Changing tax type in Reckon Hosted

Hi, we have a company that part way through the year has changed their tax type from cash based to accrual based. How do we change this in the file?

I have found how to change this in the settings but it doesn't let us change the tax type from a specific date it will only change the entire file.

Is there anyway around this without messing up all the data?

Answers

-

Yes, navigating to Settings > Preferences allows you to manage and update company file information. However, this does not apply specifically to a particular year.

Could you please confirm if you're looking to make changes for the purpose of generating reports?

If so, kindly let me know which reports you're trying to generate so I can assist you further.Regards

Tanvi

0 -

We are needing to change it from a specific date so that GST reporting match.

If we change the settings it will change all previous tax reports to the new settings, but we are needing them to stay in the old accounting (cash basis) and then moving forward we need it to show as Accrual basis.

We are based in NZ so we are needing this to match IRD, with IRD we changed from Cash bases to Accrual basis as of the 1st of June 2025 so prior to June 1st we need tax reports to show as cash accounting and from June 2025 we need the reports to show accrual based accounting.

Is there a way to do this without starting a whole new file?

0 -

The setting doesn't change the file (or any of the data in it) - It's just a display option 😊

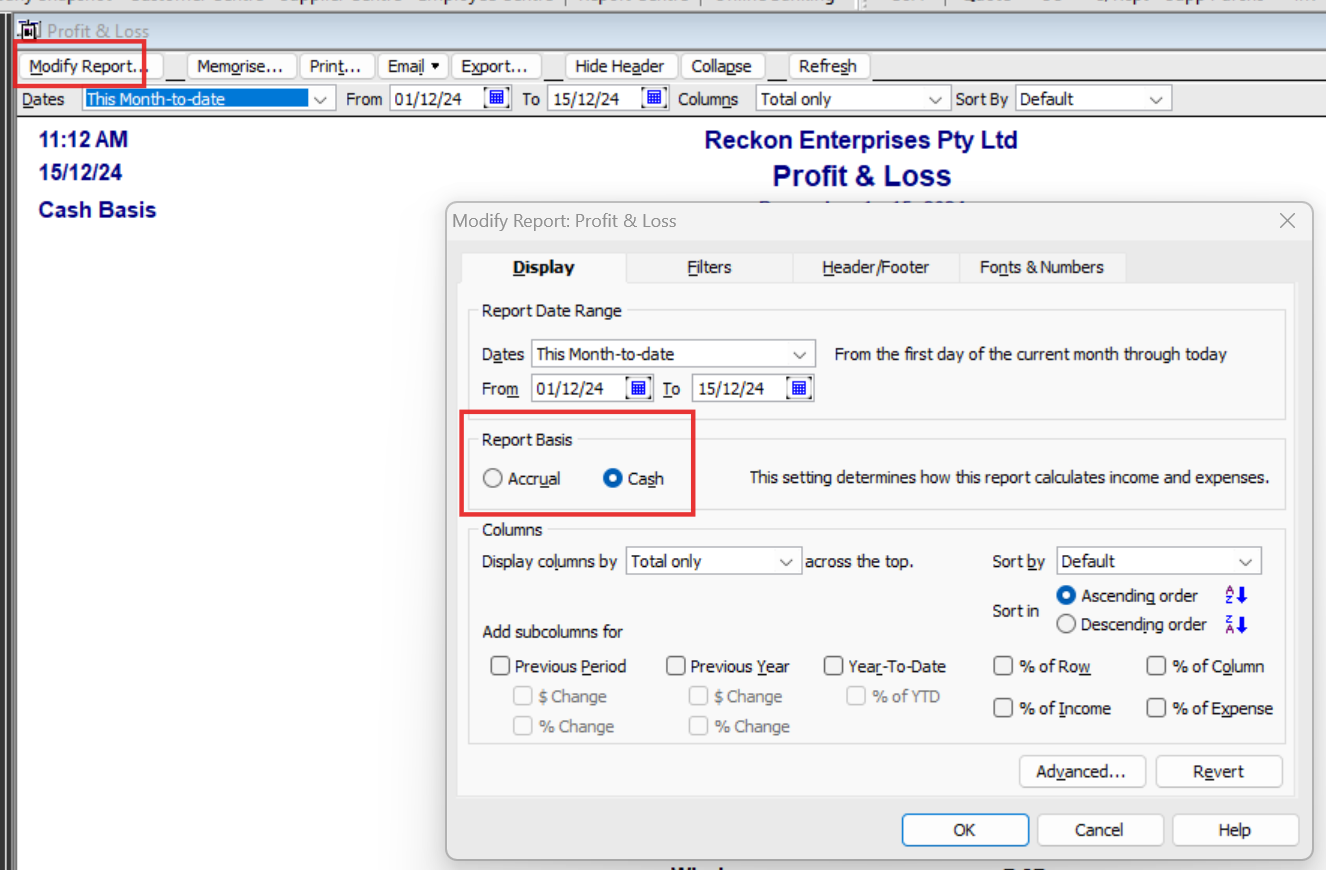

Most reports can be generated in Cash &/or Accrual (just via Modify Report …) :

The Preferences are for setting your defaults - eg for BAS - & just mean your reports will generate on that basis by default, however, you can always change it at any time.

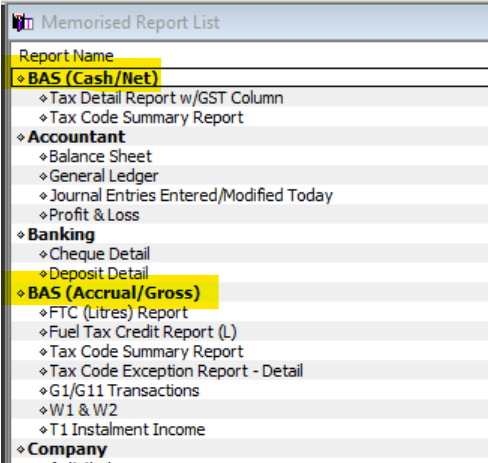

I Memorise my reports so where there's a change in GST (BAS) reporting method, I will memorise in both versions (Cash & Accrual) so I can easily generate the type I need:

😊

2