How to Report a Missed STP Pay Event

Hi,

I was reviewing the list of STP submissions in the business' ATO online portal against the payroll list in Hosted and noticed ATO's STP list was missing a pay event in mid November. I would have thought that uploading successive pay events would have included this data but it seems not to.

To rectify do I go to the (missing) pay event in Hosted and export this as a 'New Pay Event' or an 'Update Pay Event'? Or do I go to the most recent pay event and do a 'Update Pay Event' or 'Full File Replacement'?

And secondly, when I get into the GovConnect portal do I select 'Full File Replacement' or 'Finalise Year' ?

Many thanks in advance, Lee

Answers

-

Hi Lee

The ATO portal is NOT reliable as the STP section there has never been fully developed. Always rely on your Reckon GovConnect portal for checking as this is the detail that actually flows through to ATO & employees' myGov accounts.

Each STP submission only updates YTD balances (rather than reporting that specific pay run's amounts) therefore, as long as you've submitted successfully since, your YTD balances should be correct.

I use a modified Payroll Summary to check my STP figures each time I lodge. This ensures they are always correct with no time-consuming fixes required to Finalise at EOFY!

0 -

Hi Shaz, thanks for your reply. I have also checked the list of submissions in GovConnect and the pay event is not there.... so it did not have submit successfully :( and I need to rectify.

When submitting the PAYG information in the Q2 Activity Statement I have updated the information from the pre-fill (which was incorrect - missing the details from that mid-Nov pay event). But still need to rectify in STP so that relevant services linked to it are updated.

0 -

It doesn't matter though because your subsequent submissions - updating YTD balances - will have incorporated this anyway.

Check the YTD balances of your latest submission match with your payroll. You can see my instructions on how to create reports for checking here:

1 -

So i have done the same thing . I missed a payroll submission and have since lodged subsequent payrolls and my accountant said thast that should update the YTD figures but I just went to submit and pay IAS and the prefilled figures do not match my Reckon payroll summary report it is out by the missed week. So how do I fix this, the ATO seems to say I need to submit missed payroll run is that correct. If so do I submit as New event?

0 -

Hi @NarellePaterson

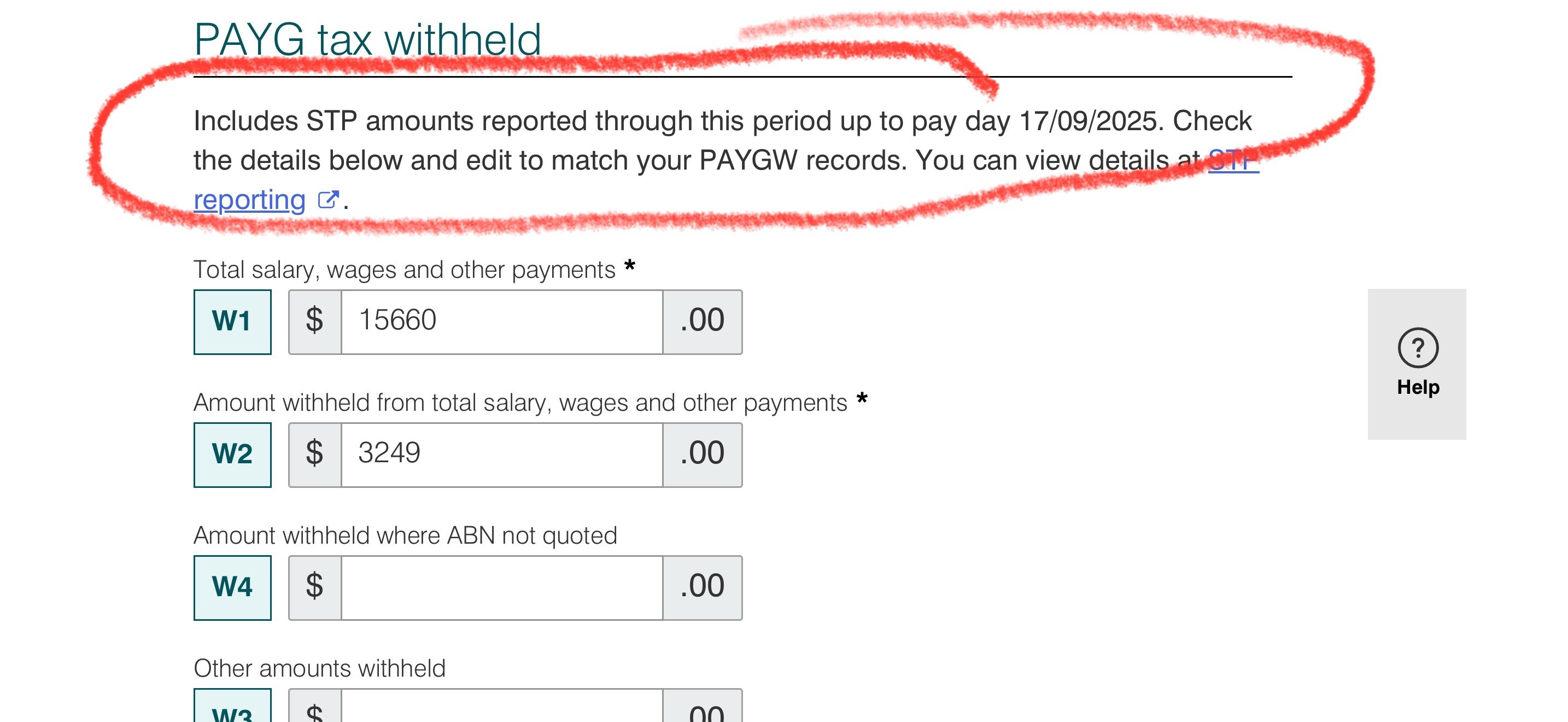

Unlike Reckon’s portal, the ATO prefill for W1/W2 is NOT live/in real time & only updates intermittently. It also only picks up original submissions, not Updates.

Therefore those pre-fill amounts are sometimes inaccurate which is why it has a note there to check your payroll records & just manually amend the pre-fill amounts if necessary 😊1