Reportable fringe benefits

I am using Reckon Accounts Hosted. How do I report reportable fringe benefits for an employee through STP in the payroll system?

Answers

-

Welcome to the Community @Sung79 !

This Payroll Item & amount (as advised by your Tax Agent) needs to be added manually onto the employee's last Paycheque for the FBT Year (ending 31/03)

It will then populate in STP accordingly 😊

0 -

Hello, do you have instructions on how to add the reportable fringe benefit for an employee in reckon accounts hosted. Once added should the RFB amount be listed in the STP year end summary for that employee? Thanks Mikayla

0 -

Hi Mikayla

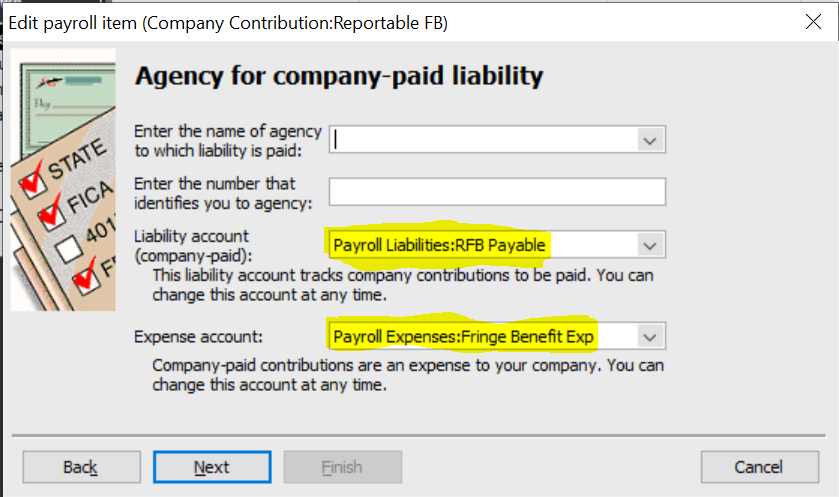

You need to set it up as a new Company Contribution-type Payroll Item called "Reportable FB" (or similar)

Select (or create, if you don't already have them) specific Liab & Exp accounts for this, here:

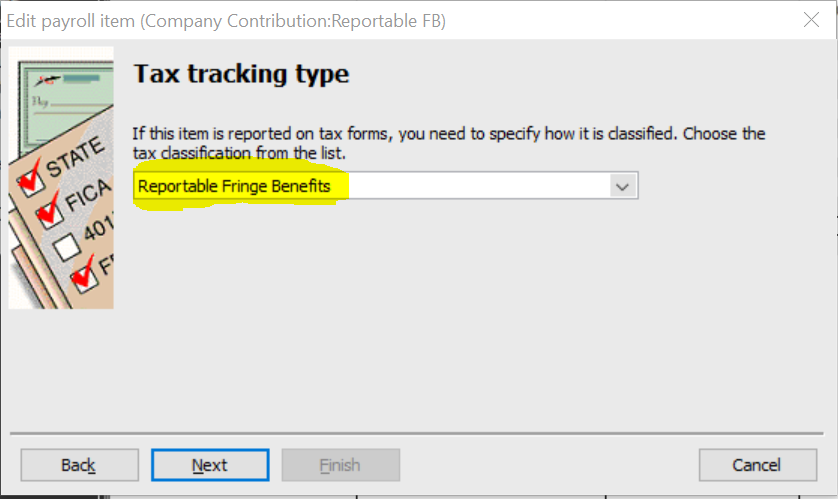

IMPORTANT! It MUST be linked here to Reportable Fringe Benefits Tax Tracking Type to ensure correct STP reporting:

- Taxes > None > Next

- Calculate based on Quantity > Neither > Next

- Gross v Net > Net Pay > Next

- Default Rate & Limit [Leave all blank] > Next

- Incl Payments … > You can either select or de-select as it's not linked to generate based on any other ones, so this allocation doesn't affect anything > Finish

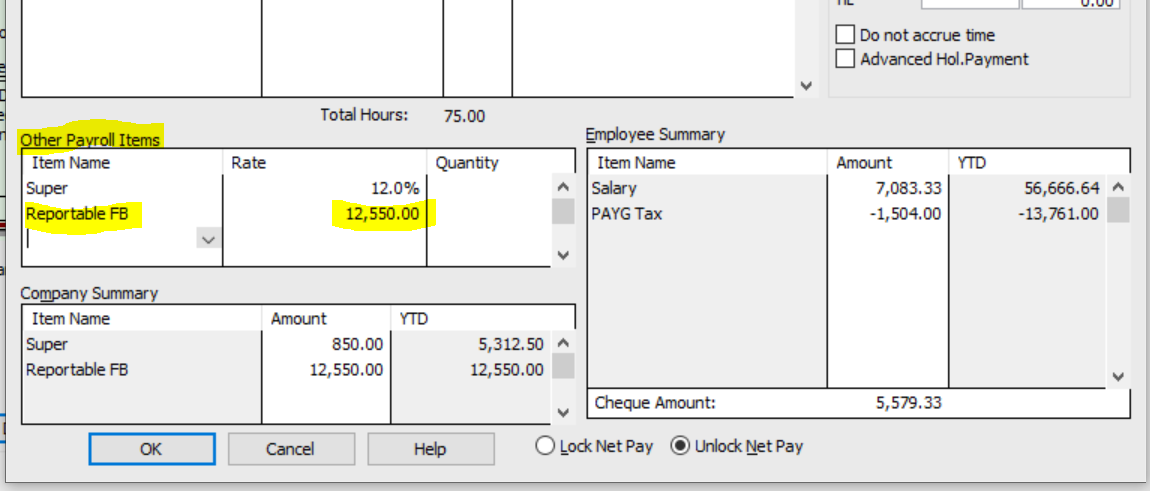

Then, manually add this RFB Payroll Item - & the applicable $ amount - onto the employee's last Paycheque dated before the end of the FBT year (eg Paycheque date 31/03 or before)

NOTE: This amount is not always reflective of the benefit cost, as the reportable amount is the grossed-up figure, which you need to obtain from your accountant:

Entry of this amount should not be impacting ANYTHING else on the paycheque (eg no changes to PAYG Tax, Super, leave etc) other than displaying - just as Super does - in the Other Payroll Items & Company Summary boxes.

1 -

Hi Shaz, Thanks so much for that information.

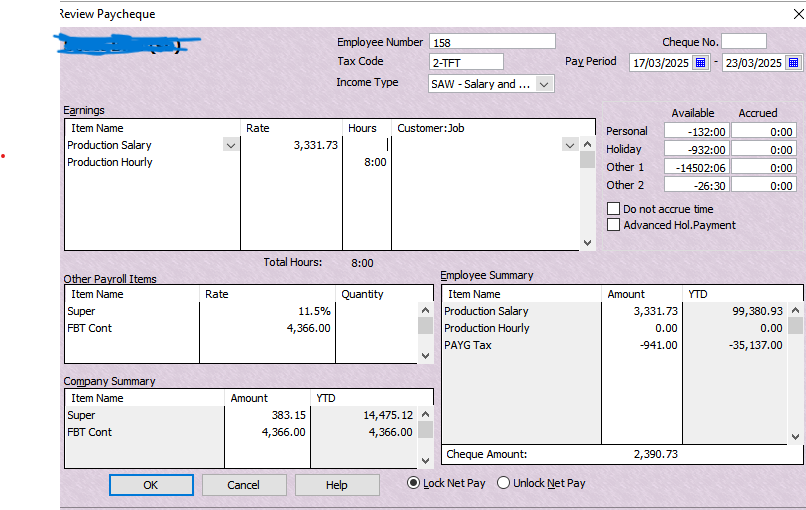

I think I have set it all up properly and added it to the employees pay.

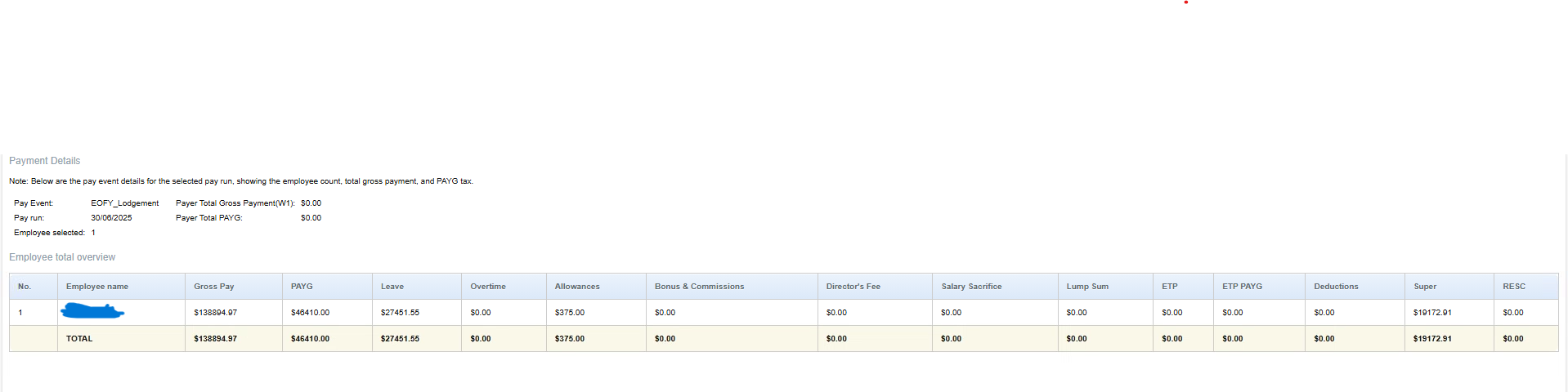

I have attached the payslip. When I go to lodge the STP finalise year for that employee the RFBT amount is not shown in the summary.

Is this correct? I thought it would be listed?

Thanks Mikayla

0 -

Hi @Mikayla

Yes, that's correct as the new summary preview doesn't have the FBT column displayed there. However, once uploaded, if you click on the Detail link in the Draft status submission & then on the Detail link for the applicable employee, you should see the FBT amount shown there 😁

0 -

Yes it's there. Thank you so much for all your help.

1 -