How do I reconcile a payment with no invoice?

I’ve figured out what happens when a customer has paid too much for an invoice, in that the customer receives a credit note within Reckon One. At a later date, I can open a new invoice, click receive payment and can see any credits available for that customer to apply to that transactions. Previously, the credit has always been less than the invoice amount, thus I receive payment of the credit (reducing the aged debt to zero) and then I reconcile their new deposit onto the transaction to pay the invoice off. This has in the past just left a new credit which I role over to the next invoice as per the discussion above.

The problem I now have is: The credits in the system are higher than the invoice due, so I’ve paid off the invoice with credits leaving credits in the system, but now the customer has paid again (they have an automatic payment setup). I now have a transaction I cannot reconcile with an invoice. Do I just leave that transaction open till I can attribute it to a future invoice or how can I reconcile it to make it a credit against the customer for future invoices as per the procedure I’ve been following?

Sorry if I’ve explained it confusingly, I hope you get what I’m trying to say.

Comments

-

You can create a customer credit and put a second line on the credit a minus figure and post it to the bank account. Call me if you get stuck Kevin t:04077449140

-

Hey Kevin. Thanks for your reply. A bit too late to phone, but I didn't really get what you mean. How do a create a customer credit and wasn't sure what you meant by a second line or the minus figure. Basically, I have a payment to my account from a customer, but no invoice due for a week. I could just let it sit there till I write a new invoice and then link the payment to that invoice, but was worried if this happens over a new month etc. Normally, if I link the payment to an invoice that is lower Reckon asks you if you want to create a credit with the left over. Essentially I need to do the same but without having an invoice to link it to. I can create a payment, but that would record it as income and obviously a new invoice would have no payment to attribute to?0

-

Call me in the morning. This is Michael Mouse.0

-

How about ringing the customer as why he keeps overpaying so you don't have this problem. Maybe he has a bookkeeper whose systems adds GST to the invoice price. A phone call is probably the best solution.

Michael m

0 -

Hi David,

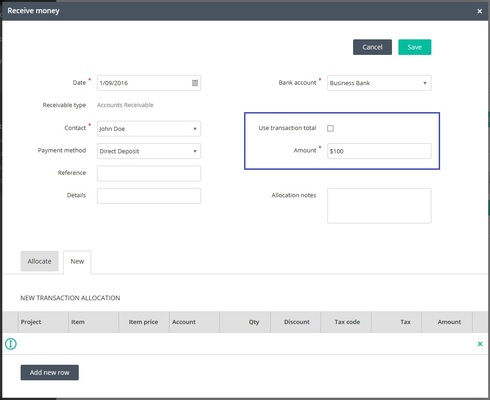

In the case where a customer pays you early & the whole payment relates to an invoice that is yet to be raised. You can enter a credit receipt transaction for this customer. In the receipt, untick the option Use transaction total, this unlocks the Amount field where you can then manually enter the amount of the early payment. Don't enter any allocations in the New or Allocate tabs in the bottom of the receipt.

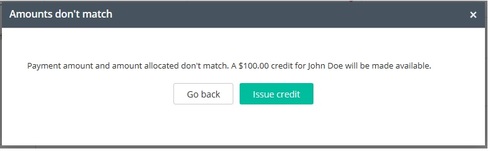

When you save this receipt you should be prompted whether you want to issue a credit, click Issue credit.

This receipt will increase your bank account balance but not affect your income on the profit & loss as the two accounts updated by this credit receipt are the bank account & accounts receivable.

Later when you have raised the invoice, you can allocate the credit to the invoice when going through the invoice payment process & apply the credit.

For anyone else viewing this thread, there is some more detailed info regarding customer credits in R1 on the thread below.

https://community.reckon.com/reckon/topics/where-do-i-find-credits-in-reckon-one1