GST 101 Summary - Reporting Period

Matt McEwen

Member Posts: 5 Novice Member

Question re the NZ version of Reckon One:

Is it possible to change the reporting period for the GST 101 Summary report? We use payments accounting basis with six monthly reporting for periods ending March and September. When generating a GST 101 Summary, reporting periods are only available for 'Sep - Feb' and 'Mar - Aug' (reports summarise GST up until end of February or end of August). Is there is a way to produce GST 101 summaries for the periods we require (Oct - Mar, Apr - Sep)?

Is it possible to change the reporting period for the GST 101 Summary report? We use payments accounting basis with six monthly reporting for periods ending March and September. When generating a GST 101 Summary, reporting periods are only available for 'Sep - Feb' and 'Mar - Aug' (reports summarise GST up until end of February or end of August). Is there is a way to produce GST 101 summaries for the periods we require (Oct - Mar, Apr - Sep)?

0

Comments

-

01/02/18

Hi Matt,

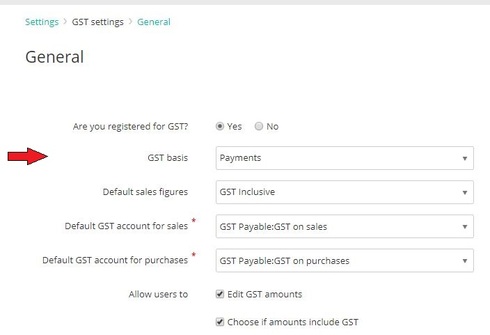

1. Click the cog icon top left > Settings

2. Under the 'GST settings' header click 'General' to configure your GST basis to 'Payments'

3. Click the cog icon top left > settings

4. Under the 'GST settings' header click 'GST reporting' to configure your frequency to six monthly & periods to Apr/Oct

This should achieve what you are after

Cheers.

1 -

Perfect! Thank you very much.

1 -

Hi, we have this issue as well, however, our settings are set exactly per the above but the GST101 summary report still shows the periods as Sep - Feb. Do you know how to fix this?0

This discussion has been closed.