Can I use online payments (ABA) to pay super?

Hello!

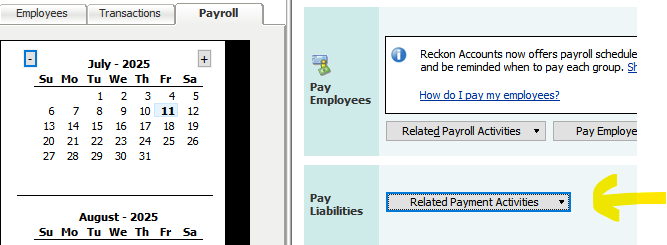

I have just started using 'banking online centre' for payments to suppliers and employees. BUT how do we pay liabilities such as Super, child support etc when they are not paid via "Pay Bill" where I can choose 'Online Banking' and add eft details into the supplier account. I currently use this window to make payments via Reckon (below) then I enter the amounts via the Super Clearing house per employee then make 1 payment to the ATO, therefore not balancing in Bank Feeds. Thanks

Answers

-

No.

Thanks for asking

You need to use the clearing house

Kr

0 -

Hi Zappy,

I understand I need to use the clearing house - but is there no way to create 1 'cheque payment' for the super in Reckon to match the 1 payment made to the ATO?

Seems strange! M

0 -

Use a clearing account in Reckon as you do for payroll

0 -

Can you please explain, I actually haven't done payroll yet.

Thank you 🌻

0 -

I have read through other comments on this subject, and I have worked out the use of a 'clearing account'!

Thanks

1 -

Okay I'm back…I have utilized 'undeposited funds' for a clearing account and now my main

account

0 -

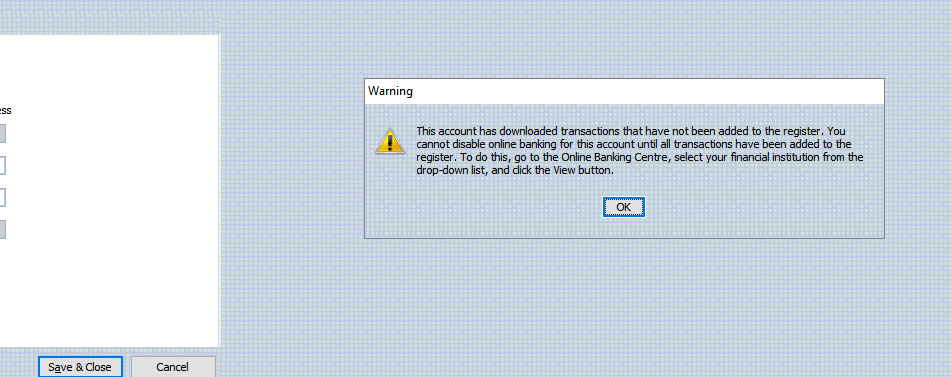

Okay I'm back…I have utilized 'undeposited funds' for a clearing account and now my main bank

account has disappeared from the online banking Centre with this message when i check the account details

0 -

You need to pay a professional

This is not something you want to screw up

Call me 0407 744 914

Zappy

1 -

go to the chart of accounts and right click on your main bank, go to online bank details and make sure it’s ticked. I would have made a new bank account called clearing rather than using undeposited funds

1 -

An ABA file is a standardized Australian file format used for electronic payments, particularly for bulk transactions like payroll, accounts payable & direct debits. It's a text file that contains payment instructions & is created within accounting and payroll software, then uploaded to a bank's online portal for processing.

Therefore, the use of ABA files is dependent on the recipient's ability to receive them. In other words, they have to have the option for you to "upload" a file in that format. This is generally NOT used by government agencies as they tend to have either their own secure portal or accept manual payments (eg EFT/BPAY) For instance, there is no "Super Data Upload" option in the ATO's Small Business Super Clearing House.

Super Funds on the other hand, are private companies (eg not government-related) so many have adopted their own optional method for receiving contributions by way of the Super Data Export. It is possible to upload your Super Data to the clearing house in the same way that you upload an ABA file however, each clearing house has their own format specifications, which need to be mapped exactly, for it to work! These files are not in the same format as an ABA file so basically … ABA files are the electronic format for banks, SuperStream data exports are the electronic format specifically for Super contributions 😊

"Clearing" accounts aren't specifically required for Super Data (but I would certainly recommend it !) :

A Clearing account is a dummy "holding" Bank account that serves 2 purposes:

- It can be used as a payment source for making payment FROM as well as receiving payments INTO, resulting in a net balance as per your bank statement

Examples:

*Accounts on monetary platforms such as PayPal, eBay etc, or

*Property management - where rent is received, expenses are deducted & you receive just the net deposit amount only

- It also allows you to record multiple payments, that are represented by a single multi-payment, such as paying employees or bills in a single EFT transaction eg

*Net Employee Paycheques in RAH (Paid from Clearing bank account) - Totaling $ 8,475

- Employee 1: $ 1,000

- Employee 2: $ 1,200

- Employee 3: $ 750

- Employee 4: $ 1,500

- Employee 5: $ 2,150

- Employee 6: $ 1,875

If the above payments were made using a single EFT multi-payment - in your online banking - of $ 8,475 …

You could enter a single Write Chq (or Transfer Funds) entry in RAH from your main bank account > Clearing account for this $ 8,475 lump sum amount, to offset the Clearing account balance back to $ 0.00.

Clearing accounts make reconciling the bank account much easier as you have a single, matching lump sum, rather than having to manually add multiple transaction amounts together 😊

2 -

Thank you Shaz…since we emailed, I have lodged a ticket and my main bank account is back in action 😁

Now my issue is, what 'bank' details do I need to put in my Clearing Account - as its not appearing in the online banking center and I have used this 'bank' account to process several super payments.

Thanks

1 -

Go back to those previous super payment entries & check which bank account you used - in Hosted - to pay them from.

You need to use the same bank details on the Online Bank Details tab as the main bank account that is actually inked.

0