Superannuation liabilities not recorded correctly. Is it me?

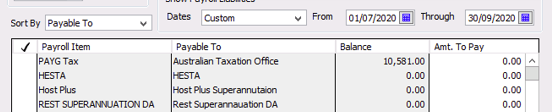

I have recently taken over the bookkeeping function of a small business when their last person left in a hurry and under a cloud... so no handover... I am mostly across everything I need to do but I found an issue in the recent superannuation Q3 payment. I used the Custom Liabilities function (the same as I did for Q2 successfully). The liability amount for each institution came up on the CHQ register, and the balance of liabilities owing shows as zero. However, each individual entry in the employees' records shows there has been no payment recorded for all weeks in the quarter - therefore there is still a liability amount for each employee. Have I missed a step, and can I fix it? Please help!

Comments

-

Whats happened is the alleged bookkeeper has posted to the liability account directly instead of using the payroll item. Its no biggy. It makes it a tad more difficult to reconcile the liability, thats all.

1 -

So can I undo it? Or change it somehow so it records it correctly?

1 -

Look in your superannuation liability account and see what the balance was at the end of the period. A super report should give you the breakdown by employee and total should equal the balance. Enter a bill for that amount at the end of the said period - this account should now be zero and pay the bill in ordinary bill window

0 -

You don't need to undo it. Just do it properly from here on. It would be a huge waste of effort to go back and change it. Whoever set it up clearly had no idea. This is why you consult experts like me. Cheers

0 -

Wrong Kris. You shouldn't be entering a bill. You should use Pay liabilities. Again, this is why we consuit accredited experts.

0 -

In this instance until the file is correct this would suffice. I was an accredited trainer for many years

0 -

So Zappy, how do I record against each employee it has actually been paid? Right now it shows zero payment in each employee record.

0 -

(And yes, we are discovering a few things that have not been set up correctly!) Unfortunately I’m not an expert and can’t just fix things. Can you recommend a good intro class on Reckon Hosted that I might be able to get some accurate information going forward?

0 -

Best to find an accredited trainer in your area

1 -

And I've been an AP for nigh on to twenty years Kris. I am pretty sure of my position.

0 -

Kate it doesn't matter as long as you can show you have paid it. That's what the industry fund clearing house is for. It would be a wicked waste of time to go back and alter Reckon and would potentially cause a whole lot more problems than you would fix

0 -

Just to be clear, recording the payment in Reckon is proof of nothing.

0 -

It's MUCH more important to understand the accounting than it is to understand Reckon. I'd look at the Cert IV in financial services (bookkeeping). Any hosted course will not teach you bookkeeping. It's not sposed to

0 -

@KateSmith Unfortunately, this does still happen sometimes even when the Super payment is recorded correctly (eg via Pay Liabilities)

The payments are lump sum totals that have accumulated from paycheques which the system tracks as owing to each fund. The payment is not reflected under the employee's record itself. Instead, the Payroll Liabilities report is generated from that "Pay Liabilities" screen so as long as you can see there that it's not outstanding, the ultimate proof of payment is in the Clearing House as per Zappy's advice.

1 -

Acctd id be very interested in seeing the evidence.

0 -

And obviously, my advice is correct

0 -

I am completely happy that it’s done and recognised where it needs to be ie SBSCH and ultimately the employees’ funds. My problem is the books look messy and incomplete.

Given there seems to be no one who can explain how to fix it, is there somewhere I can “note” it’s been paid,

0 -

If your superannuation clearing account is zero and the total super paid in the expense account agrees with the total super from the payroll report I would be confident all is correct. That’s my checkpoint that I have used since super guarantee first started

1 -

Look messy? The date paid is in the super reporting. Thanks for asking

0