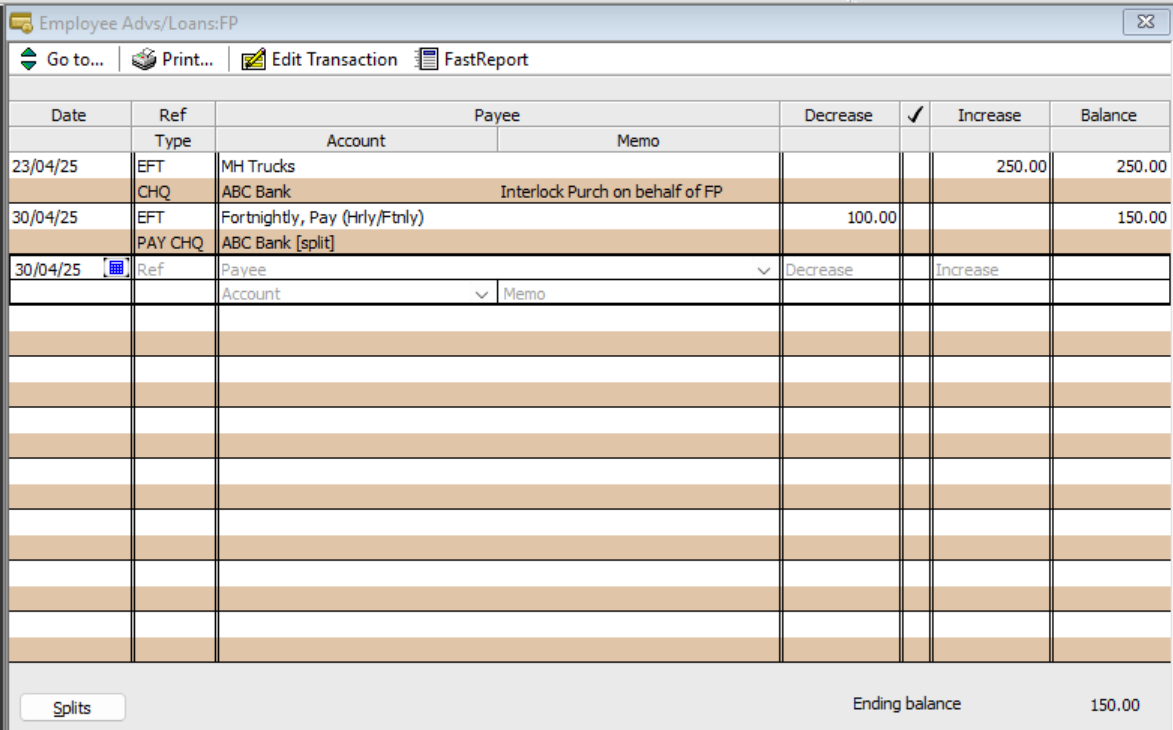

The original loan account should be an Other Asset type, (not a liability) as YOU don’t owe it to HIM, it’s the reverse 😁

It will then decrease the loan correctly:

😊

0