How to record Overpayment and refund

We accidentally made a double payment for Super. We were refunded funds. How to record this so that deposits and credits figures in reconciliation balance

Answers

-

I would enter the overpayment as a cheque into a clearing account, and the deposit into the same clearing account. I use an expense account called Contra, always have but that’s just me

0 -

Hi Instint

Post the payment to suspense. Deposit the refund to suspense.

Thanks for the question

Zappy

0 -

Cheques shouldn't be used for ANY payroll-related entries as these are unable to record Payroll Items!

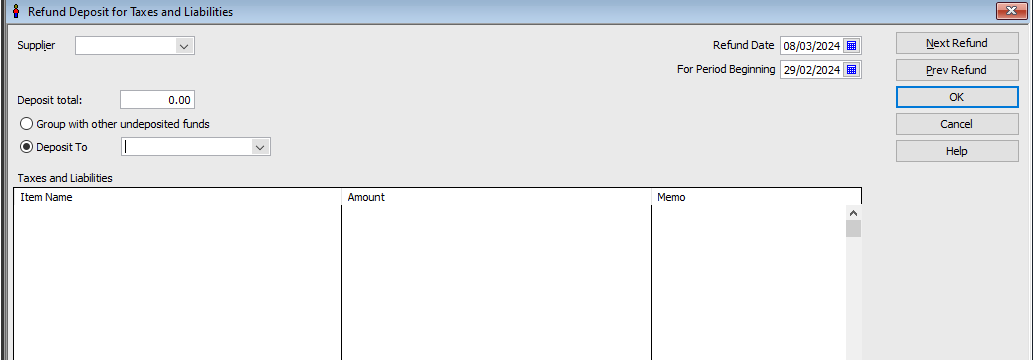

Instead, it should be entered using the Deposit Refund of Liabilities option in order to ensure your Payroll Item-based reports (Payroll Summary, Super by Employee/Fund, Payroll Liability Balances etc) also retain accuracy:

(This is under the same menu as your liability payments - Employees > Payroll Taxes & Liabilities)

This will also then adjust the Super Payroll Item (as well as the associated account it's linked to, at the same time)

The Supplier should be the same as your normal liability Chq for the original super payment.

Refund date = date shown on your bank account

For Period Beginning = 1st of relevant month/qtr (eg if this was for Oct-Dec 23, you would enter 01/10/23)

(The Deposit total will automatically update when you enter the Payroll Item/details in the lower sections)

If it's an EFT refund, select Deposit to & your bank account

Under Item Name, select the applicable Super Payroll Item

Enter the Amount being refunded

Include a relevant Memo so you'll know what this was for.

Click on OK to save.

This entry will then show in your Bank Rec as a deposit received on the designated date.

1