Bill Import .iif

Hi,

We are importing bills from our erp into Reckon Accounts Hosted successfully. However, there doesn't seem to be any documentation around how to send sales tax information through with the bill using .iif

Is it possible to have the sales tax (in our case GST at 15%) applied with the import, or does one have to manually adjust each bill to include sales tax after the bills are imported. This is presently what we do and it is quite time consuming and prone to errors.

Any help would be greatly appreciated.

Comments

-

Hi Andrew

The US documentation on iif is really misleading regarding GST in the Aust/NZ universe.

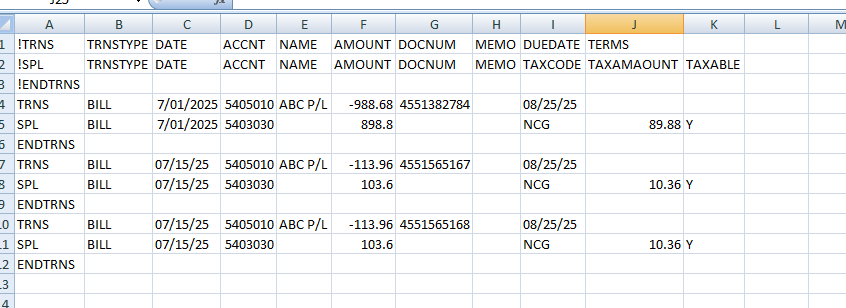

Here is an iif that shows the correct handling of GST

This imports as follows:

The TRNS line is the top half of the bill, and the SPL line (or lines) comprise the bottom half. Importantly, the sum of the AMOUNT and TAXAMOUNTS should be zero. Dates are MM/DD/YYYY. If left the terms in, but they are optional - DUEDATE works better.

For NZ, a $500 plus 15% GST $75 bill, it would be -575 in F4, 500 in F5 and 75 in J5. The Taxcode in I5 would be whatever code is used in NZ for Purchases in lieu of NCG. Column K is important! Make sure there are no commas in the amounts - 1000 not 1,000.

Good luck and let me know how it goes. Email me if you're having issues.

Graham Boast 0409 317366

Reckon Accredited Partner

graham@reckonhelp.com.au

Graham Boast | 0409 317366 | graham@reckonhelp.com.au

2 -

Thank you Graham - that's exactly what we needed! I will give you an update when I've attempted to apply this to our export.

Kind Regards

Andrew

0 -

Hello again Graham,

Finished the script in the ERP system - worked perfectly the first time. Thank you very much. You have saved us a lot of suffering!!

Kind Regards

Andrew

0 -

Did you look in the help files?

0 -

Hi @Graham Boast and all,

I don't know if I should've opened a new question, but as this seems to be a relevant discussion, I thought I'd try here first. I hope you see this 🤞.

I'm using Reckon Accounts Premier Desktop. I set up an IIF template for importing bills, backed-up the file, and then tested it on one bill. I got the OK message, so I checked the affected accounts on the G/L tran ledger, Tax reports, A/P module and a few various custom reports and the record seems to show correctly.

For my next test I populated the template with 3 bills, but this time I got import errors…

"The transaction is not in balance. Make sure the amounts in the detail area of the form for this transaction equal the amount at the top of the form."

The error said it was on lines 6,9 & 12 - which I guess is the final step on each tran before before moving on to the next record (?)

I don't know what could be wrong as the values add up. I wondered if you might have any suggestions.

Many thanks,

KAL

0 -

Hi @kal

If you imported each transaction individually, does it go through?

eg.

Rows: 1,2,3,4,56

Rows: 1,2,3,7,8,9

Rows: 1,2,3,10,11,12

Searching the Reckon Help and Support Centre | Asking good questions on the Community

#TipTuesday: Picture Paints a Thousand Words | How do I add screenshots to my discussion?

0 -

Hi @kal

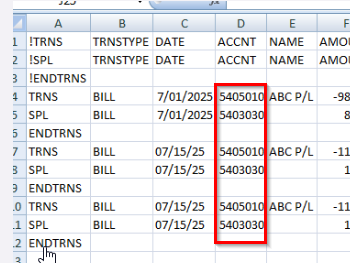

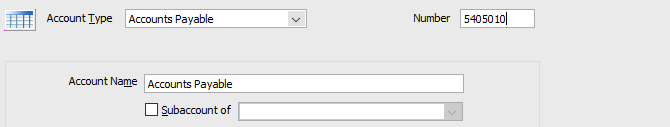

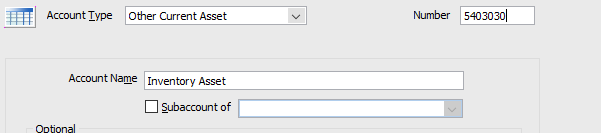

In your IIF file in the ACCNT column you have numbers.

In your company data file, in the Chart of Accounts List do you:

a) I just have account numbers and an account name

b) I just have an account name but no account numbers

That ACCNT column should have the actual account name, not the account number.

As a different test:

From your existing file export the Chart of Accounts, Supplier List as IIF files.

Create a brand-new empty test data file.

Import into that file the Chart of Accounts and Supplier List IIF files.

Test importing your BILL IIF files one at a time into that empty test data file.

Confirm if it imports and has a visible bill transaction present.

If not, then you can send me a direct message and I can send you an upload link where you can provide that blank test file and your BILL IIF file and I can take a quick look.

Searching the Reckon Help and Support Centre | Asking good questions on the Community

#TipTuesday: Picture Paints a Thousand Words | How do I add screenshots to my discussion?

1 -

Hi @Datarec,

My G/L has account numbers (unique) and account names (see screen grabs below).

Yes I could try changing to the account NAME… but my first test worked perfectly and had the G/L A/c number, NOT the name, so I don't understand why I would change that field.

Also, Reckon lets you have multiple G/L accounts named EXACTLY the same, but all account numbers MUST be unique, so how would an IIF even work when you might have more than one G/L account with the same name?

Unfortunately I don't have time today to create new data files and export chart of accounts and suppliers. I hoped this was a simple fix. I'll have to get back to this another time.

Thx, KAL

0 -

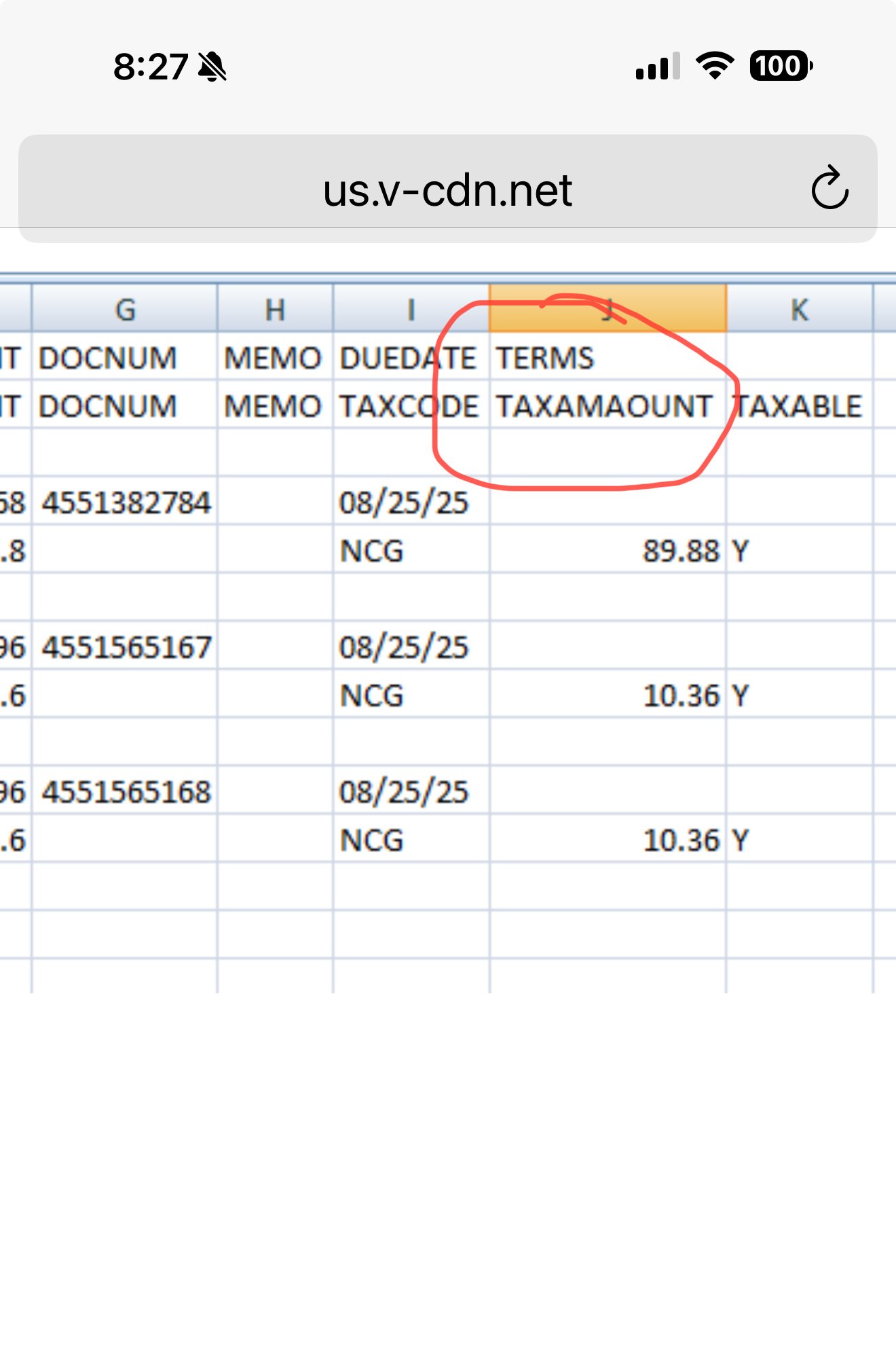

@kal Just an observation … there’s an extra “A” in the TAXAMAOUNT header name:

If you take that out & try again, does that resolve it ? 🤔

0 -