Setting up Salary Sacrifice type O

Our employees are entitled to salary sacrifice benefits type O - not super.

How do I set this up in Reckon payroll - there are no benefits

payroll types and they are not allowances. They need to be reported

under STP2

eg salary 100000, salary sacrifice

$25,000. Taxable income is $75,000 but entitled to Super guarantee on

the 100,000. Also they are exempt from FBT.

Any help appreciated.

Answers

-

Hi @Terrimc,

To Add FBT, Go to an employee and select the option to edit their profile ➡️ Click on Initial YTD ➡️ Click the Add button on the Fringe Benefits item and enter the amount and STP reporting category.

Hope this help,

Nick

Technical Support Team

0 -

Can anyone answer this Salary Sacrifice question above as I would like an answer? Nick above, this does not answer question as lady above states there is NO FBT.

0 -

Hello Burnbay,

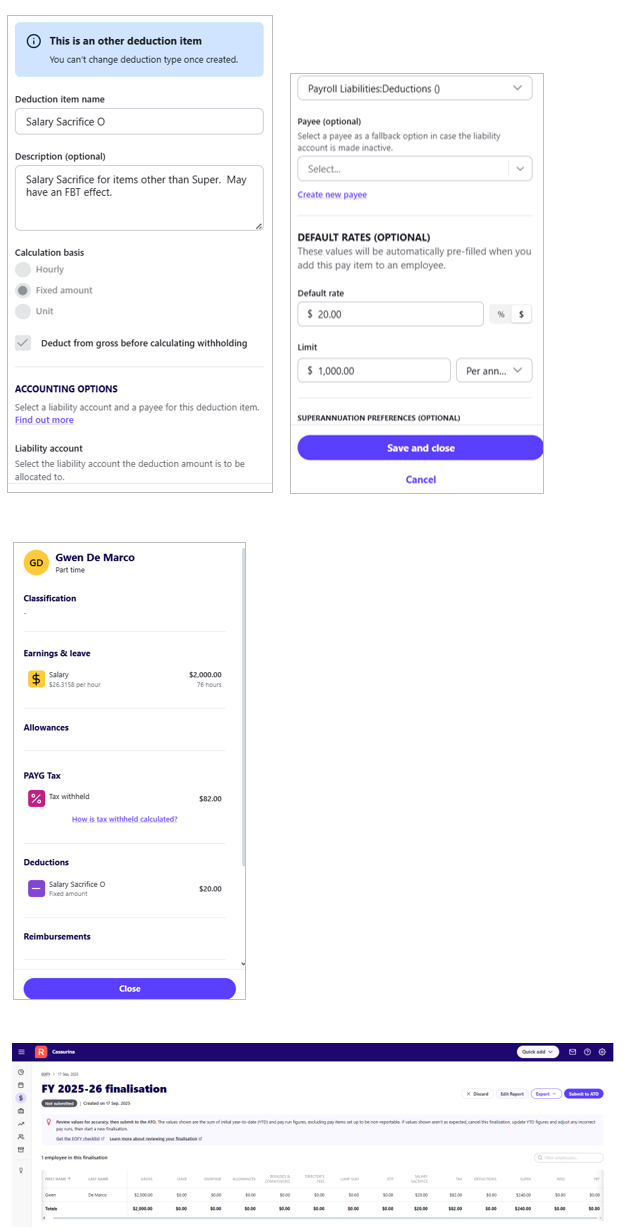

Salary Sacrifice Type O relates to items other than Super that are allowed to be deducted from Gross Salary before PAYG is calculated. That makes the item a Deduction.

Create a Deduction Item with a type of Other. Configure it as required. Ensure you tick the box: Deduct from gross before calculating withholding - its this selection that marks this deduction as a Salary Sacrifice Type O.Now add this item onto the Employee record > Pay tab, if it is to be a regular deduction in the payruns, or add it in during a payrun if it is used irregularly. Once the payrun is Marked as Paid, this item will be added to the Salary Sacrifice column of the STP report rather than into the Deductions column.

Salary Sacrifice Type O items may or may not have an impact on FBT - you should check with your accountant on how this item fits into your circumstances.

kind regards,

John.

0