Clearing an old Supplier Credit that will not be used

Good afternoon,

I have a $43 credit sitting on a supplier account from years ago that will not be used.

I am wanting to clean up the credit so that it does not appear as a negative on A/P reports.

I don't think i need to account for GST as the GST on the original Bill would have been claimed for in the relevant period and the $3.96 GST 'paid back' on the credit note also in the same period.

How i have corrected;

I have created a 'bill' for the supplier and posted it to a 'clearing' bank account - then 'paid' the bill by applying the old credit to it to clear the A/P Report. (NO TAX CODES USED)

I have then created a journal entry to debit the clearing bank account to reconcile it and credit a 'bad debt write off' expense account to balance the journal entry. (NO TAX CODES USED)

Can anyone confirm that this method is acceptable and that i am understanding correctly that there is no GST implication here?

Thank you!

Comments

-

Hi @15678341

It's important to clarify a few things …

- What the credit represents (eg was it due to an actual credit note from the supplier that just wasn't used or is it just as a result of an accidental overpayment ?)

- Your GST (BAS) reporting basis (Cash or Accrual ? This will determine whether the GST has been claimed or not)

Non-Cash (Accrual) - This method tracks Accounts Receivable & Payable as it reports revenue (income) and expenses as per Invoice/Bill dates (eg Jul-Sep 25 BAS will include all relevant BILLS & INVOICES dated in that period … regardless of whether payments have occurred. Therefore, you will have claimed the GST if the credit is from a supplier credit note & you are using this method.

Cash - This method reports solely on actual money paid/received, regardless of any source document dates (eg Jul-Sep 25 BAS will include all relevant PAYMENTS made in that period … regardless of the original bill/invoice date) Therefore, this does not pick up any unapplied payments/credits.

If you've already claimed the GST, you will need to create a Bill with the exact same figures/allocations in order to offset it. IMPORTANT: Make sure you date the Bill in the CURRENT period (eg Jan-Mar 26) & allocate the credit against it (in "Pay Bills") on that same date also!

If you're on a Cash basis, the GST won't have been claimed however, the expense may have been reduced if the tax return is on Accrual (usually it is for companies, not necessarily for other entities) Therefore, you can either use the same process as above OR just create a journal only (no bill needed) - again, dated in the CURRENT period - & post to A/P with the Supplier name in the "Name" column. This ensures it will show in "Pay Bills" under that supplier, for allocation.

If it's simply an overpayment, it shouldn't have impacted anything other than A/P so you can just enter a Deposit direct to A/P & "Received From" this supplier & again - allocate in "Pay Bills" on a date in this current period 😊

0 -

Thanks so much Shaz!

I was a credit note from the supplier. We use a CASH reporting method.

I need to re-read this a few times and come back to you with questions that i am sure i will have!

1 -

No problem 😊

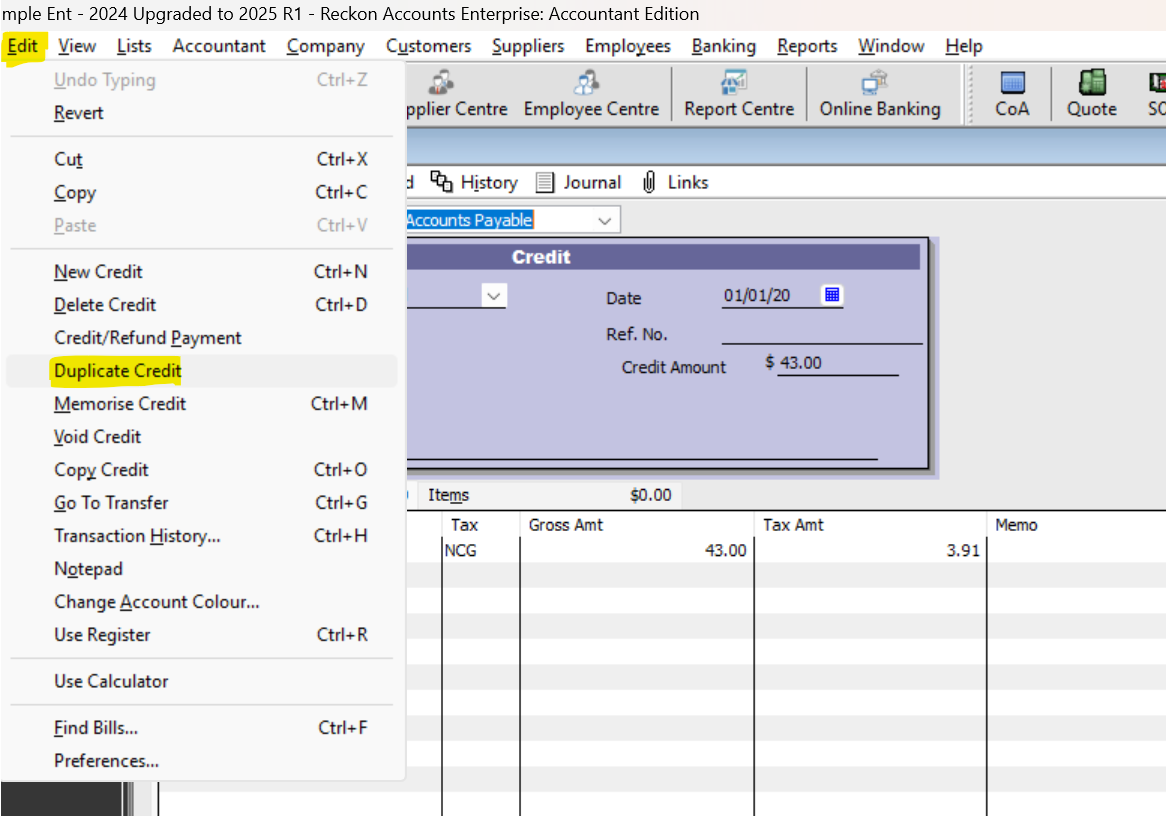

In that case, duplicate the original Bill Credit :

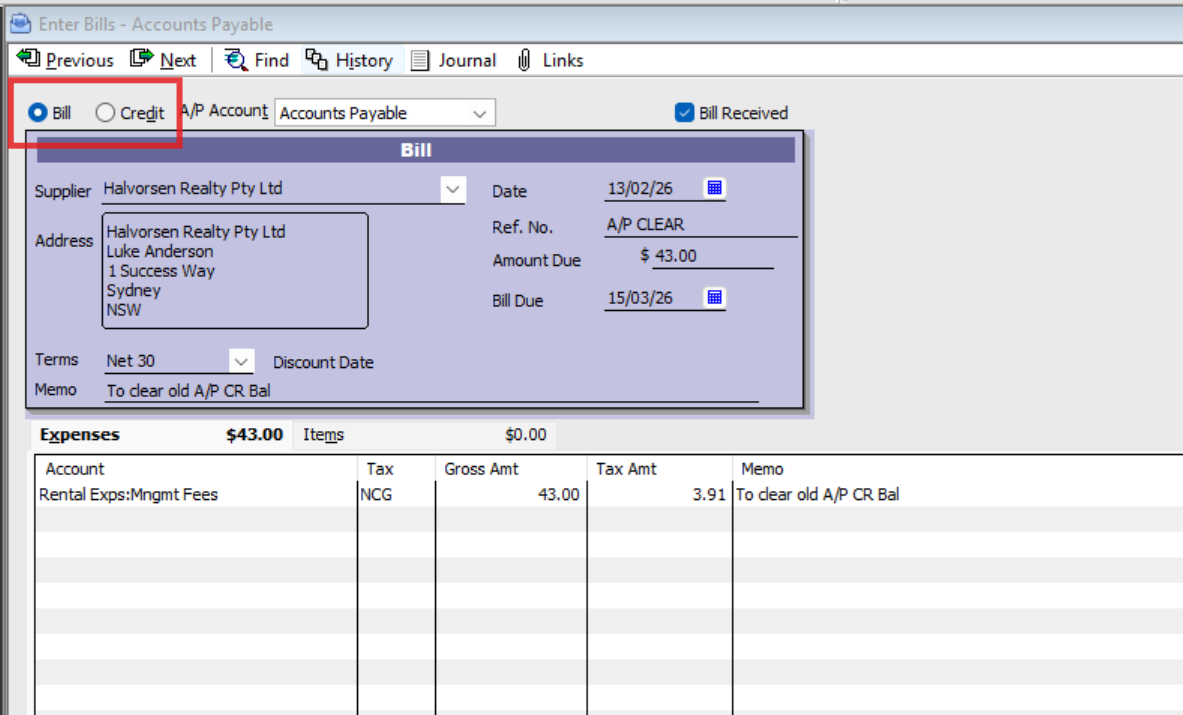

& just change it to a matching Bill (Make sure it's dated in this CURRENT quarter):

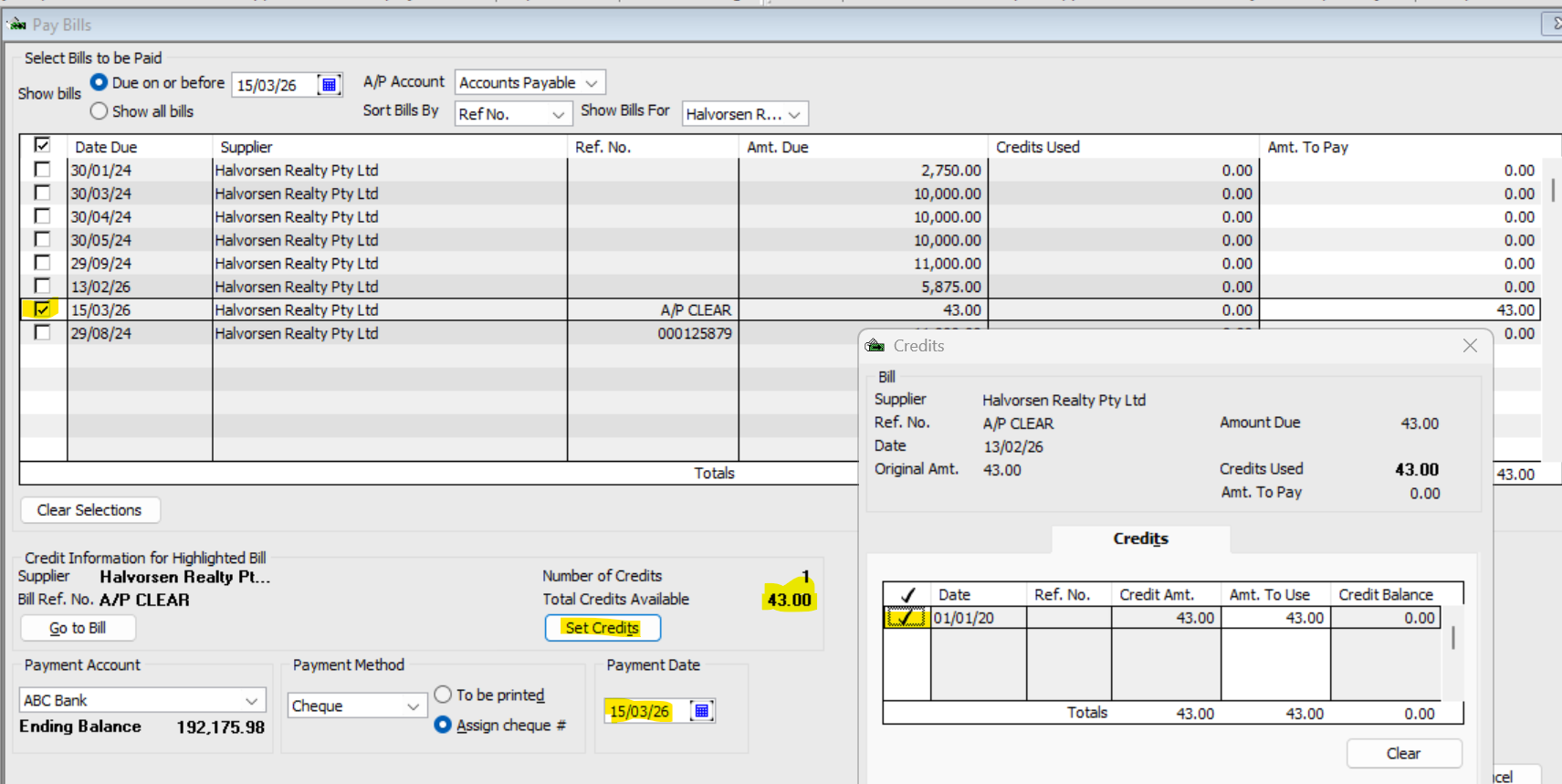

… then apply the credit to it in Pay Bills - using the same current-qtr Payment Date - here:

😁

0