how do you gross up RFBA under STP2

Rosemary Harrison

Member Posts: 20 Reckoner

we are using salary sacrifice for expense payments and although the amount paid shows on the STP reports this needs to be grossed up when finally reported on the income statement. Do we do this the way we used to through adjusting the YTD amounts before 31/3?

0

Answers

-

Hi Rosemary

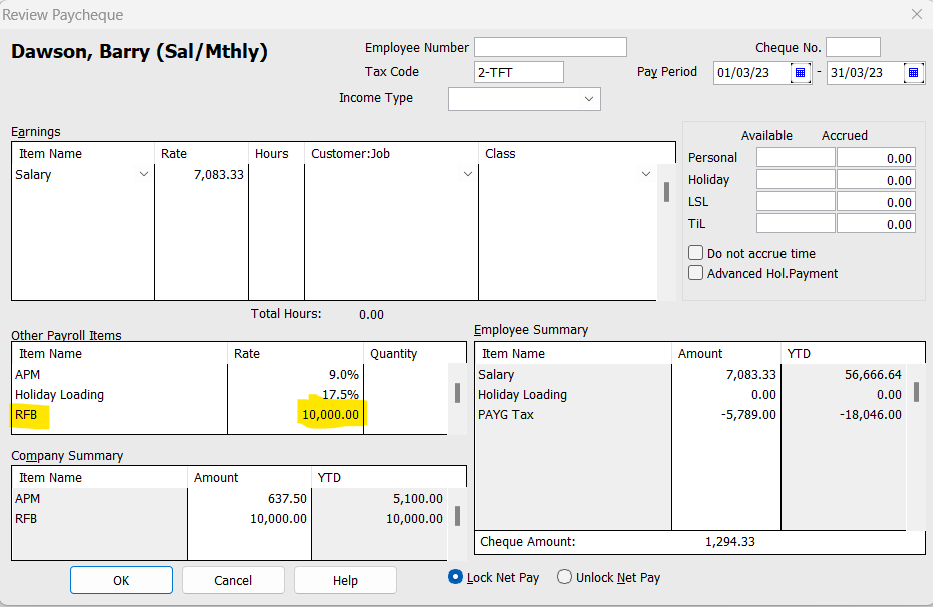

Best practice is to add it onto the last Paycheque dated pre-01/04:

NOTE: You need to obtain the specific, grossed-up figure from the Tax Agent 😊

1