GST adjustments

How do I track where the credit adjustments amount is calculated? None of the detailed reports seem to show anything that ties to this amount.

Answers

-

Have you checked by clicking on Credit Adjustments (Box13)?

As clicking on a particular entry from the report, gives you the details. To do that, hover your cursor over Credit adjustments and double-click on that, to open the records.Please let us know how you went? or if that helps. Thank you!

Regards

Tanvi

0 -

Hi Tanvi, Thanks for coming back to me. I did try that but after clicking through I couldn't seem to match any of the numbers to the total credit adjustments. Do you know why that would be?

0 -

@Lauren_10864779 This is not a default report so it looks to be one that has been specifically-created & customised.

Can you advise where you are generating it from ?

0 -

Hi

Yes, that report can be a bit useless, as it includes pretty much everything and does not total to the box. So nothing unusual in that.

I usually use the sort tab and sort of name as I have an account called IRD gst which all the GST runs through and look though those entries, I'm usually looking to check that all my GST paid to customs is included which usually shows as tax 100%, but you can see any adjustment notes etc…

However, if I can't find something, usually use the modify report, and just select the transactions related to expenses.

It is a manual task. But then it's a case of identifying the items manually and adding to total.

Best to keep a spreadsheet

0 -

@Lizwebster Ah … Is this the NZ version ? (That would explain why the labels are worded slightly differently)

You've generated it on a Cash basis - This means it's reporting income RECEIVED & expenses PAID only. However, your GST liability accounts record the GST component from ALL income & expense transactions (not payments) including customer (invoices, sales receipts & adjustment notes ) & supplier (bills, bill credits, credit card charges, credit card credits, cheques) - regardless of payment status.

There will also be liability payments recorded in the GST account too, reducing its balance. Therefore, you shouldn't be using the accounts to balance for BAS liability.

The Credit adjustments (Box 13) on that report relate to Bill Credits that have been applied.

Definitely shouldn't need to create more work by keeping a spreadsheet as everything is already entered in the software ! It's just a case of knowing what the different reports are reflecting & why 😊

0 -

Yes, its the NZ version and it's cash and it's not reporting as you see it, and need it. It includes pretty much everything. It doesn't balance to box 13. Box 13, in the NZ context, should just have credit adjustments which are specifically (on a cash basis) any corrections and GST paid at the border- on the invoice basis, it would include bad debts written off and the hybrid- well I have never had the misfortune to have to work on that basis so unsure.

Until the question was asked I hadn't given much thought to how useless it was in the NZ context, as I only have a specific type of credit adjustment on a month-to-month basis, and I had never thought "This report doesn't balance to the total". If you draw a similar report out of MYOB or Xero in NZ context it does balance. ( I went back and checked.)

But on reflection, It just reflects the fact that (in terms of number of users) there aren't many NZ users and GST in NZ is pretty simple. So if the person asking is in New Zealand, my answer is correct and a spreadsheet is a quick work around, saves time, unless your credits are something easy to find like import GST credits, which are coded 100% tax.

To NZ users I'd say, just check that the amount calc in Box13 corresponds with what you know to be GST other credits and move on and if you write off and have lots of misc import GST credits- just spreadsheet them.

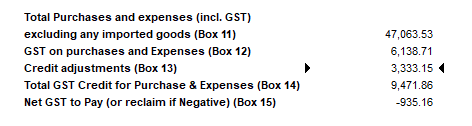

Example of a report from box 13 - box 13 totals $3333.15, there is only one transaction in that period that relates, the report goes on for pages and the total is $935.14. The GST due for that period. And no I did not click on the wrong button.

Cheers and I hope that settles any NZers minds, you haven't done anything wrong

1 -

Thanks Liz, we have a list of the GST on customs, however this is nowhere near the amount of the $90k we are getting as the credit adjustment. It is such a large amount and we have no way of verifying this amount which is extremely frustrating!

0 -

I always use the Tax Code Summary (rather than the Tax Liability report) as it matches better to the BAS labels 😊

@Lauren_10864779 If you have customs GST, those transactions need to be entered a specific way to ensure the GST is correct eg Are you using multiple mixed code lines as per the customs-determined GST amount etc (to remove the net but retain the correct GST figure) ?

0 -

I agree with @Acctd4 and use the tax summary report, customised to Accrual or Cash

1 -

While my actual report doesn't balance to amount in box 13, box 13 is correct regarding GST credits. Can only think that GST coding is incorrect to cause you to be out.

I have S=15%, E and Z =0% GST, and 100% which is customs credits which is GST charged

Mostly you get 2 invoices, the GST invoice and the freight charges from the freight company. GST which they want upfront and freight and other charges which are on account. The example below was for GST, but it included a customs fee. Just make sure that the supplier tax code is not entered or ticked when you enter these transactions.

The tax code is set up as shown below

0