Payroll Tax Reconciliation Report

Good afternoon all,

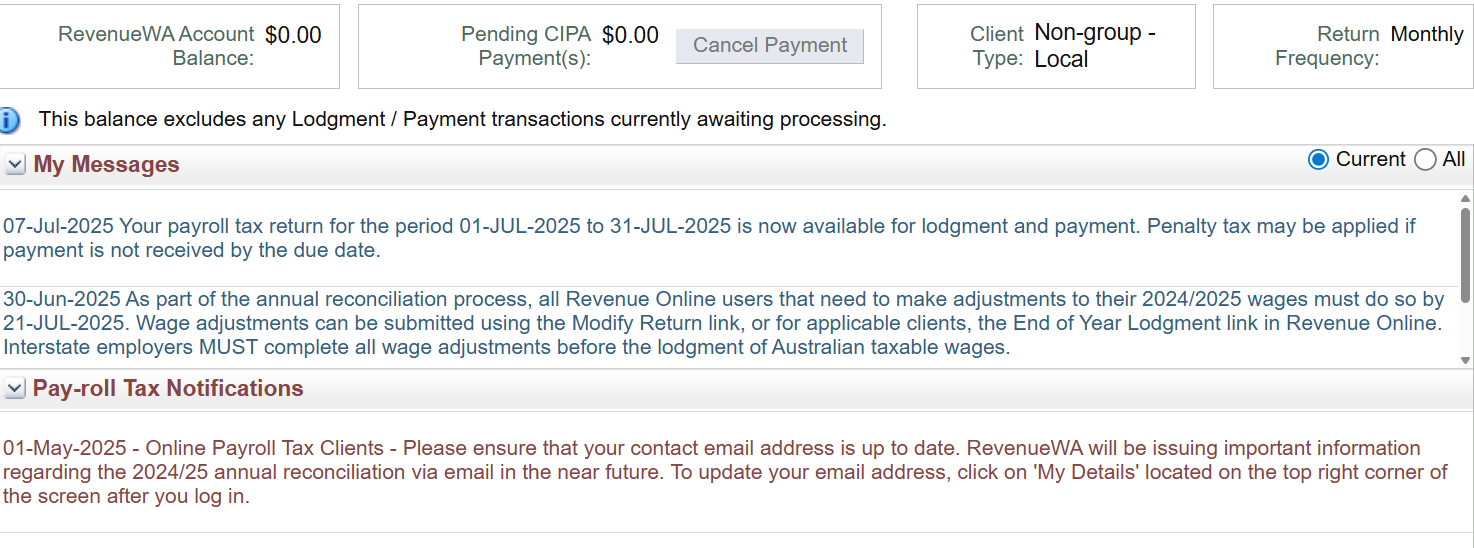

I do payroll tax every month and pay on or before 7th of every month. I did the June one too. When I was doing for the June, it was saying that I need to reconcile the payroll tax before 21st of this month. Could anyone help me with this? You assistance will be appreciated. Please advise me the steps or procedures . Thank you.

Best Answer

-

@Yeepy The reconciliation is usually done automatically by RevenueWA, unless you are a group employer. I believe it's just an automatic prompt for you to check & make any corrections, before they do this 🤔

0

Answers

-

June is not a single input, it is an annual report for the whole year, that needs to be completed by 21 July.

0 -

Thank you Fiona. Could you please advise me the steps to do this.

0 -

You will need to reconcile your figures for the whole year. 1st July through to June 30. So essentially you do one each month but not for June, it is a combination report of the whole year.

If you do it on the Qld OSR portal, you will need to log in and do your Annual Return and split your payroll into gross, super, bonuses, payments to directors etc. totals for the whole year. Some areas will equal zero but your totals should add up to what your total payroll is in Reckon for the whole year.

After your figures are uploaded, they will work out whether you still owe for the year or whether you have paid enough across the monthly data to receive a refund.

0 -

I am still confused. How do we do in Revenue WA. My Accountant asked me to do the same like May for June and Pay before 7th July, and asked me to reconcile for the year end.

0 -

Sorry but in Qld we don't do a June transaction, it is included in the Annual Return. Not sure of WA, someone else may need to step in to help you!

1 -

Thank you very much Shaz.

1