Employee Termination & Final Payment

Good morning,

I have to do the final payment to the 2 employees resigning. They have already served the notice period, and they have some annual leave balance. Also, they are entitle for the long service leave (LSL). I have calculated their LSL by using the WA long service leave calculator. Can anyone help me with the followings:

- Recording unused leave in Reckon

- Recording LSL in Reckon

Your assistance will be highly appreciated.

Thank you.

Answers

-

Morning @Miks88

Please check this out - Terminating an employee in Reckon Accounts - Reckon Help and Support Centre

I hope this helps, please feel free to reach out if any concerns. Thank you!

Regards

Tanvi

0 -

you will have to create a payroll item for LSL and enter the balance according to the leave calculator. If the annual leave isn’t already in payroll you will have to put it in there as well first.

0 -

Thank you Tanvi and Kris. Can you also please show me the steps of creating LSL and Unused leave in Reckon Accounts Hosted.

0 -

Hi @Miks88

Check this out - Processing Long Service Leave in Reckon Accounts - Reckon Help and Support Centre

The same process will be for other leave items, if you have to create any. Please let us know how you go or if any concerns. Thank you!

Regards

Tanvi

0 -

Thank you Tanvi for your assistance

1 -

Have you got a payroll item setup for annual leave?

0 -

Not yet Kris… I have not done the set up for both LSL and AL…Will let you all know in this forum once I complete. Thank you very much for your help

0 -

you’re very welcome @Miks88

0 -

Hi everyone,

Can anyone please share the screenshot having both LSL and Unused AL. And, do we need to pay the final payment with the final wages. Our pay day is tomorrow. Do I need to pay the wages along with the LSL and unused AL? You guidance will be very much appreciated.

0 -

you can pay the leave at a later date. You can call me if you wish

0415940843

0 -

Hi @Miks88

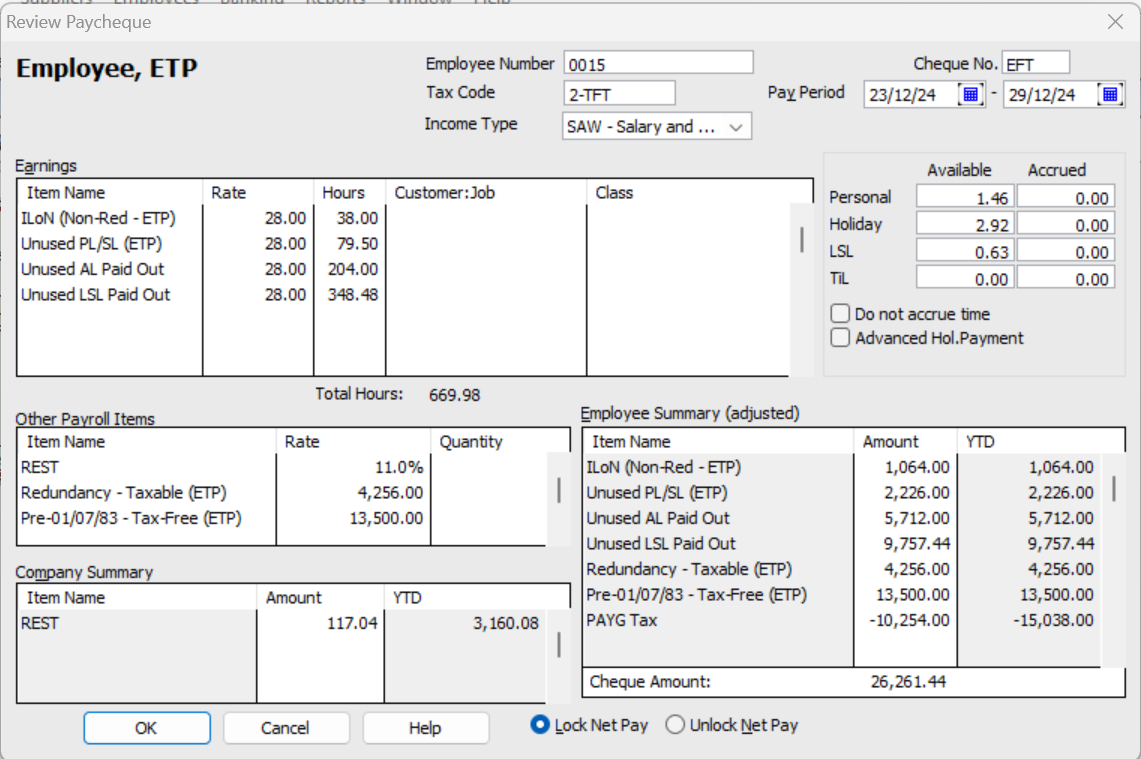

This screenshot is specifically a sample redundancy pay so you won't need the ETP-specific ones that are on here. However it also shows an example of the unused AL & LSL components:

NOTE: PAYG applies but NO leave accruals or super are applicable on unused leave paid out! (UNLESS specified otherwise in your relevant Award/Regd Agreement etc)

0 -

Hi

Thank you Kris

Thank you Shaz. That means I need to create separate items for unused AL and LSL?

0 -

yes, I use the items already there I don’t necessarily make new ones for unused, depends on your setup

0 -

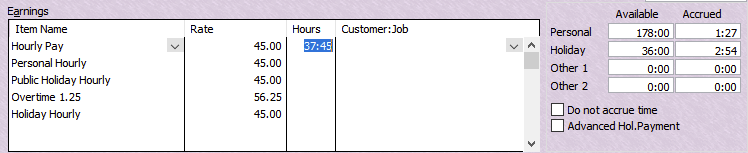

I have this…Can I book the unused leave under holiday hourly ?

0 -

that’s what I would use, however you have to decide if it has leave loading on it and see what that holiday hourly comes up with. And you would have to tick the box that says don’t accrue time - I haven’t used that before but I believe you will have to tick it or you will end up with a small balance. Tick it and see if the accrued holiday above it disappears

0 -

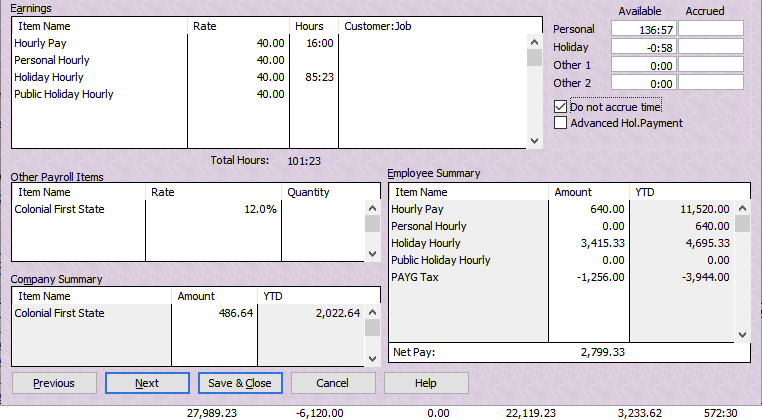

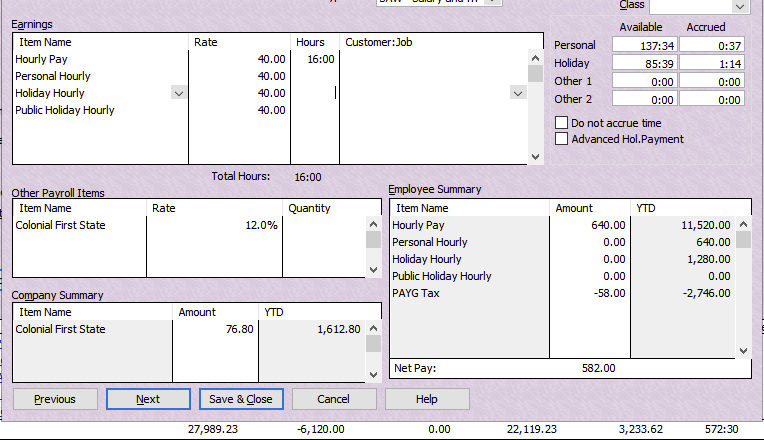

- I had the AL balance

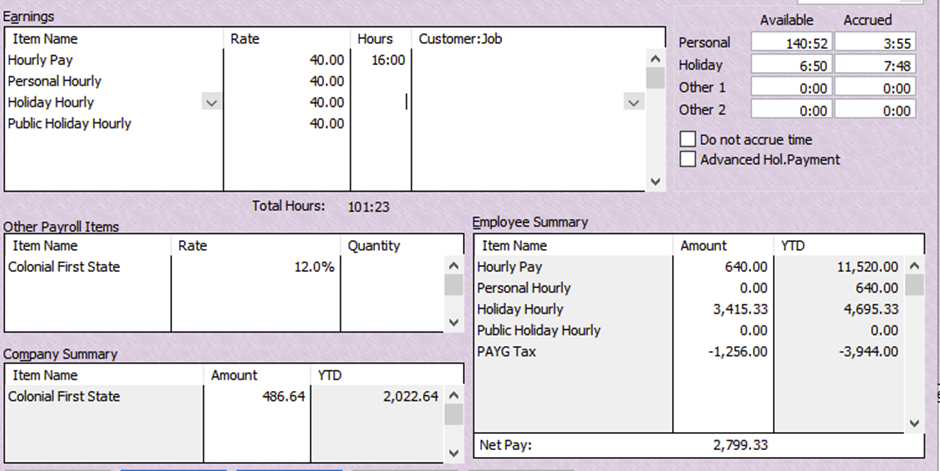

2. I typed the Al balance of 85.39 in the Earning section. It gives me the warning message ‘The leave entered exceeds the available hour. Do you want to continue? I clicked ‘Yes’. Got the following screen

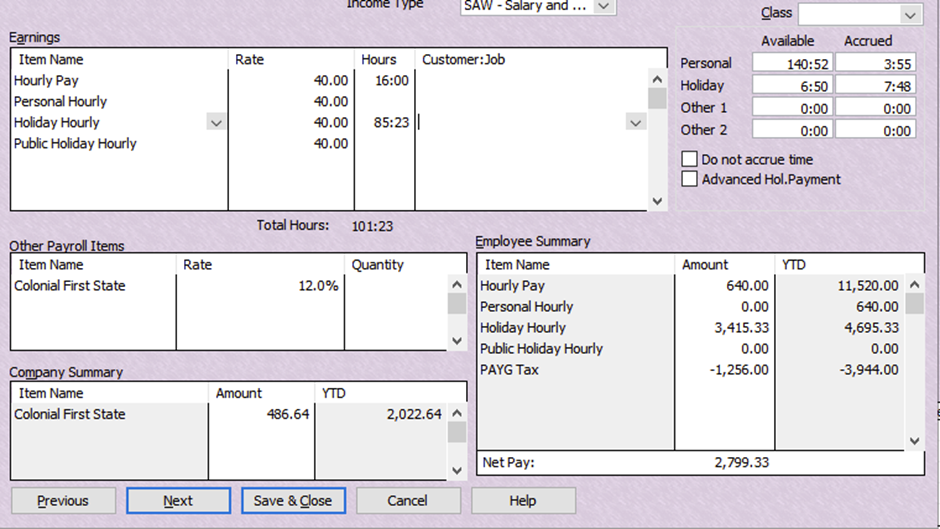

3. If I tick the 'Do not accrue time', i get the following screen

Is this correct? There is no AL loading.

0 -

sorry. Below was my first screen

0 -

You have to determine if they are entitled to leave loading, if not I would untick do not accrue time. And use no 3

0 -

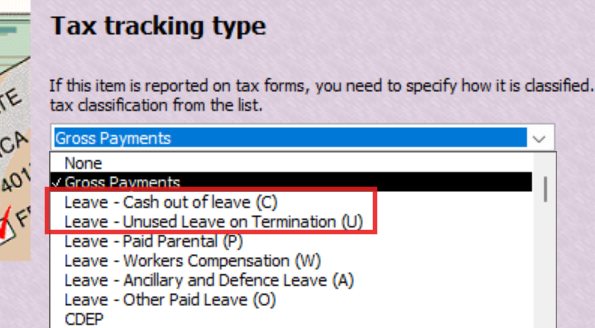

Any Unused Leave paid out on Termination - as well as any Leave cashed out - needs to be set up as as separate Payroll Items to the ones used for ordinary leave taken.

This is because there are separate STP Tax Tracking categories for these:

1 -

ok Shaz thanks for that I wasn’t aware

0 -

Sorry @Miks88 to give you a bum steer regarding payroll items

1