W1 reported on BAS includes Salary Sacrifice

Hi

I'm confused with what the W1 figure should be reported to the ATO.

The ATO has populated the amount and it includes Salary Sacrifice, however after watching the webinar the W1 should not be including Salary Sacrifice.

I was under the impression that with STP2 the ATO want to see Gross prior to Before Tax Deductions (this would include SSF).

Can I get confirmation if the ATO figure is correct or should I be manually changing this?

If the figure is reported incorrectly on the ATO site, do I need to revise every month?

How do I get reckon to report the correct amount at W1?

Answers

-

Hi @Bakerc

This post been created under the Reckon Payroll software category however based on your previous posts on the Community it looks like you're using Reckon Accounts, is that correct? Or are you using the Reckon Payroll cloud software?

0 -

Hi Rav

Yes I'm using Reckon Accounts desktop

0 -

Hi @Bakerc

Are you checking your STP submission figures each time ? It sounds like your SS may not be configured correctly. I explain how to create an STP check report - that you can refer to each submission - in this thread here:

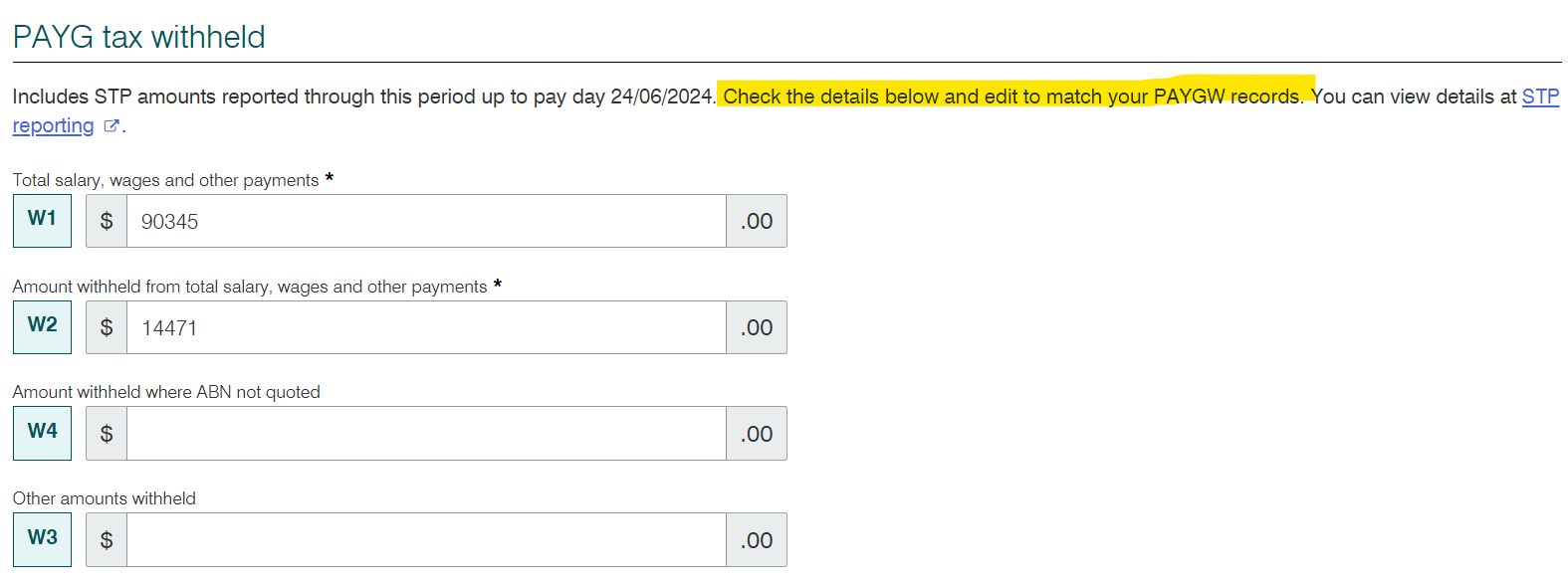

Having said that, it's important to note that the ATO prefill feature for W1 & W2 is still in its early stages & - unlike the actual STP submissions themselves - does NOT update in real time. Therefore, sometimes the populate figures may not be correct, which is why the ATO includes the note about updating them, if necessary:

TIP: Do NOT use this ATO STP reporting hyperlink to "check" - This is the ATO's section in online services & is generally useless as it hasn't been developed & is usually incomplete/inaccurate 🙄

Your Reckon portal (where you submit your STP files) is the most accurate area for checking as it's in real-time & includes the full payment breakdowns. Use this data to match with your customised STP reports - created in RA as explained in the attached thread - & you'll be spot on ! 😊

0