What is the correct 'step by step employee termination process' under STP in Reckon Accounts Hosted?

A) the process within Reckon Accounts Hosted

A) Reckon Accounts Hosted offers two options to release/terminate an employee.

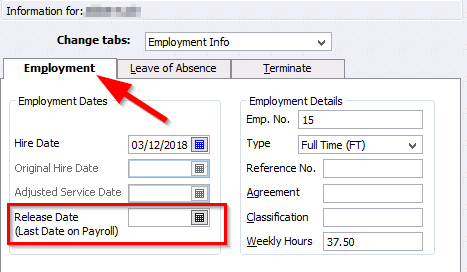

1. Releasing an employee

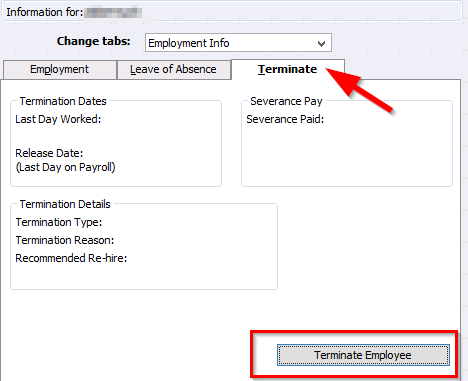

2. Terminating an employee

Do I need to process both options or only one?

Thank you very much for an up-to-date guideline on this critical process. I have searched the internet and the Reckon Community but was not able to find a comprehensive and complete guideline.

Comments

-

Hi Thomas

A) Terminating & Releasing an employee in RA/RAH is the same thing.

By using the “Terminate Employee” button, this will run you through the Reckon-prompted process (wizard) & the “Release Date” in your first screenshot will be auto-filled based on this.

This “Release Date” will then automatically mark that particular pay as “Final” for that employee in the relevant STP file.

This “Release Date” will then automatically mark that particular pay as “Final” for that employee in the relevant STP file. (Nothing different in regards to your usual STP process but the employee’s record MUST have the Release Date entered in order for it to auto-identify that payment as “Final”)

Shaz Hughes Dip(Fin) ACQ NSW, MICB

Reckon Accredited Professional Partner Bookkeeper / Registered BAS Agent (No: 92314 015)

Accounted 4 Bookkeeping Services

Ballajura, WA

0422 886 003

1 -

Hi Shaz,

Thank you very much for your detailed reply. This is most helpful.

Are you saying that if I enter a Release Date in the according Reckon payroll section, I do not need to do a separate STP file upload for the concerned employee, which I make as Final Pay?

0 -

Hi Thomas

Yes. but you do not need to create/submit a separate “Final Pay” STP submission - The STP File will automatically recognise the presence of a “Release Date” on that particular employee & mark the last corresponding pay automatically as “Final” in your normal pay run submission.

However, I wouldn’t recommend just manually entering the Release Date in that box.

Due to the flow-through now for STP, I would advise following the process via the “Terminate Employee” button.

Shaz Hughes Dip(Fin) ACQ NSW, MICB

Reckon Accredited Professional Partner Bookkeeper / Registered BAS Agent (No: 92314 015)

Accounted 4 Bookkeeping Services

Ballajura, WA

0422 886 003

1 -

Thanks Shaz,

your very detailed instructions are most helpful and greatly appreciated. Thanks a lot!

May I ask you for your recommendation how to handle a case of employee resignation after the last pay?

My client works with a number of casual workers that sometimes only inform that they are no longer coming to work after the last pay run was already processed and the STP file uploaded through Reckon GovConnect.

Will it be sufficient for the STP reporting to go through the "Terminate Employee" process once we learnt that the employee no longer comes to work (but at a time when the employee is not receiving a wage payment anymore), or do we in this case need to upload a "Full File Replacement" containing the last payment to the employee?

Sorry, it's a bit complex, but it's reality. - Thanks for your recommendation.

0 -

My understanding is that the “Finalise Year” STP submission process at EOFY picks up ALL employees paid within that FY including Termination Dates/Final Pays & tags them as such.

Therefore you shouldn’t need to do anything additional STP-wise at termination time, even if it’s after the last pay run they were included in.

Shaz Hughes Dip(Fin) ACQ NSW, MICB

Reckon Accredited Professional Partner Bookkeeper / Registered BAS Agent (No: 92314 015)

Accounted 4 Bookkeeping Services

Ballajura, WA

0422 886 003

0 -

Thank you, Shaz,

I am fully aware that we are somehow a bit in 'uncharted waters'... But I until some authority tells me otherwise, I think your understanding makes sense.

Please be kind enough and update this communication in case you sooner or later learn of a different approach.

Once again, thanks a lot for your great support.

Best wishes

Thomas

0 -

Hi Shaz, does this also apply to paying out a terminated employee whose final pay date is outside our normal fortnightly pay cycle, do I need to upload the employees final pay separately to GovConnect on the actual release date?

Caz0 -

Yes Caz, the above applies to this also eg no need to upload a separate Final Pay.

However, bear in mind the "Release Date" is crucial on the employee record for STP - regardless of whether you upload the Pay at EOFY or at the time of termination - in order for it to be tagged as "Final"

Shaz Hughes Dip(Fin) ACQ NSW, MICB

Reckon Accredited Professional Partner Bookkeeper / Registered BAS Agent (No: 92314 015)

Accounted 4 Bookkeeping Services

Ballajura, WA

0422 886 003

0