#TipTuesday - Negative balances in initial YTD and when to use them

Even the most careful payroll setups can sometimes have hiccups, like incorrect earnings, wrong leave balances, or miscalculated superannuation. That's why Reckon One Payroll has now made it easier for you to fix even the trickiest payroll errors and guess what?😀 You can now enter negative initial YTD values too!!

Adding positive YTDs (like Earnings and leaves, allowances, super) has always been part of Reckon One payroll. But thanks to popular demand from our awesome users (yes, you!), we’ve added the ability to enter negative YTDs as well.

Negative initial YTD balances is designed primarily for rare, worst-case scenarios. Although Reckon One Payroll now provides the ability to manually enter YTD data, including negative values, it is recommended to use it rarely and not as a routine practice.

We recommend verifying each employee’s pay setup carefully from the beginning to prevent issues. This option is only used to address significant errors that cannot be resolved through regular revert to draft pay run process. Please use it thoughtfully and only when it is truly necessary.

When to use this feature?

- Fixing overreported or underreported earnings

- Adjusting the overall YTD balances of certain items such as earnings, tax, super etc.

- Maintain accurate records and stay compliant with reporting requirements

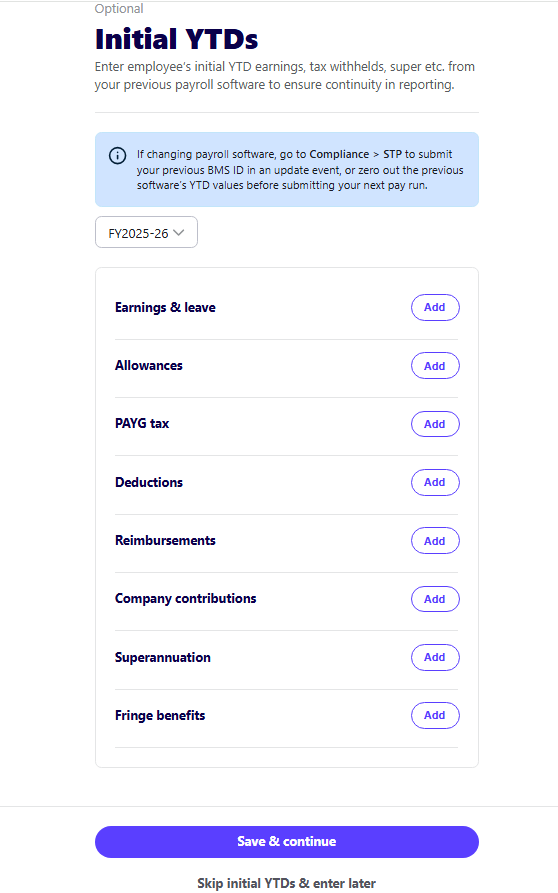

How to enter YTD figures

- Go to Payroll > Employees.

- Select the employee and click Edit Details ( On the top right corner )

- Navigate to Step 3: Initial YTDs in the employee wizard.

- Click Edit under Initial YTDs

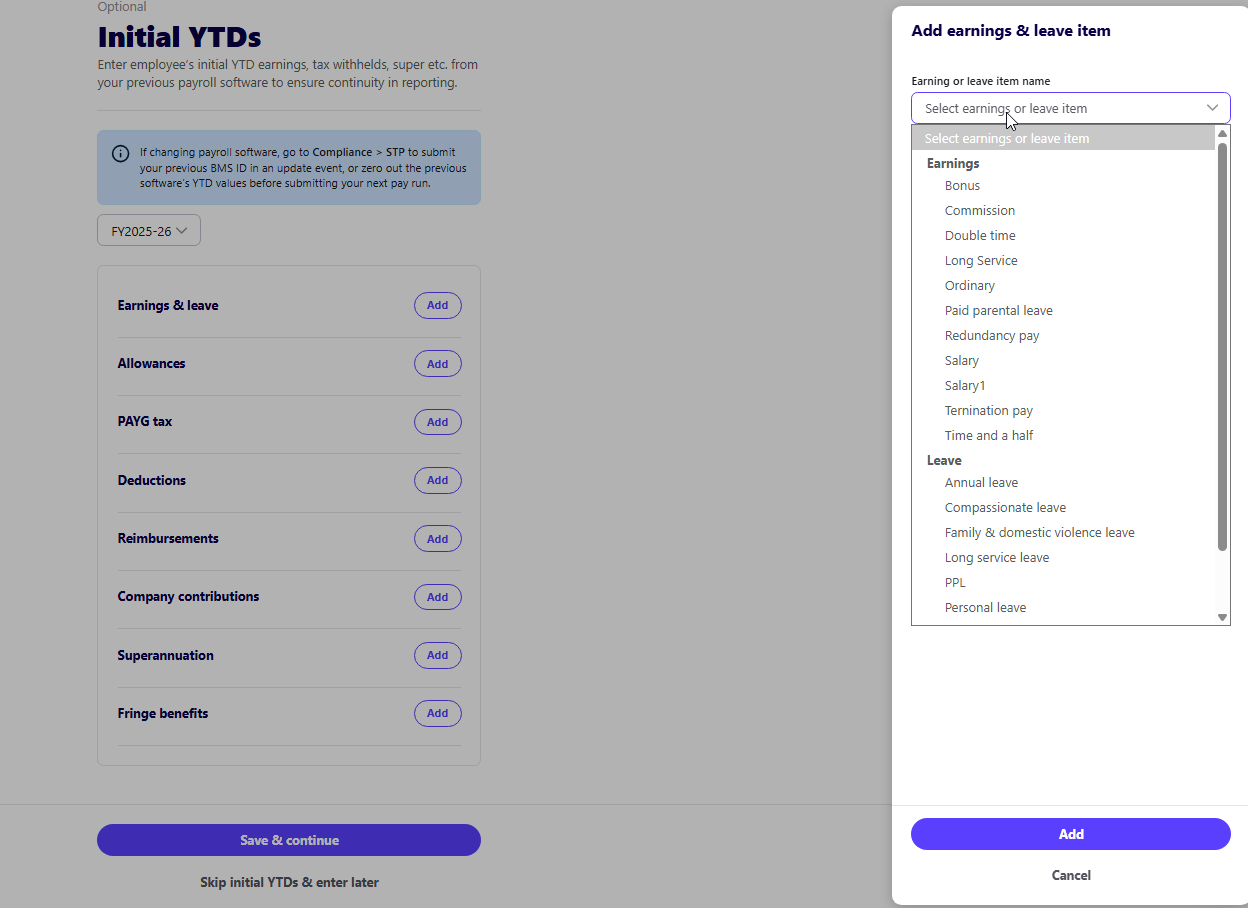

- Click Add next to the relevant pay item category

Once you click on Add , you can select the appropriate item from the drop down list.

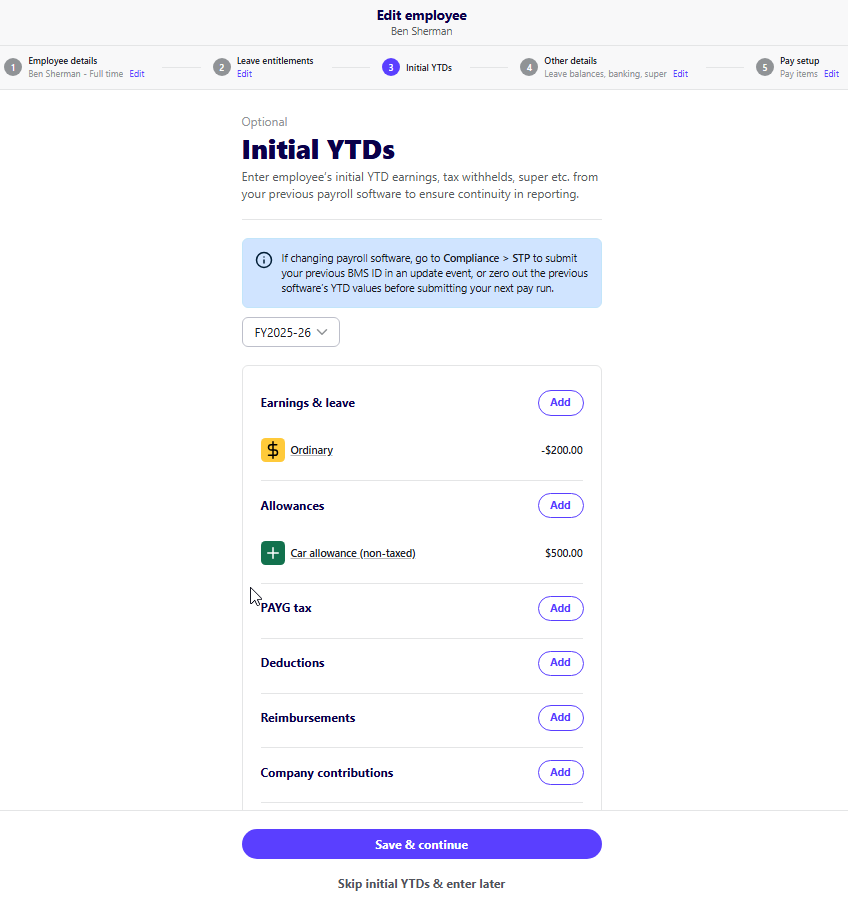

Enter the initial YTD value

- Use positive numbers to add to YTD totals.

- Use negative numbers to reduce YTD totals.

Click Add to save the entry.

The values will appear in the employee’s YTD summary and be included in STP submissions.

Select Save and continue and complete the process.

With the new ability to enter negative YTD figures, Reckon One Payroll gives you more control and flexibility to keep your payroll records accurate. Whether you're correcting a small mistake or a major discrepancy , it's now easier than ever to stay compliant and confident to keep your payroll data clean and correct.

That's all for this Tuesday, stay tuned for more !!

Kind Regards,

Reeta