Allowance Rate per unit under $1.00 is not accepted

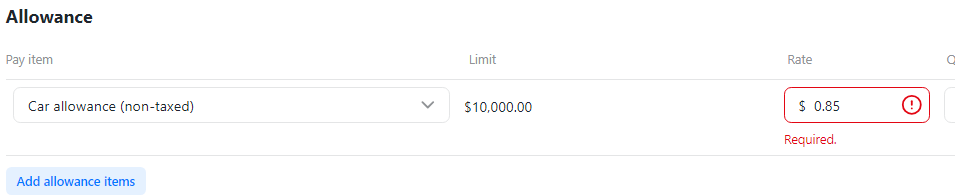

Allowances set up with a unit rate below $1.00, example cents per km is 0.85 per unit, are not accepted when you add them in employee pay set up.

Screen shot below - If you change the 0.85 rate in employee pay set up to $1.00 or higher, it accepts it.

Other allowances do the same if the unit rate is below $1.00.

I have deleted a couple of allowances and input again with no luck.

You must be able to do this, as the ATO cents per km is currently 0.85

Appreciate any advice / help please.

Answers

-

Thanks for raising. Let me get a bit more info around this and I'll come back to you shortly.

0 -

I've just had a word with our dev team and this is something they have in their list to fix up at the moment. I've added this to our Known Issues & Fixes article and will update it as soon as I more info on a fix.

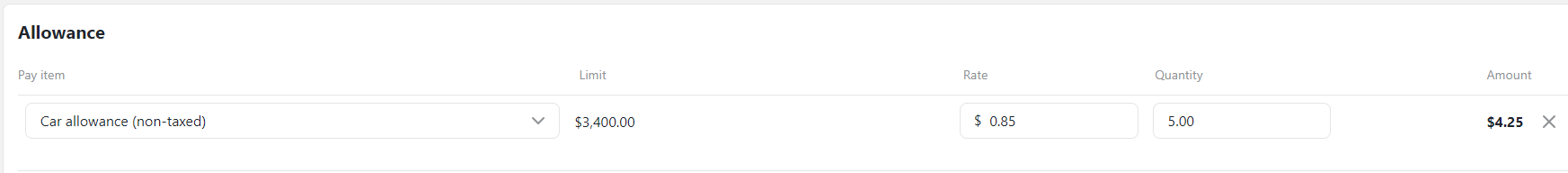

Just in the interim, please add the allowance item to the employee in the pay run manually. I'll keep you posted on when a fix is in place for this so you can add it to your employee's Pay Setup.

Apologies for the hassle this is causing.

0 -

Thank you Rav, yes it lets you add it during the pay run without problem -- I can only imagine how long it takes you to wind down at the end of your day!!!

0 -

A glass a day keeps the doctor away.. I think that's how the saying goes... 🤣😂

0 -

Just wanted to loop back to this and let you know this should now be fixed up. You'll be able to add an allowance with a value less than $1.00 in the employee Pay Setup.

Give it a go when you can and let me know if you still have any trouble.

Cheers

0 -

Hello Rav, yes all good now, I have input an allowance under $1.00 in employee pay set without problem.

Thank you - Gayle

1