Adding New Pay Items - Leave without pay (LWOP)

Good morning,

Can anyone help me with adding new pay items. I got one full time employee who want to take leave without pay. Thank you.

Comments

-

you don’t have to enter LWOP. You just don’t pay them.

0 -

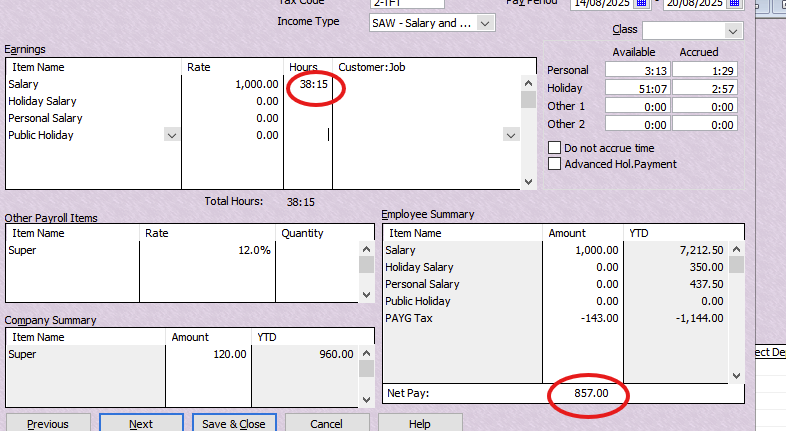

I was putting the actual hours worked, but then her net pay is not changing. She was set up as a salary - Item Name - Salary

0 -

if you want to have a record of the hours you could possibly use holiday hours but enter the rate per hour as Zero. As long as you are paying some normal pay because you can’t record a nil pay

0 -

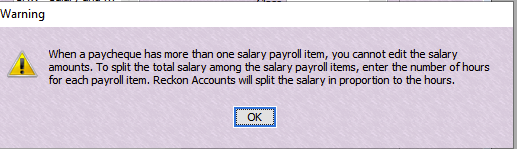

It cannot let me do - Giving me the below message

0 -

So instead of entering salary enter normal hours. Just work out the rate to get the correct gross

0 -

Hours is correct. But the net pay does not change . Do I need to go back and change the pay item name to hourly pay instead of Salary?

0 -

that’s where I would start, and if you want a record of LWOP I would enter the hours but against holiday hours not salary

0 -

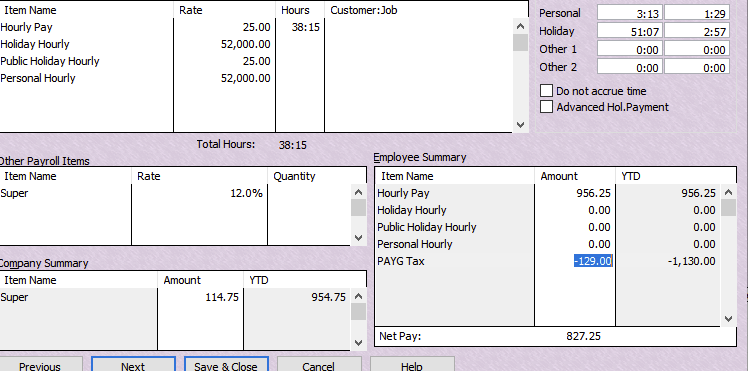

If I change the pay items to hourly, all the employee summary will change to hourly one and for previous record will be gone.

I got the below

But the personal leave and annual leave used is not showing

0 -

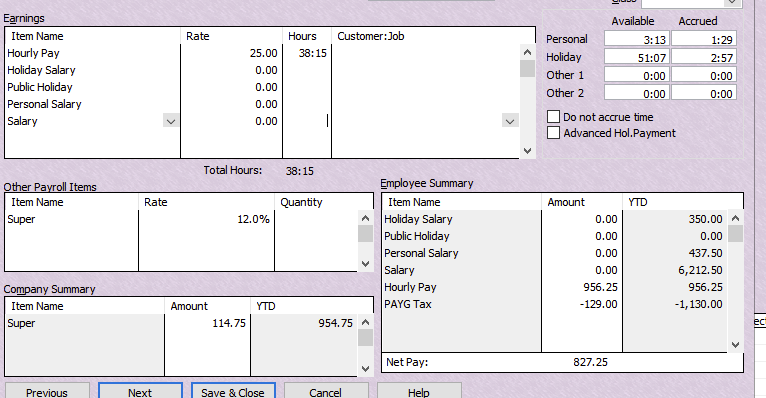

I got the below screen which tallies my net pay. Is this correct ? Showing both hourly pay and salay in the payslips?

0 -

you still need to enter the hours of leave with 0.00 in the rate column if you want a record. If the total net is correct I think all will be ok, do you agree?

0 -

You can’t use Salary as this doesn’t allow for unpaid/less to be paid. Using a leave Payroll Item will incorrectly deduct those hours from that applicable hours balance, so I wouldn’t do that 😬

You need to use Hourly Payroll Items

As long as you have some hours of gross (Hourly) entered, you can set up a separate (Hourly) LWOP Payroll Item & use that - at $0.00 rate - with the correct number of unpaid hours also entered.

1 -

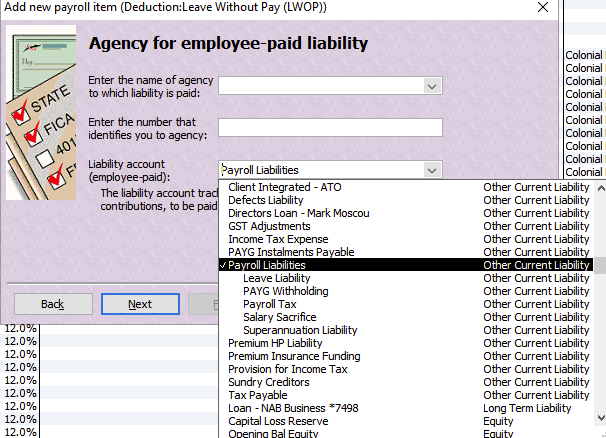

I was trying to add LWOP. What do I need to select for the following ?

0 -

it won’t be a deduction it will just be a wage, and setup the same as other leave items

1 -

It should be set up exactly the same as a normal Payroll Item:

Wage > Hourly Wages > Regular Pay

The Account & Tax Tracking Type selections won't matter too much as it will always have $ 0.00 value when used, so won't actually affect anything but I would just link it the same as any other hourly wage (eg to the Gross Wages Expense account & Tax Tracking Type Gross Payments 😊)

0 -

Thank you, Kris and Shaz for your help .

1 -

glad we finally got there, I know setting it up was your first question but there are many other aspects to be considered as Shaz pointed out

1