Reckon One update! ✨ Editing a SuperStream pay run, Payment Terms on invoice reports & more!

A much wanted improvement is finally here! We've heard lots of feedback around the ability to revert a pay run that is linked to a SuperStream lodgement (such as Beam) back to draft.. and now you can!

We've also got more improvements in this release, check out the full inclusions below.

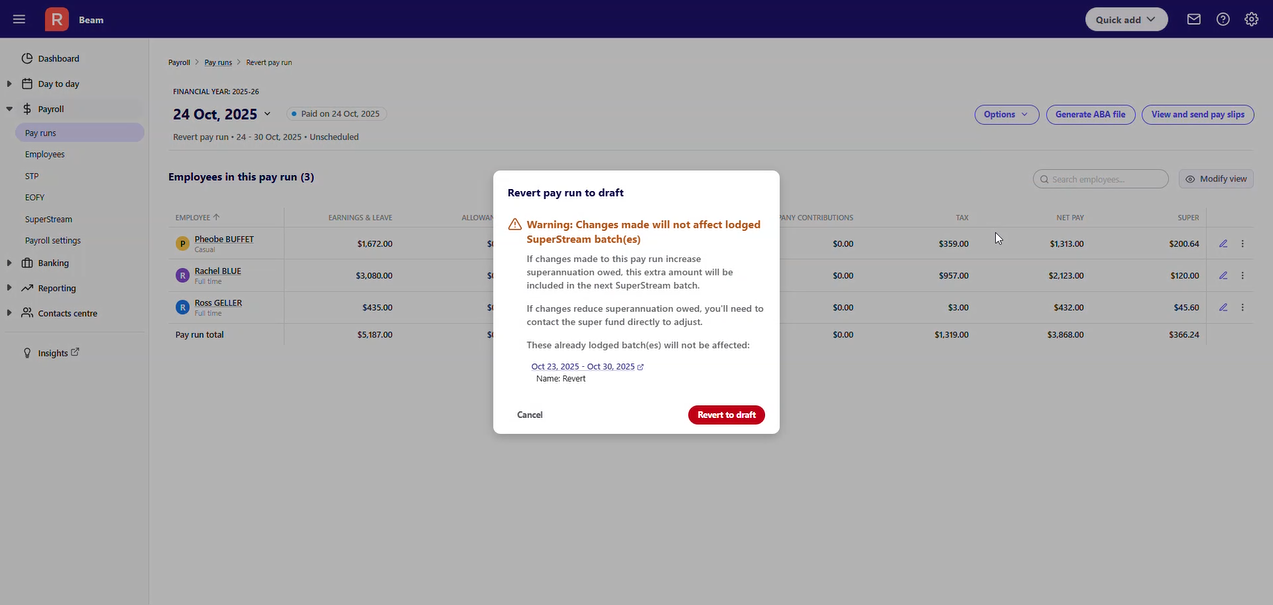

✨ Reverting a pay run to draft when linked to a SuperStream lodgement

You can now revert a pay run that is part of a SuperStream batch such as Beam back to draft allowing corrections to be made directly within the pay run when errors are identified.

Previously any pay runs linked to batches lodged with Beam could not be switched back to draft once it had reached an Awaiting Payment status.

How does it work with this update?

With this update, a pay run can be reverted to draft if its linked to a lodged SuperStream batch.

Reverting a pay run does not revert or delete the associated SuperStream batch.

If the batch has been sent to Beam, it will continue to receive status updates as it does currently. If a refund status is returned from Beam for one or more employees in a batch, when you view the batch detail, the refund status will display for the individual employee.

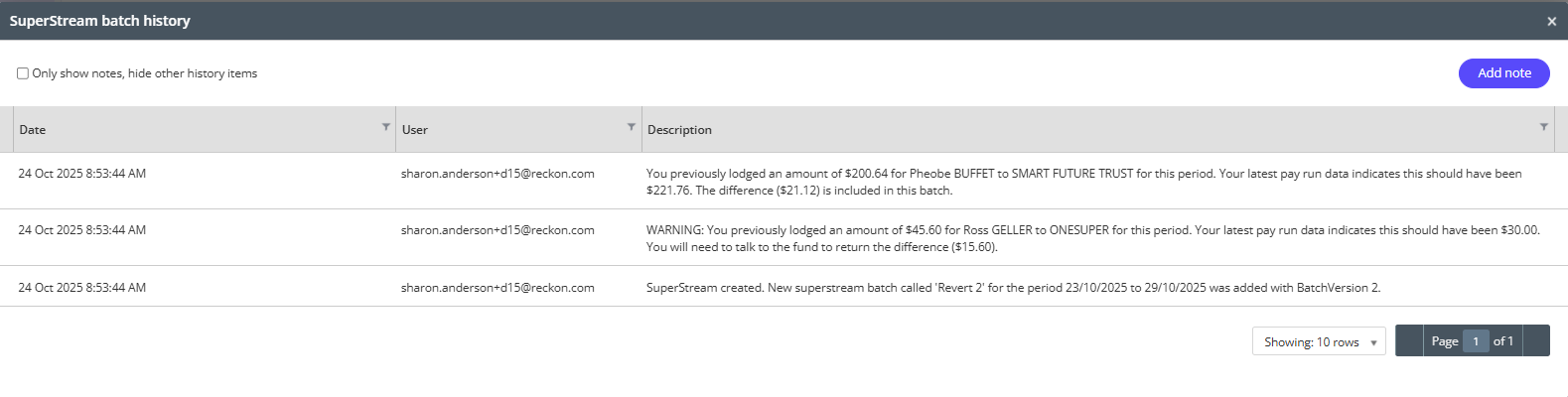

If a pay run, linked to a batch, has been reverted to draft and you make changes to any pay calculations that affect the initial super contribution value, when creating a new batch, values are compared for each employee within the pay run, with the originally lodged batch.

- If there is a positive difference, the employee will be included with the variance only. This saves you from having to perform any manual intervention.

- If there is a negative difference, a note will be added to the batch history.

Other important things to know

- The ability to revert SuperStream-linked pay runs to draft only applies to pay runs created after this release goes live, it does not apply retroactively to pay runs created prior to this update.

- Any pay runs you revert to draft cannot be deleted if any transactions are part of any lodged or draft SuperStream batches and you'll receive a message on-screen to let you know if you attempt to do so. This ensures more accurate tracking and auditing at both the batch and employee levels.

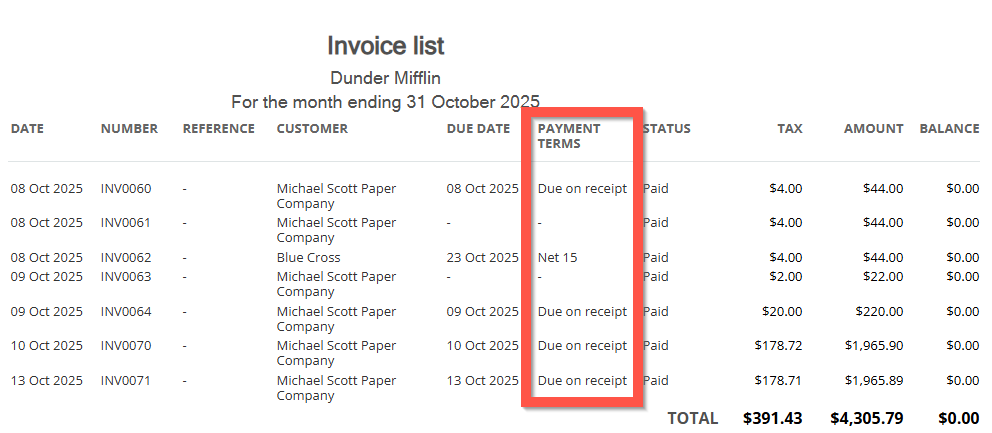

🆕 Payment Terms can now be added to Invoice Reports

You can now add Payment Terms to the Invoice List and Unpaid Invoices reports. This is a handy addition to view all payment terms across your invoices in one place and this can be further filtered by customer.

To add payment terms to your report, simply click Show More Options ➡️ tick Payment Terms ➡️ Click the Refresh button in the top right. The Payment Terms column will be added to your report, check out the examples below.

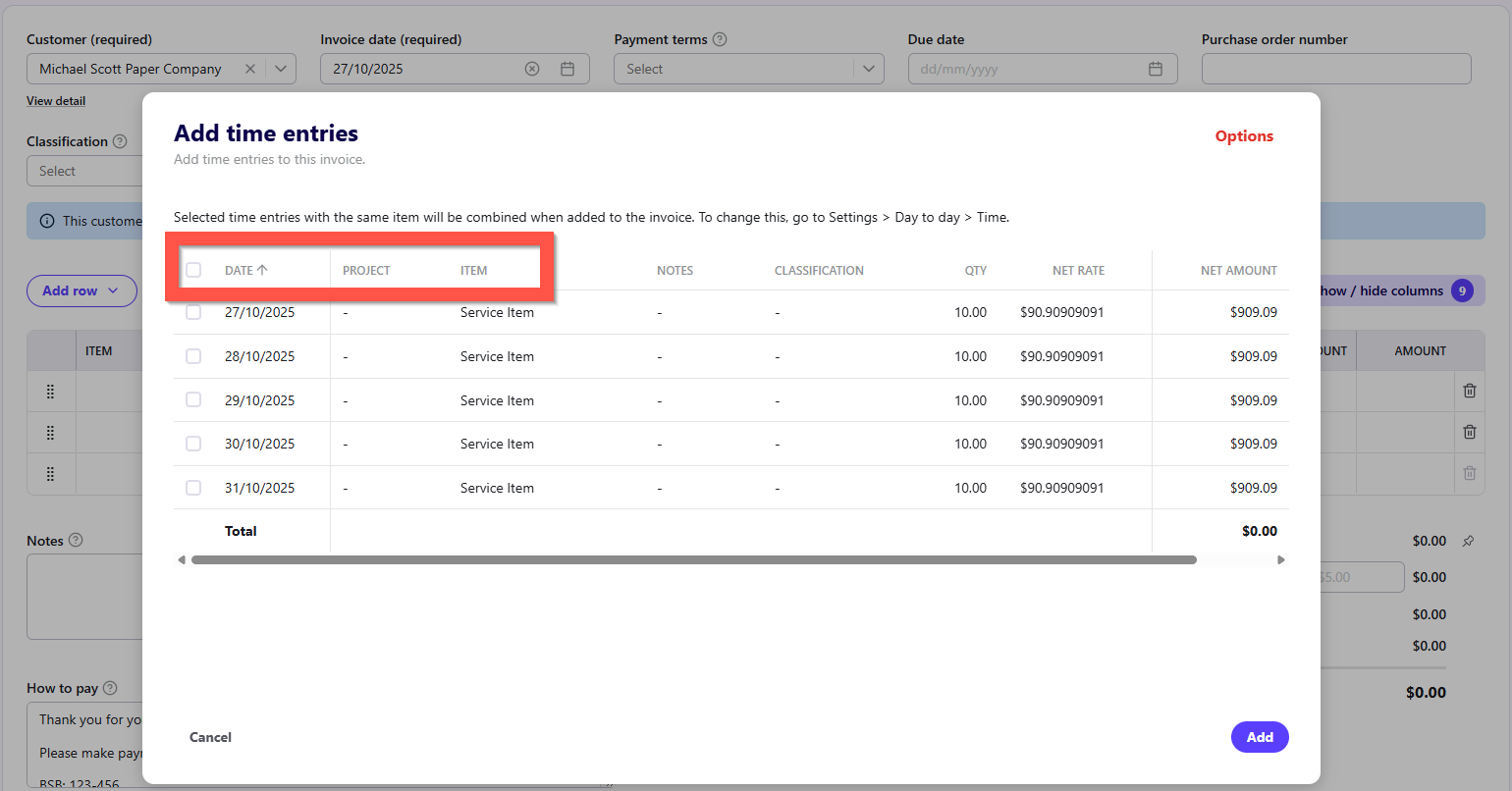

✨ Sortable time & expense import tables

We've heard feedback on having the ability to sort the time and expense import window and this is now available! You can sort the import window using the following options:

Columns that can now be sorted (A-Z/Z-A) | |

|---|---|

Time entries | Date, Project, Item |

Expenses | Date, Project, Expense no, Item/Account |

🐛 Bug Fixes

- Ensured the Statutory rate RESC exempt option is correctly set (selected or not selected) within the super pay items under the employee’s Pay tab for the relevant Superannuation pay item.

- Fixed an issue that caused a project's rate to increase unexpectedly when creating a new project in the new invoice experience.

- Improved error message when transaction type is missing in the new Journal experience.

- Fixed an issue in the new Journal where changing the tax type inflated the credit amount and caused tax data loss.

- Fixed an issue in Bankdata where an error appears when deleting coding from a transaction in Fast Coding.

- We've fixed an issue where Estimates used cost price instead of sale price for calculations

- Fixed an issue where the new Journal experience was inaccessible in the Demo book.

- Resolved a permission issue affecting access to invoices for a small group of users

- Sorted an issue where a transaction type couldn't be set when an employee or superfund was selected in a journal

- Fixed an issue where the tax code field in a journal could not be edited when the book has disabled the

Choose if amounts include taxoption. - Resolved a tax rounding issue when exceeding 4 decimal places in a journal

Comments

-

This release is one we’ve been waiting . It’s amazing that we can now reverse pay runs even when super has been paid via Beam.

A great milestone!!

0 -

Absolutely fantastic work from our development team, I know customers have been waiting for sometime to have this fixed. Hopefully they're on the community to see what you have put together ☺️

0 -

Hi, that's great. Are they still working on how we can resubmit a super payment to beam when one is rejected? So that the rejected entries can be fixed and resubmitted for the said period of time, as this will become even more important when the super changes come into effect next year, and we are on very tight timelines. Could you tell me how far away this feature will be? Once this is in place, I will re-commence using Beam as I had to stop due to the limitations.

1 -

Hi @Kelli

The above update in this release will help you out in these sorts of situations.

If your Beam lodgement has been rejected for whatever reason, it will return as Sent to Fund with Refund and you can now look at the batch detail information to see the specific status against the relevant employee(s) in the lodgement.

Once you've made any necessary corrections, when you create your next batch (dependent on dates selected) those employee(s) will be in that new batch.

0 -

So are you confirming that you can now do a new batch with identical dates as a previous batch (that had rejections), add the rejected employees (once the errors have been fixed), and submit as a separate batch? So in the batch entries, it would show 2 batches for the same dates.

0 -

That is great news. Are you also now able to do a report of the submission?

1 -

Good to see more updates with reports.

1 -

Been waiting for this update for Beam lodgements. Thank you

1