Mark up on an item

Hi Everyone

We are currently recharging Clients for expenses and adding a markup. This is done by entering a expense code on the bill and then recharging. By doing this way we can add a mark up when adding to the Clients invoice.

Thinking of changing the way we enter recharges on the supplier invoice by using item numbers, this will give us more details of the recharges.

Are you able to add a mark up on an item the same way as an expense? All the items will be charged at different rates, so can't have a standard rate for the item in Reckon.

Appreciate your help

Answers

-

Hi Megan

When you set up Items on your Items List, you can specify both a cost & a sales price for the types of Items you're likely to sell - the "markup" is the difference between the cost & sale price.

The Item markup is automatic if you have both a default cost & sale price in the Item's setup. Otherwise it will auto calculate when you edit/enter the sale price on the invoice by prefilling the markup percentage based on the two prices eg if the cost of an item is $ 25 and the sales price is $ 30, RAH will automatically enter the markup percentage as 20%. The markup is editable though & can be either a dollar amount or a percentage. (If you enter a percentage, make sure you include the % symbol)

If you change an item's total after, RAH will recalculate the markup automatically eg if the markup is $ 10 & you then increase the total by $ 5, the markup will automatically change to $ 15 ($ 10 + $ 5). If the markup is a percentage, RAH will recalculate the markup & re-enter it as a new percentage.

0 -

Hi @Acctd4

Thank you for your answer. have created an inventory item. Is this how you would enter a 10% mark up on everything?

Entered a supplier bill for $100.00 QTY 1 then created the debtors invoice and the amount charged was only $1.10.

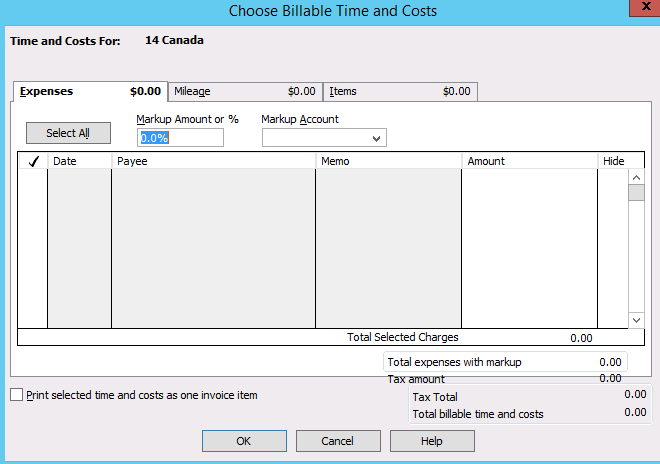

Can only see where to edit the markup on an expense

Appreciate your help.

0 -

Hi Megan

Yes, as mentioned previously, the "markup" is on the Item itself - the difference between the Cost & Sale Price (which in your screenshot is 10%)

Note: It doesn't have to have defaults in the Item - the system will use the original Item's Bill/Cheque Cost price v whatever Sale Price you enter on the Invoice to automatically display the specific markup amount/percentage.

What are the types of things you are on-charging ? Are they actually physical Items or Services ? You can create "Service" & "Other Charge"-type Items if necessary, they don't have to be "Inventory"/"Non-Inventory".

0 -

Hi @Acctd4

We are recharging purchases/services with a markup. currently we have a generic item for each type of purchase/service set up with no cost or sale price. We enter the supplier bill to the item number, when we then create the debtors invoice we manually change the amount that appears to include the mark up for arranging the services/purchases. This takes a while to enter all the new sale prices, looking for an easier way. We can do it by entering the supplier bill as an expense line, we lose the ability to create a item by sales report. We need to be able to report how much we have recharged for each generic item. the only way I can see to do it is to create a general ledger income code for generic type of purchase/service, the balance of the account should be the mark up.

Appreciate your help.

0 -

What you describe is fairly standard - every business charges a markup when on-charging their goods/services, otherwise they wouldn't make any profit !

If you have specific pricing levels for particular Items/Customers, you can use Price Levels - These allow you to set specific prices that RAH will adopt when you select a specific Customer or Item on a Sales form:

Price Levels let you set custom pricing for different customers or jobs. Once you create a Price Level & associate it with one or more Customers or Jobs, each time you create an Invoice, Estimate, Sales Receipt, Sales Order or Adj Note for those Customers or Jobs, RAH automatically pulls up the correct custom price that you've set. You create Price Levels, then use them on sales forms to adjust the price of an Item (You can also still manually adjust prices while creating a sales form)

Note: Price Levels associated with Customers are automatically used for Billable Time & Reimbursable Mileage Items. They are not automatically used for Reimbursable Items & expenses from purchase transactions or Invoices created from Estimates.

Fixed Percentage Price Levels

Fixed percentage Price Levels let you increase or decrease prices of all Items for a particular Customer or Job by a fixed percentage eg you might use a fixed percentage Price Level for a customer who gets a 10% discount on all the products & services you offer. You can choose to round Sales prices up to the next whole dollar by setting this Company Preference when you use fixed percentage Price Levels.

Per Item Price Levels

Per Item Price Levels let you set custom prices for Items that are associated with different Customers or Jobs eg you might use a Per Item Price Level for your preferred Customers who are charged $8 for product A (regularly priced at $10), $5 for product B (regularly priced at $5.50) & your standard price for product C. In another example, you might have a specific Customer you agreed to charge $50 p/hr for research time (regularly priced at $70) & $30 p/hr for administrative time (regularly priced a $35 p/hr).

There's also an option under the Company Preferences tab (under the Edit dropdown menu > Preferences > Sales & Customers) for adding a default markup % across the board - RAH uses this percentage to calculate the Sales Price of Items that have both a Cost & a Sales Price:

You'll see the effect of the default markup percentage when you create an Inventory, Non-Inventory, Service or Other Charge-type Item. When you enter the Item's cost, RAH calculates the Sales Price for you & enters it in the Sales Price field automatically eg if you enter an Item's Cost as $10 & you've set the default markup to 25%, RAH will autofill the Sales Price as $12.50. (Note: You can still edit this amount if you don't want to use the default markup price for a particular Item)

I'd recommend having a read through the info on all this in the in-program Help (some of which I've just copied & pasted above) There's a lot of detail in there on markups & Price Levels which I think you'll find useful.

The Help can be accessed via numerous methods ...

- From the Help dropdown along the top toolbar - This will take you to the Help section's Index & Search tabs

- By typing a specific question in any window's upper right "Ask" box

- By clicking on a particular window's "How do I ...?" dropdown, which will show the most common questions for that specific window:

😊

0