Upgrading before 30th June 2024 - yes or no??

I have posed this question a few days ago, "renewing my desktop licence before 30th June 2024' Lucas kindly replied and said I could and that it would be ok to use the new licence 2024 to run my last payroll on 26th June.

But I have just listened to the on-demand webinar, STP2 review masterclass, and it was mentioned do not upgrade/renew licence until after the last payroll has been processed in June, as the Superannuation percent of 11.5 will be used, when it should be 11%

I have an IT person coming in Monday morning 24th to renew the licence. Should I be renewing now or not until after last payroll is processed?

Best Answer

-

Its perfectly fine to upgrade now if that suits, the 2024 version supports both the 2023/24 and 2024/25 tax tables and will apply the relevant tax tables based on the pay date of your pay run.

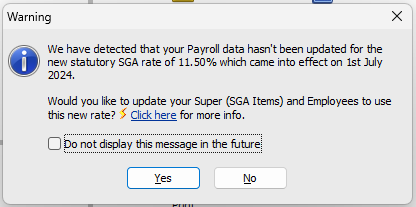

In regard to super guarantee, if you upgrade to Reckon Accounts 2024 and still have pays left to run for the current 2023/24 financial year then you need to select No to the message that appears to update your super rate to 11.5%.

The message will appear each time you attempt to create a pay run. Once you've finished all pays for the 2023/24 financial year and ready to create your first for the 2024/25 financial year, select Yes and super will calculate at 11.5%.

1

Answers

-

Thanks Rav for the great information, I now can enjoy my weekend knowing the way forward. 🙂

1 -

Superannuation, got it.

Does that also mean we can run the upgrade "before" STP "Finalise Year"

(I'm running Enterprise on a local server)

We are getting conflicting information from Support.

Regards,

Wayne.

0 -

Yes, you can run the EOFY finalisation from the 2024 version after upgrading.

1 -

We are still on Windows 10 (not Windows 10 Pro), can I upgrade to Reckon 2024 with multi user mode?

0 -

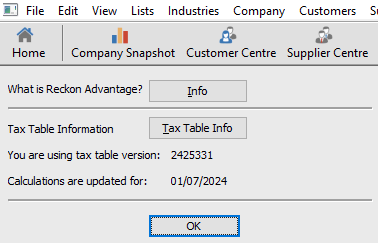

What should the current Tax Table Version be under "Payroll Information" once you upgrade to Reckon Edition 2024. Should it be "2425331"

Thank you.

0