Salary Sacrifice

I have set up a salary sacrifice as a new Payroll item.

I need to set up a regular deduction on a fortnight pay of $500.

I have set this up as a quantity but this means I have to enter the number of quantities every time I process.

I have tried amending payroll item so this is not based on a quantity but it still does not work.

Can someone help please

Comments

-

If you go into the employee name and edit the pay items can you set it up in there the way you want it

I just tried it and I see what you mean

1 -

Why does it need to be set up as a quantity then?

0 -

It can be setup as a dollar amount, I have an allowance setup for the $$ and every pay I have to enter the quantity

0 -

I've not ever set one up based on quantity as a SS deduction is normally based on a % or $ amount:

I'd recommend setting it up this way ^

2 -

Thanks for every ones comments - Shaz Hughes - I do not have this option on my version of Reckon Hosted. I only get this option when I add an addition.

I also tried and not select based on quantity and just enter a SS amount but I still have to manual enter a quantity on the pay card when I am processing payroll and checking payslips

0 -

Yes I do too for my allowance - the $$ amount comes up but I have to enter quantity- don’t know if it would be the same for SS

0 -

It's sounds like you may not have selected the correct Payroll Item Type on the prior screen(s) as this option is definitely there (after the Taxes window & before the Default Rate & Limit) ?

NB A deduction needs to be set up as a Deduction type.

0 -

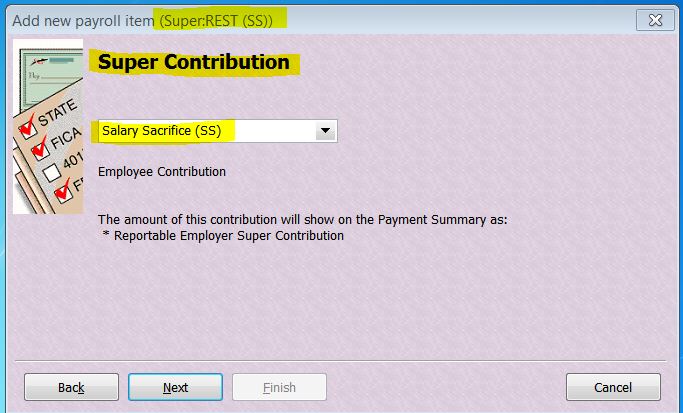

This is screen shot of what option I get - do you think I should recreate the payroll item - but this would mean I would then have to go through every payslip and change the pay

0 -

Thanks for further comments - Shaz Hughes do you think it is worth recreating payroll item again and then adjusting this years pay cheques only - just wondering if I do this whether this would affect any other reports.

1 -

You could create another item and use it only for the employee you’re having trouble with maybe

1 -

I only have one employee who is doing Super Salary Sacrifice - I thought you had to create individual salary sacrifices for every individual as how would you identify in your super quarterly report who the sacrifice was for.

0 -

Ahhh ... OK - If it's SUPER SS, that has it's OWN specific Payroll Item Type(s) in order to report correctly as RESC in STP/at EOFY:

Then on the the 3rd screen:

So unfortunately - if this isn't how you've already set it up - then yes, you will need to recreate it in order to achieve this. However if you go into each applicable pay, Unlock ... it & delete the old SS/overwrite with the new one & re-save ("OK"), if it's only this current FY, it won't take long 😁

No, Payroll Items are not employee-specific, they're designed to be applicable to any employee so you should be creating one per relevant type/payee eg If this employee is SS'ing to REST Super, create one for "REST (SS)" - It can be used if any other employee also decides to SS to REST.

I tend to use the "Super Report by Employee" report rather than " ... by Fund" as the totals have to be reported per employee anyway. This report gives you the total for each employee (incl their SS eg RESC total) as well as the overall monthly/quarterly total too.

The "SS" in the name & it's Payroll Item type are easily identifiable on this report:

2 -

You allocate the employee’s super fund in his own details, then the super guarantee and SS default to each person’s own super fund

0 -

This particular employee has his own superannuation fund - it is not a company super like REST.

I have the payroll item set up as a Salary Sacrifice item

Yes I meant I run the Super report by Employee not fund.

So I am not sure what I have done incorrectly. Maybe if I recreate and then unlock paycheques for this year only this may be the best way to correct the error.

At the moment I have a post-it reminder on my screen to try and remember to make sure I process this.

0 -

Doesn’t matter what the super company is, those details are in his name and personal details. Yes I would do want Shaz suggested and unlock pays, keeping a note of the gross, tax and net so that when you replace the item nothing else changes

3 -

Thank you for your assistance

0